Duke Energy 2013 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

194

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

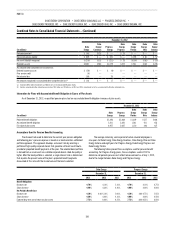

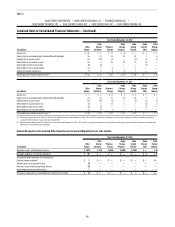

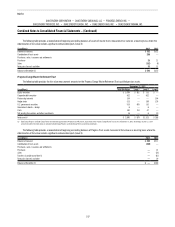

Sensitivity to Changes in Assumed Health Care Cost Trend Rates

Year Ended December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

1-Percentage Point Increase

Effect on total service and interest costs $ 11 $ 2 $ 7 $ 4 $ 3 $ 1 $ 1

Effect on post-retirement benefit obligation 42 10 20 9 10 2 4

1-Percentage Point Decrease

Effect on total service and interest costs (9) (1) (6) (3) (2) — (1)

Effect on post-retirement benefit obligation (36) (9) (16) (7) (8) (1) (4)

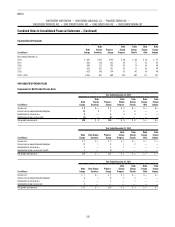

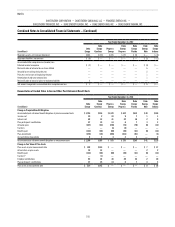

Expected Benefit Payments

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Years ending December 31,

2014 $ 85 $ 21 $ 36 $ 17 $ 17 $ 4 $ 11

2015 88 22 38 17 17 4 12

2016 89 23 38 18 17 4 12

2017 89 23 38 18 17 3 11

2018 89 24 38 18 17 3 11

2019 – 2023 413 109 180 81 84 17 47

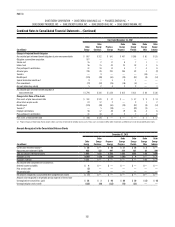

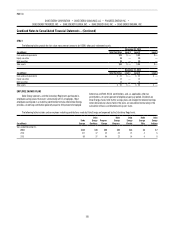

PLAN ASSETS

Description and Allocations

Duke Energy Master Retirement Trust

Assets for both the qualified pension and other post-retirement benefits

are maintained in the Duke Energy Master Retirement Trust. Approximately 98

percent of the Duke Energy Master Retirement Trust assets were allocated to

qualified pension plans and approximately 2 percent were allocated to other

post-retirement plans, as of December 31, 2013 and 2012. The investment

objective of the Duke Energy Master Retirement Trust is to achieve reasonable

returns, subject to a prudent level of portfolio risk, for the purpose of enhancing

the security of benefits for plan participants.

The asset allocation targets were set after considering the investment

objective and the risk profile. Equity securities are held for their high expected

return. Debt securities, hedge funds, real estate and other global securities are

held for diversification. Investments within asset classes are to be diversified

to achieve broad market participation and reduce the impact of individual

managers or investments. Duke Energy regularly reviews its actual asset

allocation and periodically rebalances its investments to the targeted allocation

when considered appropriate.

Qualified pension and other post-retirement benefits for the Subsidiary

Registrants are derived from the Duke Energy Master Retirement Trust, as such,

each are allocated their proportionate share of the assets discussed below.

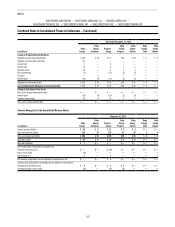

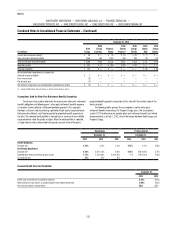

The following table includes the target asset allocations by asset class at

December 31, 2013 and the actual asset allocations for the Duke Energy Master

Retirement Trust.

Target

Allocation

Actual Allocation at December 31,

2013 2012

U.S. equity securities 10% 10% 28%

Non-U.S. equity securities 8% 8% 15%

Global equity securities 10% 10% 10%

Global private equity securities 3% 3% 3%

Debt securities 63% 63% 32%

Hedge funds 2% 3% 4%

Real estate and cash 2% 1% 4%

Other global securities 2% 2% 4%

Total 100% 100% 100%