Duke Energy 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

will be adjusted at least every four years. Included in this recovery, but not

subject to the cap, are costs of building a dry cask storage facility for spent

nuclear fuel. The return rate will be based on the currently approved AFUDC rate

with a return on equity of 7.35 percent, or 70 percent of the currently approved

10.5 percent. The return rate is subject to change if the return on equity changes

in the future. Construction of the dry cask storage facility is subject to separate

FPSC approval. The regulatory asset associated with the uprate project will

continue to be recovered through the Nuclear Cost Recovery Clause (NCRC) over

an estimated seven-year period beginning in 2013.

Through December 31, 2013, Duke Energy Florida deferred $1,310 million

for rate recovery related to Crystal River Unit 3, which is subject to the rate

recovery cap in the 2013 Settlement. In addition, Duke Energy Florida deferred

$323 million for recovery costs associated with building a dry cask storage

facility and the original uprate project, which is not subject to the rate recovery

cap discussed above. Duke Energy Florida does not expect the Crystal River Unit

3 regulatory asset to exceed the cap prior to full cash recovery from its retail

customers.

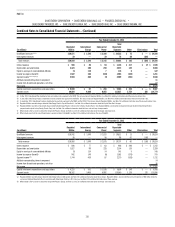

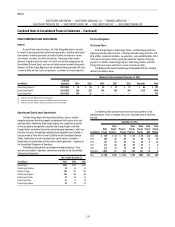

The following table includes a summary of retail customer refunds agreed

to in the 2012 Settlement and the 2013 Settlement.

December 31, 2013

Remaining Amount to be Refunded

Refunded to

(in millions) Total date 2014 2015 2016

2012 Settlement refund(a) $ 288 $ 129 $ 139 $ 10 $ 10

Retirement decision refund 100 — — 40 60

NEIL proceeds 490 326 164 — —

Total customer refunds 878 455 303 50 70

Accelerated regulatory asset recovery (130) — (37) (37) (56)

Net customer refunds $ 748 $ 455 $ 266 $ 13 $ 14

(a) See discussion under Customer Rate Matters section below.

Duke Energy Florida is a party to a master participation agreement

and other related agreements with the joint owners of Crystal River Unit 3,

which convey certain rights and obligations on Duke Energy Florida and the

joint owners. In December 2012, Duke Energy Florida reached an agreement

with one joint owner and extended a settlement offer to the other joint owner

related to all Crystal River Unit 3 matters. Duke Energy Florida recorded a

charge of $45 million in the fourth quarter of 2012 related to the December

2012 settlement and settlement offer. In January 2014, Duke Energy Florida

reached an agreement in principle with the remaining joint owner regarding

resolution of matters associated with Crystal River Unit 3 based on condition

precedents that must be met in order to carry out the agreement. Duke Energy

Florida recorded a charge of $57 million in the fourth quarter of 2013 related to

the January 2014 agreement. The signicant majority of these amounts were

included in Operations, maintenance and other on the Statements of Operations

and Comprehensive Income.

Customer Rate Matters

Pursuant to the 2013 Settlement, Duke Energy Florida will maintain

base rates at the current level through the last billing period of 2018, subject

to the return on equity range of 9.5 percent to 11.5 percent, with exceptions

for base rate increases for the recovery of the Crystal River Unit 3 regulatory

asset beginning no later than 2017 and base rate increases for new generation

through 2018, per the provisions of the 2013 Settlement. Duke Energy Florida is

not required to le a depreciation study, fossil dismantlement study or nuclear

decommissioning study until the earlier of the next rate case ling or March 31,

2019. The 2012 Settlement provided for a $150 million increase in base revenue

effective with the rst billing cycle of January 2013. Costs associated with

Crystal River Unit 3 investments were removed from retail rate base effective

with the rst billing cycle of January 2013. Duke Energy Florida is accruing,

for future rate-setting purposes, a carrying charge on the Crystal River Unit 3

investment until the Crystal River Unit 3 regulatory asset is recovered in base

rates. If Duke Energy Florida’s retail base rate earnings fall below the return on

equity range, as reported on a FPSC-adjusted or pro-forma basis on a monthly

earnings surveillance report, it may petition the FPSC to amend its base rates

during the term of the 2013 Settlement.

Duke Energy Florida is refunding $288 million to retail customers through

its fuel clause, as required by the 2012 Settlement.

Levy

On July 28, 2008, Duke Energy Florida applied to the NRC for a COL for

two Westinghouse AP1000 reactors at Levy. Various parties led a joint petition

to intervene in the Levy COL application. On March 26, 2013, the Atomic Safety

and Licensing Board issued a ruling that the NRC had carried its burden of

demonstrating its Final Environmental Impact Statement complies with the

National Environmental Policy Act and applicable NRC regulatory requirements.

In 2008, the FPSC granted Duke Energy Florida’s petition for an afrmative

Determination of Need and related orders requesting cost recovery under

Florida’s nuclear cost-recovery rule, together with the associated facilities,

including transmission lines and substation facilities.

Under the terms of the 2012 Settlement, Duke Energy Florida began retail

cost recovery of Levy costs effective in the rst billing cycle of January 2013 at

the xed rates contained in the settlement and continuing for a ve-year period,

with true-up of any actual costs not recovered during the ve-year period

occurring in the nal year. This amount is intended to recover the estimated

retail project costs to date including costs necessary to obtain the COL and any

engineering, procurement and construction (EPC) agreement cancellation costs.

The 2012 Settlement provided that Duke Energy Florida will treat the allocated

wholesale cost of Levy as a retail regulatory asset and include this asset as a

component of rate base and amortization expense for regulatory reporting. The

consumer parties agree to not oppose Duke Energy Florida continuing to pursue

a COL for Levy.