SunTrust 2014 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

136

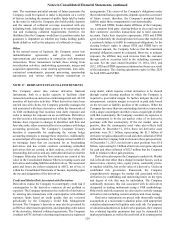

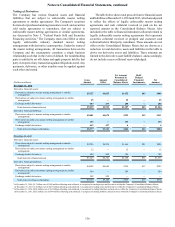

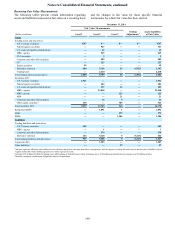

Netting of Derivatives

The Company has various financial assets and financial

liabilities that are subject to enforceable master netting

agreements or similar agreements. The Company's securities

borrowed or purchased under agreements to resell, and securities

sold under agreements to repurchase, that are subject to

enforceable master netting agreements or similar agreements,

are discussed in Note 3, "Federal Funds Sold and Securities

Financing Activities." The Company enters into ISDA or other

legally enforceable industry standard master netting

arrangements with derivative counterparties. Under the terms of

the master netting arrangements, all transactions between the

Company and the counterparty constitute a single business

relationship such that in the event of default, the nondefaulting

party is entitled to set off claims and apply property held by that

party in respect of any transaction against obligations owed. Any

payments, deliveries, or other transfers may be applied against

each other and netted.

The table below shows total gross derivative financial assets

and liabilities at December 31, 2014 and 2013, which are adjusted

to reflect the effects of legally enforceable master netting

agreements and cash collateral received or paid on the net

reported amount in the Consolidated Balance Sheets. Also

included in the table is financial instrument collateral related to

legally enforceable master netting agreements that represents

securities collateral received or pledged and customer cash

collateral held at third party custodians. These amounts are not

offset on the Consolidated Balance Sheets but are shown as a

reduction to total derivative assets and liabilities in the table to

derive net derivative assets and liabilities. These amounts are

limited to the derivative asset/liability balance, and accordingly,

do not include excess collateral received/pledged.

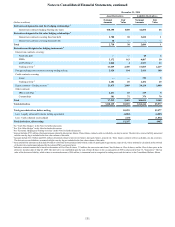

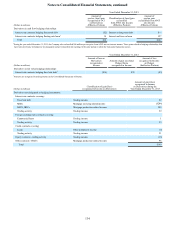

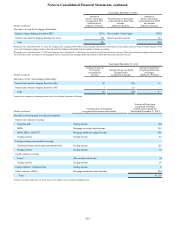

(Dollars in millions) Gross

Amount Amount

Offset

Net Amount

Presented in

Consolidated

Balance Sheets

Held/

Pledged

Financial

Instruments Net

Amount

December 31, 2014

Derivative financial assets:

Derivatives subject to master netting arrangement or similar

arrangement $5,127 $4,095 $1,032 $63 $969

Derivatives not subject to master netting arrangement or similar

arrangement 25 — 25 — 25

Exchange traded derivatives 687 437 250 — 250

Total derivative financial assets $5,839 $4,532 $1,307 1$63 $1,244

Derivative financial liabilities:

Derivatives subject to master netting arrangement or similar

arrangement $5,001 $4,678 $323 $12 $311

Derivatives not subject to master netting arrangement or similar

arrangement 133 — 133 — 133

Exchange traded derivatives 443 437 6 — 6

Total derivative financial liabilities $5,577 $5,115 $462 2$12 $450

December 31, 2013

Derivative financial assets:

Derivatives subject to master netting arrangement or similar

arrangement $5,285 $4,239 $1,046 $51 $995

Derivatives not subject to master netting arrangement or similar

arrangement 12 — 12 — 12

Exchange traded derivatives 828 502 326 — 326

Total derivative financial assets $6,125 $4,741 $1,384 1$51 $1,333

Derivative financial liabilities:

Derivatives subject to master netting arrangement or similar

arrangement $4,982 $4,646 $336 $13 $323

Derivatives not subject to master netting arrangement or similar

arrangement 189 — 189 — 189

Exchange traded derivatives 502 502 — — —

Total derivative financial liabilities $5,673 $5,148 $525 2$13 $512

1 At December 31, 2014, $1.3 billion, net of $449 million offsetting cash collateral, is recognized in trading assets and derivatives within the Company's Consolidated Balance Sheets.

At December 31, 2013, $1.4 billion, net of $457 million offsetting cash collateral, is recognized in trading assets and derivatives within the Company's Consolidated Balance Sheets.

2 At December 31, 2014, $462 million, net of $1.0 billion offsetting cash collateral, is recognized in trading liabilities and derivatives within the Company's Consolidated Balance Sheets.

At December 31, 2013, $525 million, net of $864 million offsetting cash collateral, is recognized in trading liabilities and derivatives within the Company's Consolidated Balance Sheets.