Duke Energy 2013 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

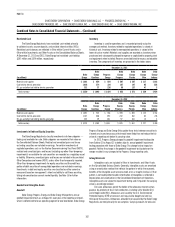

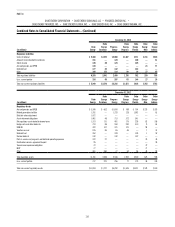

Year Ended December 31, 2013

(in millions)

Regulated

Utilities

International

Energy

Commercial

Power

Total

Reportable

Segments Other Eliminations Total

Unafliated revenues(a)(b)(c) $ 20,871 $ 1,546 $ 2,106 $ 24,523 $ 75 $ — $ 24,598

Intersegment revenues 39 — 39 78 88 (166) —

Total revenues $ 20,910 $ 1,546 $ 2,145 $ 24,601 $ 163 $ (166) $ 24,598

Interest expense $ 986 $ 86 $ 64 $ 1,136 $ 417 $ (7) $ 1,546

Depreciation and amortization 2,323 100 250 2,673 135 — 2,808

Equity in earnings of unconsolidated afliates (1) 110 7 116 6 — 122

Income tax expense (benet) 1,522 166 (104) 1,584 (323) — 1,261

Segment income(a)(b)(c)(d)(e)(f)(g) 2,504 408 (3) 2,909 (261) — 2,648

Add back noncontrolling interest component 11

Income from discontinued operations, net of tax 17

Net income $ 2,676

Capital investments expenditures and acquisitions $ 5,049 $ 67 $ 268 $ 5,384 $ 223 $ — $ 5,607

Segment assets 99,884 4,998 6,955 111,837 2,754 188 114,779

(a) In May 2013, Duke Energy Ohio implemented revised customer rates approved by the PUCO. This increase impacts Regulated Utilities. See Note 4 for additional information about the revised customer rates.

(b) In June 2013, Duke Energy Progress implemented revised customer rates approved by the NCUC. This increase impacts Regulated Utilities. See Note 4 for additional information about the revised customer rates.

(c) In September 2013, Duke Energy Carolinas implemented revised rates approved by the NCUC and the PSCSC. This increase impacts Regulated Utilities. See Note 4 for additional information about the revised customer rates.

(d) Regulated Utilities recorded charges related to Duke Energy Florida’s Crystal River Unit 3. See Note 4 for additional information about the Crystal River Unit 3 charges.

(e) Regulated Utilities recorded an impairment charge related to Duke Energy Progress’ Shearon Harris Nuclear Station (Harris) site. Regulated Utilities also recorded an impairment charge related to Duke Energy Florida’s

proposed nuclear plant in Levy County, Florida (Levy) site. See Note 4 for additional information about the Harris site and Levy site impairments.

(f) Other includes after-tax costs to achieve the merger with Progress Energy. See Notes 2 and 25 for additional information about the merger and related costs.

(g) Other includes gain from the sale of Duke Energy’s ownership interest in DukeNet. See Note 12 for additional information on the sale of DukeNet.

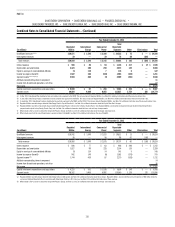

Year Ended December 31, 2012

(in millions)

Regulated

Utilities

International

Energy

Commercial

Power

Total

Reportable

Segments Other Eliminations Total

Unafliated revenues $ 16,042 $ 1,549 $ 2,020 $ 19,611 $ 13 $ — $ 19,624

Intersegment revenues 38 — 58 96 47 (143) —

Total revenues $ 16,080 $ 1,549 $ 2,078 $ 19,707 $ 60 $ (143) $ 19,624

Interest expense $ 806 $ 77 $ 63 $ 946 $ 296 $ — $ 1,242

Depreciation and amortization 1,827 99 228 2,154 135 — 2,289

Equity in earnings of unconsolidated afliates (5) 134 14 143 5 — 148

Income tax expense (benet) 942 149 (8) 1,083 (378) — 705

Segment income(a)(b) 1,744 439 87 2,270 (538) — 1,732

Add back noncontrolling interest component 14

Income from discontinued operations, net of tax 36

Net income $ 1,782

Capital investments expenditures and acquisitions $ 4,220 $ 551 $ 1,038 $ 5,809 $ 149 $ — $ 5,958

Segment assets 98,162 5,406 6,992 110,560 3,126 170 113,856

(a) Regulated Utilities recorded charges related to Duke Energy Indiana’s IGCC project. See Note 4 for additional information about these charges. Regulated Utilities also recorded the reversal of expenses of $60 million related to

a prior year Voluntary Opportunity Plan in accordance with Duke Energy Carolinas’ 2011 rate case. See Note 19 for additional information about these expenses.

(b) Other includes after-tax costs to achieve the merger with Progress Energy. See Notes 2 and 25 for additional information about the merger and related costs.