Duke Energy 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

a $154 million payment, which represented payment of the total judgment,

including prejudgment interest, and a required premium equivalent to two years

of interest, to the Broward County Clerk of Court bond account. Progress Energy

continued to accrue interest related to this judgment.

On October 3, 2012, the Florida Fourth District Court of Appeals reversed

the lower court ruling. The court held that Global was entitled to approximately

$90 million of the amount paid into the registry of the court. Progress Energy

was entitled to a refund of the remainder of the funds. Progress Energy received

cash and recorded a $63 million pretax gain for the refund in December 2012.

The gain was recorded in Income from Discontinued Operations, net of tax in the

Consolidated Statements of Operations.

On May 9, 2013, Global led a Seventh Amended Complaint asserting a

single count for breach of the Asset Purchase Agreement and seeking specic

performance. A trial is scheduled to commence in the second quarter of 2014.

In a second suit led in the Superior Court for Wake County, N.C.,

Progress Synfuel Holdings, Inc. et al. v. U.S. Global, LLC (the North Carolina

Global Case), the Progress Energy Afliates seek declaratory relief consistent

with their interpretation of the Asset Purchase Agreement. In August 2003, the

Wake County Superior Court stayed the North Carolina Global Case, pending the

outcome of the Florida Global Case. Based upon the verdict in the Florida Global

Case, Progress Energy anticipates dismissal of the North Carolina Global Case.

Progress Energy does not expect the resolution of these matters to have a

material effect on it results of operations, cash ows or nancial position.

Duke Energy Progress and Duke Energy Florida

Spent Nuclear Fuel Matters

On December 12, 2011, Duke Energy Progress and Duke Energy Florida

sued the United States in the U.S. Court of Federal Claims. The lawsuit claims

the DOE breached a contract in failing to accept spent nuclear fuel under the

Nuclear Waste Policy Act of 1982 and asserts damages for the cost of on-site

storage. Claims for all periods prior to 2006 have been resolved. Duke Energy

Progress and Duke Energy Florida assert damages of $84 million and $21 million,

respectively, for the period January 1, 2006 through December 31, 2010. Duke

Energy Progress and Duke Energy Florida may le subsequent damage claims as

they incur additional costs. Duke Energy Progress and Duke Energy Florida cannot

predict the outcome of this matter.

Duke Energy Ohio

Antitrust Lawsuit

In January 2008, four plaintiffs, including individual, industrial and

nonprot customers, led a lawsuit against Duke Energy Ohio in federal court

in the Southern District of Ohio. Plaintiffs alleged Duke Energy Ohio conspired

to provide inequitable and unfair price advantages for certain large business

consumers by entering into non-public option agreements in exchange for their

withdrawal of challenges to Duke Energy Ohio’s Rate Stabilization Plan (RSP)

implemented in early 2005. A ruling is pending on the plaintiffs’ motion to certify

this matter as a class action. It is not possible to predict whether Duke Energy

Ohio will incur any liability or to estimate the damages which may be incurred in

connection with this lawsuit.

Asbestos-related Injuries and Damages Claims

Duke Energy Ohio has been named as a defendant or co-defendant in

lawsuits related to asbestos exposure at its electric generating stations. The

impact on Duke Energy Ohio’s results of operations, cash ows or nancial

position of these cases to date has not been material. Based on estimates under

varying assumptions concerning uncertainties, such as, among others: (i) the

number of contractors potentially exposed to asbestos during construction or

maintenance of Duke Energy Ohio generating plants, (ii) the possible incidence

of various illnesses among exposed workers, and (iii) the potential settlement

costs without federal or other legislation that addresses asbestos tort actions,

Duke Energy Ohio estimates that the range of reasonably possible exposure

in existing and future suits over the foreseeable future is not material. This

assessment may change as additional settlements occur, claims are made, and

more case law is established.

Duke Energy Indiana

Edwardsport IGCC

On December 11, 2012, Duke Energy Indiana led an arbitration action

against General Electric Company and Bechtel Corporation in connection with

their work at the Edwardsport IGCC facility. Duke Energy Indiana is seeking

damages of not less than $560 million. An arbitration hearing is scheduled for

October 2014. Duke Energy Indiana cannot predict the outcome of this matter.

Other Litigation and Legal Proceedings

The Duke Energy Registrants are involved in other legal, tax and regulatory

proceedings arising in the ordinary course of business, some of which involve

signicant amounts. The Duke Energy Registrants believe the nal disposition of

these proceedings will not have a material effect on their results of operations,

cash ows or nancial position.

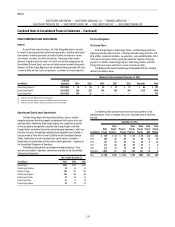

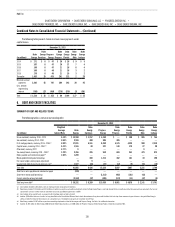

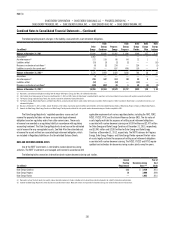

The table below presents recorded reserves based on management’s best

estimate of probable loss for legal matters discussed above and the associated

insurance recoveries. The reasonably possible range of loss for all non-asbestos

related matters in excess of recorded reserves is not material.

December 31,

(in millions) 2013 2012

Reserves for Legal and Other Matters(a)

Duke Energy(b) $824 $846

Duke Energy Carolinas(b) 616 751

Progress Energy 78 79

Duke Energy Progress 10 12

Duke Energy Florida(c) 43 47

Duke Energy Indiana 8 8

Probable Insurance Recoveries(d)

Duke Energy(e) $649 $781

Duke Energy Carolinas(e) 649 781

(a) Classied in the respective Consolidated Balance Sheets in Other within Deferred Credits and Other

Liabilities and Other within Current Liabilities.

(b) Includes reserves for asbestos-related injuries and damages claims.

(c) Includes workers’ compensation claims.

(d) Classied in the respective Consolidated Balance Sheets in Other within Investments and Other Assets

and Receivables.

(e) Relates to recoveries associated with asbestos-related injuries and damages claims.