Duke Energy 2013 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

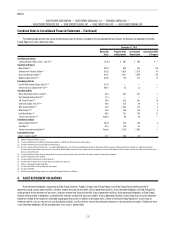

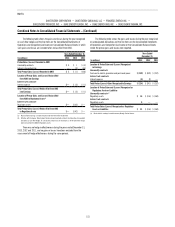

In addition to the amounts presented above, the Subsidiary Registrants

record the impact on net income of other affiliate transactions, including rental

of office space, participation in a money pool arrangement, other operational

transactions and their proportionate share of certain charged expenses. See

Note 6 for more information regarding money pool. The net impact of these

transactions was not material for the years ended December 31, 2013, 2012 and

2011 for the Subsidiary Registrants.

As discussed in Note 17, certain trade receivables have been sold by Duke

Energy Ohio and Duke Energy Indiana to CRC, an affiliate formed by a subsidiary

of Duke Energy. The proceeds obtained from the sales of receivables are largely

cash but do include a subordinated note from CRC for a portion of the purchase

price.

In January 2012, Duke Energy Ohio recorded a non-cash equity transfer of

$28 million related to the sale of Vermilion to Duke Energy Indiana. Duke Energy

Indiana recorded a non-cash after-tax equity transfer of $26 million for the

purchase of Vermillion from Duke Energy Ohio. See Note 2 for further discussion.

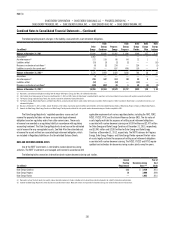

Duke Energy Commercial Asset Management (DECAM) is a nonregulated,

direct subsidiary of Duke Energy Ohio. DECAM conducts business activities

including the execution of commodity transactions, third-party vendor and supply

contracts, and service contracts for certain of Duke Energy’s nonregulated

entities. The commodity contracts DECAM enters are accounted for as

undesignated contracts or NPNS. Consequently, mark-to-market impacts of

intercompany contracts with, and sales of power to, nonregulated entities are

reflected in Duke Energy Ohio’s Consolidated Statements of Operations and

Comprehensive Income. These amounts totaled net expense of $6 million and

net revenue of $24 million and $18 million, respectively, for the years ended

December 31, 2013, 2012 and 2011. Because it is not a rated entity, DECAM

receives its credit support from Duke Energy or its nonregulated subsidiaries

and not the regulated utility operations of Duke Energy Ohio. DECAM meets its

funding needs through an intercompany loan agreement from a subsidiary of

Duke Energy. DECAM also has the ability to loan money to the subsidiary of Duke

Energy. DECAM had an outstanding intercompany loan payable of $43 million

and $79 million, respectively, as of December 31, 2013 and 2012. This amount

is recorded in Notes payable to affiliated companies on Duke Energy Ohio’s

Consolidated Balance Sheets.

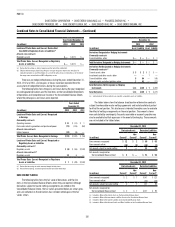

14. DERIVATIVES AND HEDGING

The Duke Energy Registrants use commodity and interest rate contracts

to manage commodity price and interest rate risks. The primary use of energy

commodity derivatives is to hedge the generation portfolio against changes in

the prices of electricity and natural gas. Interest rate swaps are used to manage

interest rate risk associated with borrowings.

All derivative instruments not identified as NPNS are recorded at fair value

as assets or liabilities on the Consolidated Balance Sheets. Cash collateral

related to derivative instruments executed under master netting agreement is

offset against the collateralized derivatives on the balance sheet.

Changes in the fair value of derivative agreements that either do not

qualify for or have not been designated as hedges are reflected in current

earnings or as regulatory assets or liabilities.

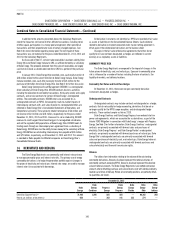

COMMODITY PRICE RISK

The Duke Energy Registrants are exposed to the impact of changes in the

future prices of electricity, coal, and natural gas. Exposure to commodity price

risk is influenced by a number of factors including the term of contracts, the

liquidity of markets, and delivery locations.

Commodity Fair Value and Cash Flow Hedges

At December 31, 2013, there were no open commodity derivative

instruments designated as hedges.

Undesignated Contracts

Undesignated contracts may include contracts not designated as a hedge,

contracts that do not qualify for hedge accounting, derivatives that do not or

no longer qualify for the NPNS scope exception, and de-designated hedge

contracts. These contracts expire as late as 2018.

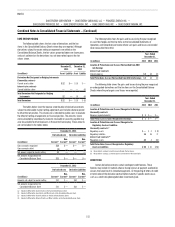

Duke Energy Carolinas and Duke Energy Progress have entered into firm

power sale agreements, which are accounted for as derivatives, as part of the

Interim FERC Mitigation in connection with Duke Energy’s merger with Progress

Energy. See Note 2 for further information. Duke Energy Carolinas’ undesignated

contracts are primarily associated with forward sales and purchases of

electricity. Duke Energy Progress’ and Duke Energy Florida’s undesignated

contracts are primarily associated with forward purchases of natural gas. Duke

Energy Ohio’s undesignated contracts are primarily associated with forward

sales and purchases of electricity, coal, and natural gas. Duke Energy Indiana’s

undesignated contracts are primarily associated with forward purchases and

sales of electricity and financial transmission rights.

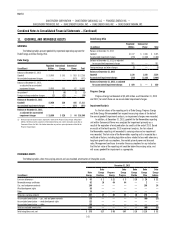

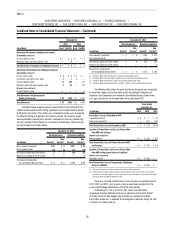

Volumes

The tables show information relating to the volume of the outstanding

commodity derivatives. Amounts disclosed represent the notional volumes of

commodity contracts excluding NPNS. Amounts disclosed represent the absolute

value of notional amounts. The Duke Energy Registrants have netted contractual

amounts where offsetting purchase and sale contracts exist with identical delivery

locations and times of delivery. Where all commodity positions are perfectly offset,

no quantities are shown.

December 31, 2013

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Electricity (Gigawatt-hours)(a) 71,466 1,205 925 925 — 69,362 203

Natural gas (millions of decatherms) 636 — 363 141 222 274 —