Duke Energy 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

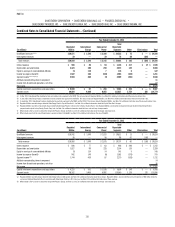

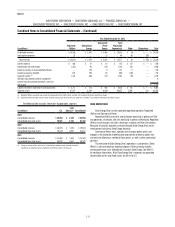

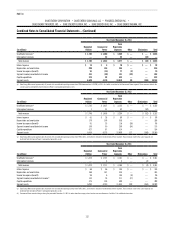

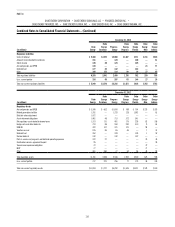

Combined Notes to Consolidated Financial Statements – (Continued)

On January 28, 2014, Duke Energy Florida terminated the EPC. Duke

Energy Florida may be required to pay for work performed under the EPC

and to bring existing work to an orderly conclusion, including but not limited

to, costs to demobilize and cancel certain equipment and material orders

placed. Duke Energy Florida is allowed to recover reasonable and prudent EPC

cancellation costs from its retail customers. If Duke Energy Florida, at its own

discretion, decides not to pursue the COL prior to March 31, 2015, it agrees to

credit customers $10 million as a reduction to fuel costs.

In accordance with the 2013 Settlement, Duke Energy Florida ceased

amortization of the wholesale allocation of Levy investments against retail rates.

In the second quarter of 2013, Duke Energy Florida recorded a pretax charge

of $65 million to write-off the wholesale portion of Levy investments. This

amount is included in Impairment charges on the Statements of Operations and

Comprehensive Income.

Recovery of the remaining retail portion of the project costs will occur

over ve years from 2013 through 2017. Duke Energy Florida has an ongoing

responsibility to demonstrate prudency related to the wind down of the Levy

investment and the potential for salvage of Levy assets. As of December 31,

2013, Duke Energy Florida has a net uncollected investment in Levy of

approximately $264 million, including AFUDC. Of this amount, $50 million

is included in Regulatory assets, $117 million related to land and the COL is

included in Net, property, plant and equipment, and $97 million is included in

Regulatory assets within Current Assets on the Balance Sheets.

Crystal River 1 and 2 Coal Units

Duke Energy Florida has evaluated Crystal River 1 and 2 coal units for

retirement in order to comply with certain environmental regulations. Based on

this evaluation, those units will likely be retired by 2018. Once those units are

retired Duke Energy Florida will continue recovery of existing annual depreciation

expense through the end of 2020. Beginning in 2021, Duke Energy Florida will

be allowed to recover any remaining net book value of the assets from retail

customers through the Capacity Cost Recovery Clause. On December 31, 2013

Duke Energy Florida led a petition with the FPSC to allow for the recovery of

prudently incurred costs to comply with the Mercury and Air Toxics Standard

through the Environmental Cost Recovery Clause.

New Generation

Duke Energy Florida currently projects a signicant need for additional

generation to offset the impact of retirement of Crystal River Unit 3 as well as

the possible retirement of Crystal River 1 and 2 coal units. The 2013 Settlement

establishes a recovery mechanism for additional generation needs. This recovery

mechanism, the Generation Base Rate Adjustment (GBRA), will apply to (i) the

construction, uprate of existing generation, and/or purchase of up to 1,150 MW

of combustion turbine and/or combined cycle generating capacity prior to the end

of 2017, and (ii) the construction of additional generation of up to 1,800 MW to

be placed in service in 2018 upon FPSC approval of a need determination. The

GBRA allows recovery of prudent costs of these items through an increase in base

rates, upon the in-service date of such assets, without a general rate case at a

10.5 percent return on equity. On October 8, 2013, Duke Energy Florida issued a

request for proposals to evaluate alternatives for an additional generation facility.

Duke Energy Florida is currently reviewing bids received on December 9, 2013.

Cost of Removal Reserve

The 2012 Settlement and the 2013 Settlement provide Duke Energy

Florida the discretion to reduce cost of removal amortization expense up to

the balance in the cost of removal reserve until the earlier of its applicable

cost of removal reserve reaches zero or the expiration of the 2013 Settlement.

Duke Energy Florida may not reduce amortization expense if the reduction

would cause it to exceed the appropriate high point of the return on equity

range. Duke Energy Florida recognized a reduction in amortization expense of

$114 million, $178 million, and $250 million for the years ended December 31,

2013, 2012, and 2011 respectively. Duke Energy Florida had no cost of removal

reserves eligible for amortization to income remaining at December 31, 2013.

Duke Energy Ohio

Capacity Rider Filing

On August 29, 2012, Duke Energy Ohio applied to the PUCO for the

establishment of a charge for capacity provided pursuant to its obligations as

a Fixed Resource Requirement (FRR) entity. The charge, which is consistent

with Ohio’s state compensation mechanism, is estimated to be approximately

$729 million, and reects Duke Energy Ohio’s embedded cost of capacity. On

February 13, 2014, the PUCO denied Duke Energy Ohio’s request.

2012 Electric Rate Case

On May 1, 2013, the PUCO approved a settlement agreement (the Electric

Settlement) related to Duke Energy Ohio’s electric distribution rate case. All

intervening parties signed the Electric Settlement. The Electric Settlement

provides for a net increase in electric distribution revenues of $49 million, or an

average increase of 2.9 percent, based upon a return on equity of 9.84 percent.

Revised rates were effective in May 2013.

2012 Natural Gas Rate Case

On April 2, 2013, Duke Energy Ohio, the PUCO Staff, and intervening

parties led a settlement (the Gas Settlement) with the PUCO related to a gas

distribution case. The Gas Settlement provides for no increase in base rates

for gas distribution service. The Gas Settlement left unresolved the recovery

of environmental remediation costs associated with former manufactured

gas plants (MGP). The Gas Settlement is based upon a return on equity of

9.84 percent.

On November 13, 2013, the PUCO issued an order approving the Gas

Settlement and allowing for the recovery of $56 million of MGP costs, excluding

carrying costs, to be recovered over a ve-year period beginning in 2014. On

February 19, 2014, the PUCO denied intervening consumer groups’ motion to

stay implementation of its order, or, in the alternative, to implement the MGP

rider subject to refund. Intervening groups have provided notice of their intent

to appeal the PUCO’s decision to the Ohio Supreme Court. Duke Energy Ohio

cannot predict the outcome of this matter.

Generation Asset Transfer

On April 2, 2012 and amended on June 22, 2012, Duke Energy Ohio and

various afliated entities led an Application for Authorization for Disposition

of Jurisdictional Facilities with FERC. The application seeks to transfer, from

Duke Energy Ohio’s rate-regulated Ohio utility company, the legacy coal-red

and combustion gas turbine assets to a nonregulated afliate, consistent

with the ESP stipulation approved by the PUCO on November 22, 2011. The

application outlines a potential additional step in the reorganization that would

result in a transfer of all of Duke Energy Ohio’s Commercial Power business to

an indirect wholly owned subsidiary of Duke Energy. The process of determining