SunTrust 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

101

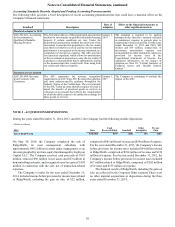

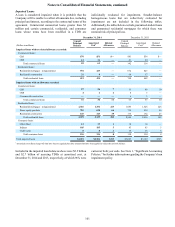

Impaired Loans

A loan is considered impaired when it is probable that the

Company will be unable to collect all amounts due, including

principal and interest, according to the contractual terms of the

agreement. Commercial nonaccrual loans greater than $3

million and certain commercial, residential, and consumer

loans whose terms have been modified in a TDR are

individually evaluated for impairment. Smaller-balance

homogeneous loans that are collectively evaluated for

impairment are not included in the following tables.

Additionally, the tables below exclude guaranteed student loans

and guaranteed residential mortgages for which there was

nominal risk of principal loss.

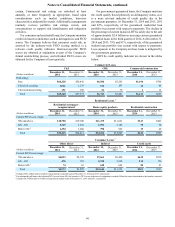

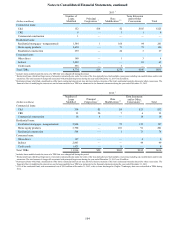

December 31, 2014 December 31, 2013

(Dollars in millions)

Unpaid

Principal

Balance Amortized

Cost1Related

Allowance

Unpaid

Principal

Balance Amortized

Cost1Related

Allowance

Impaired loans with no related allowance recorded:

Commercial loans:

C&I $70 $51 $— $81 $56 $—

CRE 12 11 — 61 60 —

Total commercial loans 82 62 — 142 116 —

Residential loans:

Residential mortgages - nonguaranteed 592 425 — 672 425 —

Residential construction 31 9 — 68 17 —

Total residential loans 623 434 — 740 442 —

Impaired loans with an allowance recorded:

Commercial loans:

C&I 27 26 7 51 49 10

CRE 4 4 4 8 3 —

Commercial construction — — — 6 3 —

Total commercial loans 31 30 11 65 55 10

Residential loans:

Residential mortgages - nonguaranteed 1,381 1,354 215 1,685 1,626 226

Home equity products 703 630 66 710 638 96

Residential construction 145 145 19 173 172 23

Total residential loans 2,229 2,129 300 2,568 2,436 345

Consumer loans:

Other direct 13 13 1 14 14 —

Indirect 105 105 5 83 83 5

Credit cards 8 8 2 13 13 3

Total consumer loans 126 126 8 110 110 8

Total impaired loans $3,091 $2,781 $319 $3,625 $3,159 $363

1 Amortized cost reflects charge-offs that have been recognized plus other amounts that have been applied to reduce the net book balance.

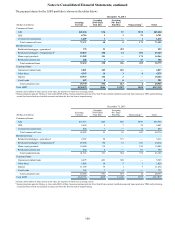

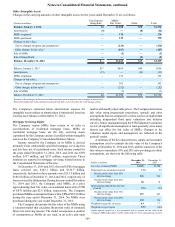

Included in the impaired loan balances above were $2.5 billion

and $2.7 billion of accruing TDRs at amortized cost, at

December 31, 2014 and 2013, respectively, of which 96% were

current at both year ends. See Note 1, “Significant Accounting

Policies,” for further information regarding the Company’s loan

impairment policy.