SunTrust 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

to the behavior of interest rates and spreads, the changes in

product balances, and the behavior of loan and deposit clients in

different rate environments. This analysis incorporates several

assumptions, the most material of which relate to the repricing

characteristics and balance fluctuations of deposits with

indeterminate or non-contractual maturities.

As the future path of interest rates cannot be known, we use

simulation analysis to project net interest income under various

scenarios including implied forward and deliberately extreme

and perhaps unlikely scenarios. The analyses may include rapid

and gradual ramping of interest rates, rate shocks, basis risk

analysis, and yield curve twists. Specific strategies are also

analyzed to determine their impact on net interest income levels

and sensitivities.

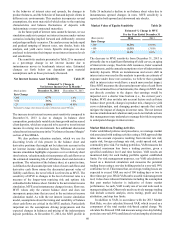

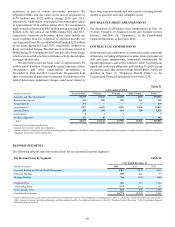

The sensitivity analysis presented in Table 25 is measured

as a percentage change in net interest income due to

instantaneous moves in benchmark interest rates. Estimated

changes set forth below are dependent upon material

assumptions such as those previously discussed.

Net Interest Income Asset Sensitivity Table 25

Estimated % Change in

Net Interest Income Over 12 Months 1

(Basis points) December 31, 2014 December 31, 2013

Rate Change

+200 6.7% 1.8%

+100 3.5% 1.0%

-25 (1.0)% (0.8)%

1 Estimated % change of net interest income is reflected on a non-FTE basis.

The increase in net interest income asset sensitivity compared to

December 31, 2013 is due to changes in balance sheet

composition, particularly variable rate loan growth and increased

client deposits, which are expected to be accretive to net interest

income in a rising rate environment. See additional discussion

related to net interest income in the "Net Interest Income/Margin"

section of this MD&A.

We also perform valuation analysis, which we use for

discerning levels of risk present in the balance sheet and

derivative positions that might not be taken into account in the

net interest income simulation horizon. Whereas net interest

income simulation highlights exposures over a relatively short

time horizon, valuation analysis incorporates all cash flows over

the estimated remaining life of all balance sheet and derivative

positions. The valuation of the balance sheet, at a point in time,

is defined as the discounted present value of asset cash flows and

derivative cash flows minus the discounted present value of

liability cash flows, the net of which is referred to as MVE. The

sensitivity of MVE to changes in the level of interest rates is a

measure of the longer-term repricing risk and options risk

embedded in the balance sheet. Similar to the net interest income

simulation, MVE uses instantaneous changes in rates. However,

MVE values only the current balance sheet and does not

incorporate projections that are used in the net interest income

simulation model. As with the net interest income simulation

model, assumptions about the timing and variability of balance

sheet cash flows are critical in the MVE analysis. Particularly

important are the assumptions driving prepayments and the

expected changes in balances and pricing of the indeterminate

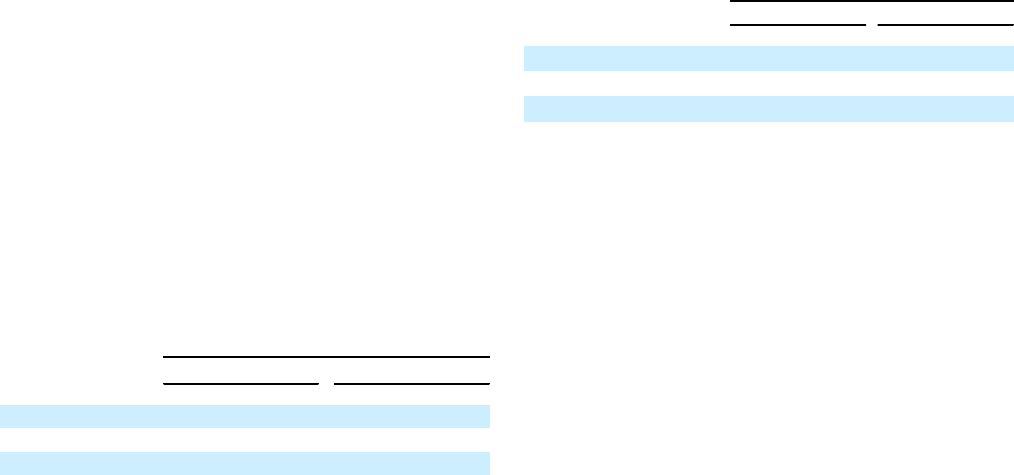

deposit portfolios. At December 31, 2014, the MVE profile in

Table 26 indicated a decline in net balance sheet value due to

instantaneous upward changes in rates. MVE sensitivity is

reported in both upward and downward rate shocks.

Market Value of Equity Sensitivity Table 26

Estimated % Change in MVE

For the Year Ended December 31

(Basis points) 2014 2013

Rate Change

+200 (4.2)% (8.0)%

+100 (1.5)% (3.8)%

-25 0.1% 0.8%

The decrease in MVE sensitivity from December 31, 2013 is

primarily due to a significant flattening of yield curves, an aging

of interest rate swaps, fixed rate debt issuances, faster assumed

prepayments, and the annual assumption review of indeterminate

maturity deposits. While an instantaneous and severe shift in

interest rates was used in this analysis to provide an estimate of

exposure under these rate scenarios, we believe that a gradual

shift in interest rates would have a much more modest impact.

Since MVE measures the discounted present value of cash flows

over the estimated lives of instruments, the change in MVE does

not directly correlate to the degree that earnings would be

impacted over a shorter time horizon (i.e., the current year).

Further, MVE does not take into account factors such as future

balance sheet growth, changes in product mix, changes in yield

curve relationships, and changing product spreads that could

mitigate the impact of changes in interest rates. The net interest

income simulation and valuation analyses do not include actions

that management may undertake to manage this risk in response

to anticipated changes in interest rates.

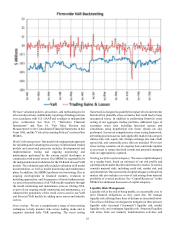

Market Risk from Trading Activities

Under established policies and procedures, we manage market

risk associated with trading activities using a VAR approach that

takes into account exposures resulting from interest rate risk,

equity risk, foreign exchange rate risk, credit spread risk, and

commodity price risk. For trading portfolios, VAR measures the

estimated maximum loss from a trading position, given a

specified confidence level and time horizon. VAR results are

monitored daily for each trading portfolio against established

limits. For risk management purposes, our VAR calculation is

based on a historical simulation and measures the potential

trading losses using a one-day holding period at a one-tail, 99%

confidence level. This means that, on average, trading losses are

expected to exceed VAR one out of 100 trading days or two to

three times per year. While VAR can be a useful risk management

tool, it does have inherent limitations including the assumption

that past market behavior is indicative of future market

performance. As such, VAR is only one of several tools used to

manage trading risk. Other tools used to actively manage trading

risk include scenario analysis, stress testing, profit and loss

attribution, and stop loss limits.

In addition to VAR, in accordance with the 2013 Market

Risk Rule, we also calculate Stressed VAR, which is used as a

component of the total market risk-based capital charge. We

calculate the Stressed VAR risk measure using a ten-day holding

period at a one-tail, 99% confidence level and employ a historical