SunTrust 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

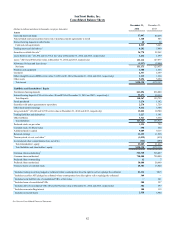

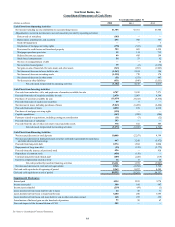

SunTrust Banks, Inc.

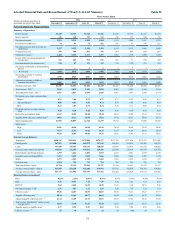

Consolidated Statements of Income

Year Ended December 31

(Dollars in millions and shares in thousands, except per share data) 2014 2013 2012

Interest Income

Interest and fees on loans $4,617 $4,633 $5,035

Interest and fees on loans held for sale 78 107 112

Interest and dividends on securities available for sale 613 579 655

Trading account interest and other 76 69 65

Total interest income 5,384 5,388 5,867

Interest Expense

Interest on deposits 235 291 429

Interest on long-term debt 270 210 299

Interest on other borrowings 39 34 37

Total interest expense 544 535 765

Net interest income 4,840 4,853 5,102

Provision for credit losses 342 553 1,395

Net interest income after provision for credit losses 4,498 4,300 3,707

Noninterest Income

Service charges on deposit accounts 645 657 676

Other charges and fees 368 369 402

Card fees 320 310 316

Trust and investment management income 423 518 512

Retail investment services 297 267 241

Investment banking income 404 356 342

Trading income 182 182 211

Mortgage production related income 201 314 343

Mortgage servicing related income 196 87 260

Gain on sale of subsidiary 105 — —

Net securities (losses)/gains (15) 2 1,974

Other noninterest income 197 152 96

Total noninterest income 3,323 3,214 5,373

Noninterest Expense

Employee compensation 2,576 2,488 2,603

Employee benefits 386 413 474

Outside processing and software 741 746 710

Operating losses 441 503 277

Net occupancy expense 340 348 359

Regulatory assessments 142 181 233

Equipment expense 169 181 188

Marketing and customer development 134 135 184

Credit and collection services 91 264 239

Consulting and legal fees 72 73 165

Amortization 25 23 46

Other real estate (income)/expense (4) 4 140

Net loss on debt extinguishment —— 16

Other noninterest expense 1430 472 650

Total noninterest expense 5,543 5,831 6,284

Income before provision for income taxes 2,278 1,683 2,796

Provision for income taxes 1493 322 812

Net income including income attributable to noncontrolling interest 1,785 1,361 1,984

Net income attributable to noncontrolling interest 11 17 26

Net income $1,774 $1,344 $1,958

Net income available to common shareholders $1,722 $1,297 $1,931

Net income per average common share:

Diluted $3.23 $2.41 $3.59

Basic 3.26 2.43 3.62

Dividends declared per common share 0.70 0.35 0.20

Average common shares - diluted 533,391 539,093 538,061

Average common shares - basic 527,500 534,283 534,149

1 Amortization expense related to qualified affordable housing investment costs is recognized in provision for income taxes for each of the periods presented as allowed by an accounting

standard adopted in 2014. Prior to 2014, these amounts were recognized in other noninterest expense.

See Notes to Consolidated Financial Statements.