SunTrust 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

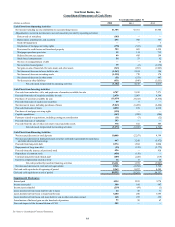

Notes to Consolidated Financial Statements, continued

94

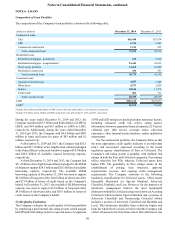

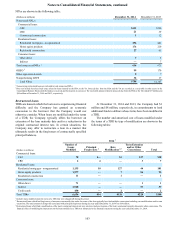

The following table presents the Company's eligible securities borrowed or purchased under agreements to resell and securities sold

under agreements to repurchase at December 31, 2014 and 2013:

Net Amount

Presented in

Consolidated

Balance Sheets

(Dollars in millions) Gross

Amount Amount

Offset

Held/

Pledged

Financial

Instruments Net

Amount

December 31, 2014

Financial assets:

Securities borrowed or purchased under agreements to resell $1,122 $— $1,122 1,2 $1,112 $10

Financial liabilities:

Securities sold under agreements to repurchase 2,276 — 2,276 12,276 —

December 31, 2013

Financial assets:

Securities borrowed or purchased under agreements to resell $908 $— $908 1,2 $899 $9

Financial liabilities:

Securities sold under agreements to repurchase 1,759 — 1,759 11,759 —

1 None of the Company's repurchase or resell transactions met the right of setoff criteria for net balance sheet presentation at December 31, 2014 and 2013.

2 Excludes $38 million and $75 million of Fed funds sold which are not subject to a master netting agreement at December 31, 2014 and 2013, respectively.

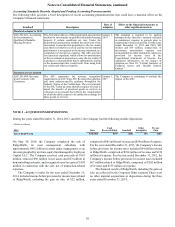

NOTE 4 - TRADING ASSETS AND LIABILITIES AND DERIVATIVES

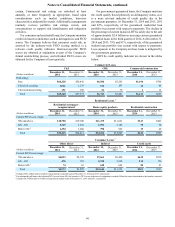

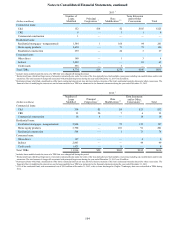

The fair values of the components of trading assets and liabilities and derivatives at December 31 were as follows:

(Dollars in millions) 2014 2013

Trading Assets and Derivatives:

U.S. Treasury securities $267 $219

Federal agency securities 547 426

U.S. states and political subdivisions 42 65

MBS - agency 545 323

CDO/CLO securities 357

ABS —6

Corporate and other debt securities 509 534

CP 327 29

Equity securities 45 109

Derivatives 11,307 1,384

Trading loans 22,610 1,888

Total trading assets and derivatives $6,202 $5,040

Trading Liabilities and Derivatives:

U.S. Treasury securities $485 $472

MBS - agency 1—

Corporate and other debt securities 279 179

Equity securities —5

Derivatives 1462 525

Total trading liabilities and derivatives $1,227 $1,181

1 Amounts include the impact of offsetting cash collateral received from and paid to the same derivative counterparties and the impact of netting derivative assets and derivative liabilities

when a legally enforceable master netting agreement or similar agreement exists.

2 Includes loans related to TRS.

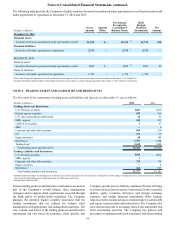

Various trading products and derivative instruments are used as

part of the Company’s overall balance sheet management

strategies and to support client requirements executed through

the Bank and/or its broker/dealer subsidiary. The Company

manages the potential market volatility associated with the

trading instruments that are utilized for balance sheet

management with appropriate risk management strategies. The

size, volume, and nature of the trading products and derivative

instruments can vary based on economic, client specific, and

Company specific asset or liability conditions. Product offerings

to clients include debt securities, loans traded in the secondary

market, equity securities, derivative and foreign exchange

contracts, and similar financial instruments. Other trading-

related activities include acting as a market maker in certain debt

and equity securities and related derivatives. The Company also

uses end user derivatives to manage interest rate and market risk

from non-trading activities. The Company has policies and

procedures to manage market risk associated with client trading