Duke Energy 2013 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

201

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

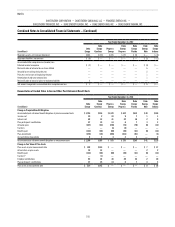

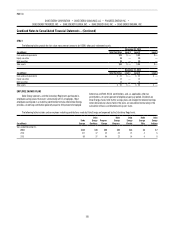

Year Ended December 31, 2012

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Income tax expense, computed at the statutory rate of 35 percent $ 858 $ 461 $ 185 $ 134 $ 145 $ 96 $ (43)

State income tax, net of federal income tax effect 64 34 33 1 14 1 1

Tax differential on foreign earnings (66) — — — — — —

AFUDC equity income (101) (54) (37) (24) (13) (2) (26)

Renewable energy production tax credits (25) — — — — — —

Other items, net (25) 12 (9) (1) 1 3 (5)

Income tax expense (benefit) from continuing operations $ 705 $ 453 $ 172 $ 110 $ 147 $ 98 $ (73)

Effective tax rate 28.8 % 34.3 % 32.7 % 28.7 % 35.7 % 36.0 % 59.5 %

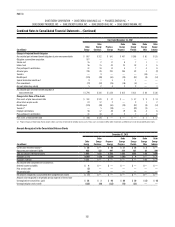

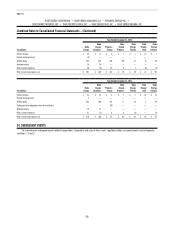

Year Ended December 31, 2011

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Income tax expense, computed at the statutory rate of 35 percent $ 863 $ 457 $ 319 $ 270 $ 173 $ 102 $ 85

State income tax, net of federal income tax effect 50 46 39 18 17 (1) 13

Tax differential on foreign earnings (44) — — — — — —

AFUDC equity income (91) (59) (36) (25) (11) (2) (31)

Renewable energy production tax credits (21) — — — — — —

Other items, net (5) 28 1 (7) 1 (3) 7

Income tax expense from continuing operations $ 752 $ 472 $ 323 $ 256 $ 180 $ 96 $ 74

Effective tax rate 30.5 % 36.1 % 35.6 % 33.2 % 36.3 % 33.1 % 30.6 %

Valuation allowances have been established for certain foreign and state

NOL carryforwards and state income tax credits that reduce deferred tax assets

to an amount that will be realized on a more-likely-than-not basis. The net

change in the total valuation allowance is included in Tax differential on foreign

earnings and State income tax, net of federal income tax effect in the above

tables.

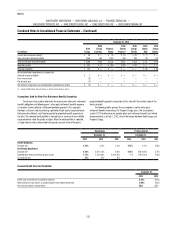

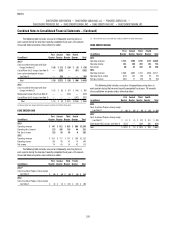

DEFERRED TAXES

Net Deferred Income Tax Liability Components

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Deferred credits and other liabilities $ 245 $ 56 $ 136 $ 9 $ 96 $ (13) $ 9

Capital lease obligations 59 11 — — — — (2)

Pension, postretirement and other employee benefits 649 18 341 119 145 23 54

Progress Energy merger purchase accounting adjustments(a) 1,184 — — — — — —

Tax credits and NOL carryforwards 4,307 488 1,965 396 365 165 521

Other 265 15 116 39 43 20 14

Valuation allowance (192) — (40) (1) — — —

Total deferred income tax assets 6,517 588 2,518 562 649 195 596

Investments and other assets (1,396) (999) (209) (160) (49) (17) (7)

Accelerated depreciation rates (12,615) (4,400) (3,663) (2,528) (1,160) (1,937) (1,591)

Regulatory assets and deferred debits (3,185) (609) (1,389) (202) (1,159) (168) (117)

Total deferred income tax liabilities (17,196) (6,008) (5,261) (2,890) (2,368) (2,122) (1,715)

Net deferred income tax liabilities $ (10,679) $ (5,420) $ (2,743) $(2,328) $ (1,719) $(1,927) $ (1,119)

(a) Primarily related to capital lease obligations and debt fair value adjustments.