SunTrust 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

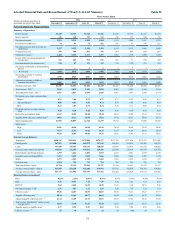

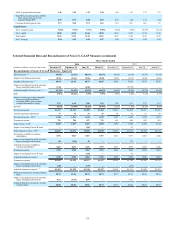

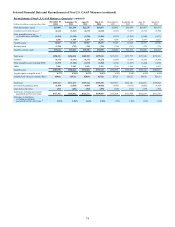

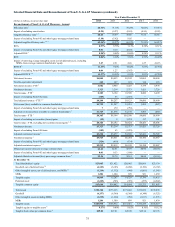

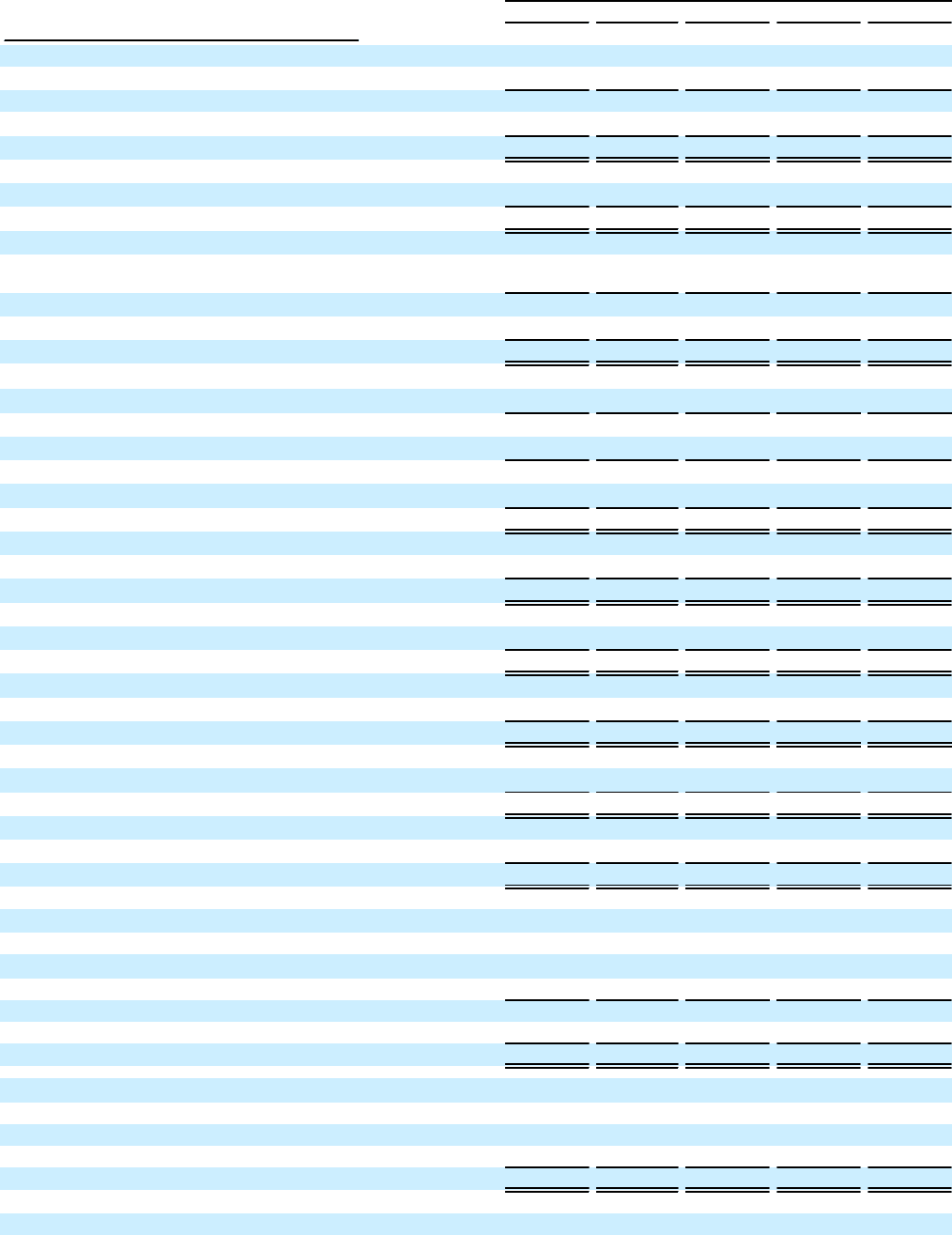

Selected Financial Data and Reconcilement of Non-U.S. GAAP Measures (continued)

Year Ended December 31

(Dollars in millions, except per share data) 2014 2013 2012 2011 2010

Reconcilement of Non-U.S. GAAP Measures - Annual

Efficiency ratio 1 66.74% 71.16% 59.29% 72.02% 67.44 %

Impact of excluding amortization (0.30) (0.27) (0.43) (0.50) (0.59)

Tangible efficiency ratio 1, 7 66.44 70.89 58.86 71.52 66.85

Impact of excluding Form 8-K and other legacy mortgage-related items (3.10) (5.62) 8.05 — —

Adjusted tangible efficiency ratio 1, 2, 7 63.34% 65.27% 66.91% 71.52% 66.85 %

ROA 0.97% 0.78% 1.11% 0.38% 0.11%

Impact of excluding Form 8-K and other legacy mortgage-related items 0.01 0.10 (0.43) — —

Adjusted ROA 20.98% 0.88% 0.68% 0.38% 0.11%

ROE 8.06% 6.34% 9.56% 2.56% (0.49)%

Impact of removing average intangible assets (net of deferred taxes), excluding

MSRs, from average common shareholders' equity 3.27 2.91 4.46 1.27 (0.27)

ROTCE 5 11.33% 9.25% 14.02% 3.83% (0.76%)

Impact of excluding Form 8-K and other legacy mortgage-related items 0.04 1.27 (5.47) — —

Adjusted ROTCE 2, 5 11.37% 10.52% 8.55% 3.83% (0.76%)

Net interest income $4,840 $4,853 $5,102 $5,065 $4,854

Taxable-equivalent adjustment 142 127 123 114 116

Net interest income - FTE 34,982 4,980 5,225 5,179 4,970

Noninterest income 3,323 3,214 5,373 3,421 3,729

Total revenue - FTE 3 8,305 8,194 10,598 8,600 8,699

Impact of excluding Form 8-K items (105) 63 (1,475) — —

Total adjusted revenue - FTE 2, 3 $8,200 $8,257 $9,123 $8,600 $8,699

Net income/(loss) available to common shareholders $1,722 $1,297 $1,931 $495 ($87)

Impact of excluding Form 8-K and other legacy mortgage-related items 7179 (753) — —

Adjusted net income/(loss) available to common shareholders 2 $1,729 $1,476 $1,178 $495 ($87)

Total revenue - FTE 3$8,305 $8,194 $10,598 $8,600 $8,699

Impact of excluding net securities (losses)/gains (15) 2 1,974 117 191

Total revenue - FTE, excluding net securities (losses)/gains 3, 13 $8,320 $8,192 $8,624 $8,483 $8,508

Noninterest income $3,323 $3,214 $5,373 $3,421 $3,729

Impact of excluding Form 8-K items (105) 63 (1,475) — —

Adjusted noninterest income 2 $3,218 $3,277 $3,898 $3,421 $3,729

Noninterest expense 1$5,543 $5,831 $6,284 $6,194 $5,867

Impact of excluding Form 8-K and other legacy mortgage-related items (324) (419) (134) — —

Adjusted noninterest expense 1, 2 $5,219 $5,412 $6,150 $6,194 $5,867

Diluted net income/(loss) per average common share $3.23 $2.41 $3.59 $0.94 ($0.18)

Impact of excluding Form 8-K and other legacy mortgage-related items 0.01 0.33 (1.40) — —

Adjusted diluted net income/(loss) per average common share 2$3.24 $2.74 $2.19 $0.94 ($0.18)

At December 31:

Total shareholders’ equity $23,005 $21,422 $20,985 $20,066 $23,130

Goodwill, net of deferred taxes 10 (6,123) (6,183) (6,206) (6,190) (6,189)

Other intangible assets, net of deferred taxes, and MSRs 11 (1,219) (1,332) (949) (1,001) (1,545)

MSRs 1,206 1,300 899 921 1,439

Tangible equity 16,869 15,207 14,729 13,796 16,835

Preferred stock (1,225) (725) (725) (275) (4,942)

Tangible common equity $15,644 $14,482 $14,004 $13,521 $11,893

Total assets $190,328 $175,335 $173,442 $176,859 $172,874

Goodwill (6,337) (6,369) (6,369) (6,344) (6,323)

Other intangible assets including MSRs (1,219) (1,334) (956) (1,017) (1,571)

MSRs 1,206 1,300 899 921 1,439

Tangible assets $183,978 $168,932 $167,016 $170,419 $166,419

Tangible equity to tangible assets 89.17% 9.00% 8.82% 8.10% 10.12 %

Tangible book value per common share 4 $29.82 $27.01 $25.98 $25.18 $23.76