Duke Energy 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

The cost of the Duke Energy Registrants’ coverage can uctuate year to

year reecting claims history and conditions of the insurance and reinsurance

markets.

In the event of a loss, terms and amounts of insurance and reinsurance

available might not be adequate to cover claims and other expenses incurred.

Uninsured losses and other expenses, to the extent not recovered by other

sources, could have a material effect on the Duke Energy Registrants’ results of

operations, cash ows or nancial position. Each company is responsible to the

extent losses may exceed limits of the coverage available.

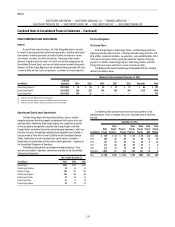

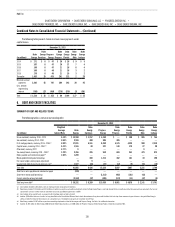

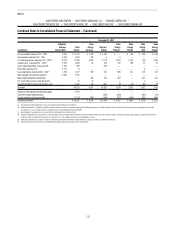

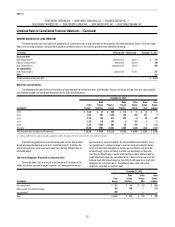

NUCLEAR INSURANCE

Duke Energy Carolinas owns and operates the McGuire Nuclear Station

(McGuire) and the Oconee Nuclear Station (Oconee) and operates and has a

partial ownership interest in the Catawba Nuclear Station (Catawba). McGuire

and Catawba each have two reactors. Oconee has three reactors. The other

joint owners of Catawba reimburse Duke Energy Carolinas for certain expenses

associated with nuclear insurance per the Catawba joint owner agreements.

Duke Energy Progress owns and operates the Robinson Nuclear Station

(Robinson) and operates and has a partial ownership interest in the Brunswick

Nuclear Station (Brunswick) and Harris. Robinson and Harris each have one

reactor. Brunswick has two reactors. The other joint owners of Brunswick and

Harris reimburse Duke Energy Progress for certain expenses associated with

nuclear insurance per the Brunswick and Harris joint owner agreements.

Duke Energy Florida manages and has a partial ownership interest in

Crystal River Unit 3, which has been retired. The other joint owners of Crystal

River Unit 3 reimburse Duke Energy Florida for certain expenses associated with

nuclear insurance per the Crystal River Unit 3 joint owner agreement.

In the event of a loss, terms and amounts of insurance available might

not be adequate to cover property damage and other expenses incurred.

Uninsured losses and other expenses, to the extent not recovered by other

sources, could have a material effect on Duke Energy Carolinas’, Duke Energy

Progress’ and Duke Energy Florida’s results of operations, cash ows or

nancial position. Each company is responsible to the extent losses may exceed

limits of the coverage available.

Nuclear Liability Coverage

The Price-Anderson Act requires owners of nuclear reactors to provide

for public nuclear liability protection per nuclear incident up to a maximum

total nancial protection liability. The maximum total nancial protection

liability increased to a total of $13.6 billion. This amount is adjusted every ve

years for an inationary provision. Total nuclear liability coverage consists of

a combination of private primary nuclear liability insurance coverage and a

mandatory industry risk-sharing program to provide for excess nuclear liability

coverage above the maximum reasonably available private primary coverage.

The United States Congress could impose revenue-raising measures on the

nuclear industry to pay claims.

Primary Liability Insurance

Duke Energy Carolinas, Duke Energy Progress and Duke Energy Florida

have purchased the maximum reasonably available private primary nuclear

liability insurance as required by law, which currently is $375 million per station.

Excess Liability Program

This program provides $13.2 billion of coverage per incident through the

Price-Anderson Act’s mandatory industry-wide excess secondary nancial

protection program of risk pooling. This amount is the product of potential

cumulative retrospective premium assessments of $127 million times the

current 104 licensed commercial nuclear reactors in U.S. Under this program,

licensees could be assessed retrospective premiums to compensate for public

nuclear liability damages in the event of a nuclear incident at any licensed

facility in the U.S. Retrospective premiums may be assessed at a rate not

to exceed $19 million per year per licensed reactor for each incident. The

assessment may be subject to state premium taxes.

Nuclear Property Coverage

Duke Energy Carolinas, Duke Energy Progress and Duke Energy Florida are

members of NEIL, which provides insurance coverage for nuclear facilities under

three policy programs: the primary property insurance program, the excess

property insurance program and the accidental outage insurance program.

Pursuant to regulations of the NRC, each company’s property damage

insurance policies provide that all proceeds from such insurance be applied,

rst, to place the plant in a safe and stable condition after a qualifying accident,

and second, to decontaminate the plant before any proceeds can be used for

decommissioning, plant repair or restoration.

Losses resulting from non-certied acts of terrorism are covered as

common occurrences, such that if non-certied terrorist acts occur against one

or more commercial nuclear power plants insured by NEIL within a 12-month

period, they would be treated as one event and the owners of the plants where

the act occurred would share one full limit of liability. The full limit of liability is

currently $3.2 billion. NEIL sublimits the total aggregate for all of their policies

for non-nuclear terrorist events to approximately $1.83 billion.

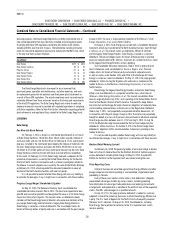

Primary Property Insurance

This policy provides $500 million of primary property damage coverage.

The deductible per occurrence is $3 million for Catawba, and $10 million for

the remaining nuclear facilities. This policy also has a 10 percent deductible

provision excess of these deductibles for natural catastrophe damage.

Excess Property Insurance

This policy provides excess property, decontamination and

decommissioning liability insurance of $2.25 billion for Catawba, $750 million

each for Oconee, McGuire, Brunswick, Harris and Robinson; and $560 million

for Crystal River Unit 3. All nuclear facilities except for Catawba and Crystal

River Unit 3 also share an additional $1 billion insurance limit above their

dedicated underlying excess. This shared additional excess limit is not subject

to reinstatement in the event of a loss.

Crystal River Unit 3’s primary and excess property insurance is on an

actual cash value basis. NEIL coverage does not include property damage

to or resulting from the containment structure except coverage does apply to

decontamination and debris removal, if required following an accident, to ensure

public health and safety or if property damage results from a terrorism event.

NEIL sublimits property damage losses to $1.5 billion for non-nuclear

accidental property damage.

Accidental Outage Insurance

This policy provides replacement power expense coverage resulting from

an accidental property damage outage of a nuclear unit. Coverage amounts

decrease in the event more than one unit at a station is out of service due to a

common accident. Initial coverage begins after a 12-week deductible period.