SunTrust 2014 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

158

stayed pending a decision in the Edwards case also. In June 2012,

the U.S. Supreme Court withdrew its grant of certiorari in

Edwards and, as a result, the stays in these cases were lifted.

SunTrust has filed a motion to dismiss the Thurmond case which

was granted in part and denied in part, allowing limited discovery

surrounding the argument that the statute of limitations for

certain claims should be equitably tolled. Discovery on this

matter is underway. The Acosta plaintiffs have voluntarily

dismissed their case.

United States Attorney’s Office for the Southern District of

New York Foreclosure Expense Investigation

STM has been cooperating with the United States Attorney's

Office for the Southern District of New York (the "Southern

District") in a broad-based industry investigation regarding

claims for foreclosure-related expenses charged by law firms in

connection with the foreclosure of loans guaranteed or insured

by Fannie Mae, Freddie Mac, or FHA. The investigation relates

to a private litigant qui tam lawsuit filed under seal and remains

in early stages. The Southern District has not yet advised STM

how it will proceed in this matter. The Southern District and STM

engaged in dialogue regarding potential resolution of this matter

as part of the National Mortgage Servicing Settlement, but were

unable to reach agreement. The Company's financial statements

at December 31, 2014 reflect the Company's current estimate of

probable losses associated with the matter.

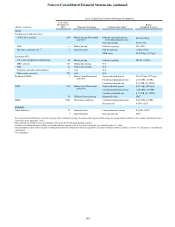

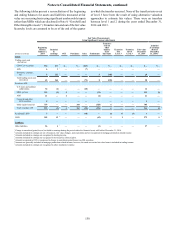

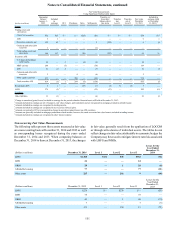

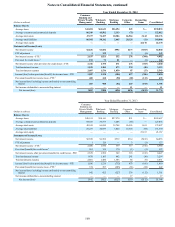

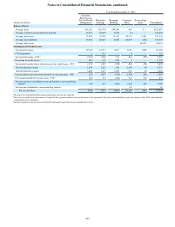

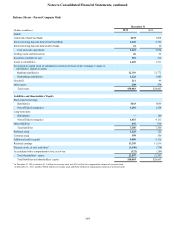

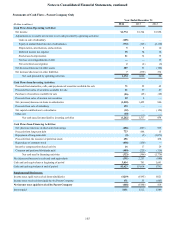

NOTE 20 - BUSINESS SEGMENT REPORTING

The Company has three segments used to measure business

activity: Consumer Banking and Private Wealth Management,

Wholesale Banking, and Mortgage Banking, with functional

activities included in Corporate Other. The business segments

are determined based on the products and services provided or

the type of client served, and they reflect the manner in which

financial information is evaluated by management. The

following is a description of the segments and their composition.

The Consumer Banking and Private Wealth Management

segment is made up of two primary businesses: Consumer

Banking and Private Wealth Management.

• Consumer Banking provides services to consumers and

branch-managed small business clients through an

extensive network of traditional and in-store branches,

ATMs, the internet (www.suntrust.com), mobile banking,

and telephone (1-800-SUNTRUST). Financial products and

services offered to consumers and small business clients

include deposits, home equity lines and loans, credit lines,

indirect auto, student lending, bank card, other lending

products, and various fee-based services. Consumer

Banking also serves as an entry point for clients and provides

services for other lines of business.

• PWM provides a full array of wealth management products

and professional services to both individual and institutional

clients including loans, deposits, brokerage, professional

investment management, and trust services to clients

seeking active management of their financial resources.

Institutional clients are served by the IIS business. Discount/

online and full-service brokerage products are offered to

individual clients through STIS. PWM also includes

GenSpring, which provides family office solutions to ultra-

high net worth individuals and their families. Utilizing

teams of multi-disciplinary specialists with expertise in

investments, tax, accounting, estate planning, and other

wealth management disciplines, GenSpring helps families

manage and sustain wealth across multiple generations.

The Wholesale Banking segment includes the following four

businesses:

• CIB delivers comprehensive capital markets solutions,

including advisory, capital raising, and financial risk

management, with the first goal of best serving the needs of

both public and private companies in the Wholesale Banking

segment and PWM business. Investment Banking and

Corporate Banking teams within CIB serve clients across

the nation, offering a full suite of traditional banking and

investment banking products and services to companies

with annual revenues typically greater than $150 million.

Investment Banking serves select industry segments

including consumer and retail, energy, financial services,

healthcare, industrials, media and communications, real

estate, and technology. Corporate Banking serves clients

across diversified industry sectors based on size,

complexity, and frequency of capital markets issuance. Also

managed within CIB is the Equipment Finance Group,

which provides lease financing solutions (through SunTrust

Equipment Finance & Leasing).

• Commercial & Business Banking offers an array of

traditional banking products, including cash management

services and investment banking solutions via STRH to

commercial clients (generally those with average revenues

$1 million to $150 million), not-for-profit organizations, and

governmental entities, as well as auto dealer financing (floor

plan inventory financing). Also managed within

Commercial & Business Banking is the Premium

Assignment Corporation, which creates corporate insurance

premium financing solutions.

• Commercial Real Estate provides a full range of financial

solutions for commercial real estate developers, owners, and

investors, including construction, mini-perm, and

permanent real estate financing as well as tailored financing

and equity investment solutions via STRH, primarily

through the REIT group focused on Real Estate Investment

Trusts. The Institutional Real Estate team targets

relationships with institutional advisors, private funds, and

insurance companies and the Regional team focuses on real

estate owners and developers through a regional delivery

structure. Commercial Real Estate also offers tailored

financing and equity investment solutions for community

development and affordable housing projects through

SunTrust Community Capital, with particular expertise in

Low Income Housing Tax Credits and New Market Tax

Credits.