Duke Energy 2013 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

143

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

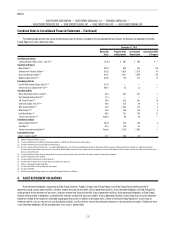

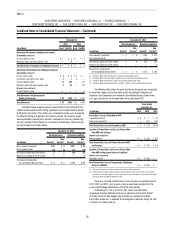

The following table presents Duke Energy’s investments in unconsolidated affiliates accounted for under the equity method, as well as the respective equity in

earnings, by segment.

Years Ended December 31,

2013 2012 2011

(in millions) Investments Equity in earnings Investments Equity in earnings Equity in earnings

Regulated Utilities $ 4 $ (1) $ 5 $ (5) $ —

International Energy 82 110 81 134 145

Commercial Power 252 7 219 14 6

Other 52 6 178 5 9

Total $ 390 $ 122 $ 483 $ 148 $ 160

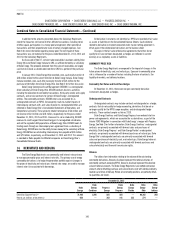

During the years ended December 31, 2013, 2012 and 2011, Duke Energy

received distributions from equity investments of $144 million, $183 million and

$149 million, respectively, which are included in Other assets within Cash Flows

from Operating Activities on the Consolidated Statements of Cash Flows.

Significant investments in affiliates accounted for under the equity

method are discussed below.

International Energy

Duke Energy owns a 25 percent indirect interest in NMC, which owns and

operates a methanol and MTBE business in Jubail, Saudi Arabia.

Commercial Power

Investments accounted for under the equity method primarily consist of

Duke Energy’s approximate 50 percent ownership interest in the five Catamount

Sweetwater, LLC wind farm projects (Phase I-V), INDU Solar Holdings, LLC and

DS Cornerstone, LLC. All of these entities own solar or wind power projects

in the United States. Duke Energy also owns a 50 percent interest in Duke

American Transmission Co., LLC which builds, owns and operates electric

transmission facilities in North America.

Other

As of December 31, 2012, investments accounted for under the equity

method primarily included a 50 percent ownership interest in DukeNet, which

owns and operates telecommunications businesses. On December 31, 2013,

Duke Energy completed the sale of its ownership interest in DukeNet to

Time Warner Cable, Inc. After retiring existing DukeNet debt and payment of

transactions expenses, Duke Energy received $215 million in cash proceeds and

recorded a $105 million pretax gain in the fourth quarter of 2013.

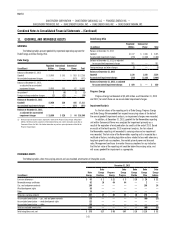

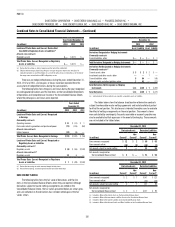

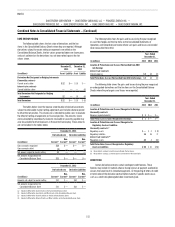

13. RELATED PARTY TRANSACTIONS

The Subsidiary Registrants engage in related party transactions, which are

generally performed at cost and in accordance with the applicable state and federal

commission regulations. Refer to the Consolidated Balance Sheets of the Subsidiary

Registrants for balances due to or due from related parties. Amounts related

to transactions with related parties included in the Consolidated Statements of

Operations and Comprehensive Income are presented in the following table.

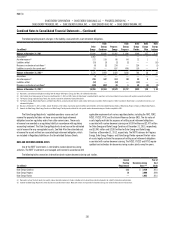

Years Ended December 31,

(in millions) 2013 2012 2011

Duke Energy Carolinas

Corporate governance and shared service expenses(a) $ 927 $1,112 $1,009

Indemnification coverages(b) 22 21 21

Joint Dispatch Agreement (JDA) revenue(c) 121 18 —

Joint Dispatch Agreement (JDA) expense(c) 116 91 —

Progress Energy

Corporate governance and shared services provided

by Duke Energy(a) $ 290 $ 63 $ —

Corporate governance and shared services provided

to Duke Energy(d) 96 47 —

Indemnification coverages(b) 34 17 —

JDA revenue(c) 116 91 —

JDA expense(c) 121 18 —

Duke Energy Progress

Corporate governance and shared service expenses(a) $ 266 $ 254 $ 203

Indemnification coverages(b) 20 8 —

JDA revenue(c) 116 91 —

JDA expense(c) 121 18 —

Duke Energy Florida

Corporate governance and shared service expenses(a) $ 182 $ 186 $ 160

Indemnification coverages(b) 14 8 —

Duke Energy Ohio

Corporate governance and shared service expenses(a) $ 347 $ 358 $ 401

Indemnification coverages(b) 15 15 17

Duke Energy Indiana

Corporate governance and shared service expenses(a) $ 422 $ 419 $ 415

Indemnification coverages(b) 14 8 7

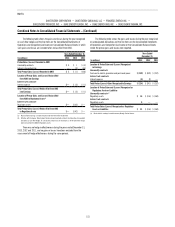

(a) The Subsidiary Registrants are charged their proportionate share of corporate governance and other costs by

unconsolidated affiliates that are consolidated affiliates of Duke Energy and Progress Energy. Corporate governance

and other shared services costs are primarily related to human resources, employee benefits, legal and accounting

fees, as well as other third-party costs. These amounts are recorded in Operation, maintenance and other on the

Consolidated Statements of Operations and Comprehensive Income. See Note 21 for additional information.

(b) The Subsidiary Registrants incur expenses related to certain indemnification coverages through Bison,

Duke Energy’s wholly owned captive insurance subsidiary. These expenses are recorded in Operation,

maintenance and other on the Consolidated Statements of Operations and Comprehensive Income.

(c) Effective with the consummation of the merger between Duke Energy and Progress Energy, Duke Energy

Carolinas and Duke Energy Progress began to participate in a JDA. The JDA allows the collective dispatch

of power plants between service territories to reduce customer rates. Revenues from the sale of power

under the JDA are recorded in Operating Revenues and expenses from the purchase of power under the

JDA are recorded in Fuel used in electric generation and purchased power on the Consolidated Statements

of Operations and Comprehensive Income.

(d) Progress Energy charges a proportionate share of corporate governance and other costs to unconsolidated

affiliates that are consolidated affiliates of Duke Energy. Corporate governance and other shared costs

are primarily related to human resources, employee benefits, legal and accounting fees, as well as other

third-party costs. These charges are recorded as an offset to Operation, maintenance and other in the

Statements of Operations and Comprehensive Income.