SunTrust 2014 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

123

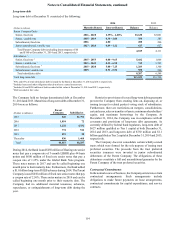

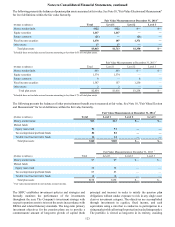

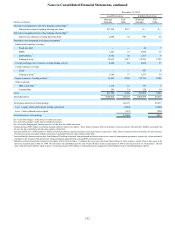

The following presents the balances of pension plan assets measured at fair value. See Note 18, "Fair Value Election and Measurement"

for level definitions within the fair value hierarchy.

Fair Value Measurements at December 31, 2014 1

(Dollars in millions) Total Level 1 Level 2 Level 3

Money market funds $122 $122 $— $—

Equity securities 1,467 1,467 — —

Futures contracts (21) — (21) —

Fixed income securities 1,478 107 1,371 —

Other assets 17 17 — —

Total plan assets $3,063 $1,713 $1,350 $—

1 Schedule does not include accrued income amounting to less than 0.6% of total plan assets.

Fair Value Measurements at December 31, 2013 1

(Dollars in millions) Total Level 1 Level 2 Level 3

Money market funds $83 $83 $— $—

Equity securities 1,374 1,374 — —

Futures contracts 8 — 8 —

Fixed income securities 1,387 157 1,230 —

Other assets 2 2 — —

Total plan assets $2,854 $1,616 $1,238 $—

1 Schedule does not include accrued income amounting to less than 0.7% of total plan assets

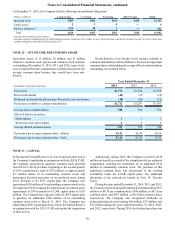

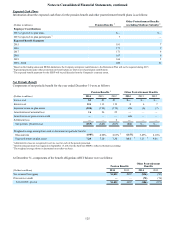

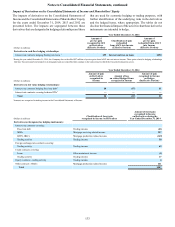

The following presents the balances of other postretirement benefit assets measured at fair value. See Note 18, "Fair Value Election

and Measurement" for level definitions within the fair value hierarchy.

Fair Value Measurements at December 31, 2014 1

(Dollars in millions) Total Level 1 Level 2 Level 3

Money market funds $13 $13 $— $—

Mutual funds:

Equity index fund 51 51 — —

Tax exempt municipal bond funds 82 82 — —

Taxable fixed income index funds 14 14 — —

Total plan assets $160 $160 $— $—

Fair Value Measurements at December 31, 2013 1

(Dollars in millions) Total Level 1 Level 2 Level 3

Money market funds $7 $7 $— $—

Mutual funds:

Equity index fund 52 52 — —

Tax exempt municipal bond funds 85 85 — —

Taxable fixed income index funds 14 14 — —

Total plan assets $158 $158 $— $—

1 Fair value measurements do not include accrued income.

The SBFC establishes investment policies and strategies and

formally monitors the performance of the investments

throughout the year. The Company’s investment strategy with

respect to pension assets is to invest the assets in accordance with

ERISA and related fiduciary standards. The long-term primary

investment objectives for the pension plans are to provide a

commensurate amount of long-term growth of capital (both

principal and income) in order to satisfy the pension plan

obligations without undue exposure to risk in any single asset

class or investment category. The objectives are accomplished

through investments in equities, fixed income, and cash

equivalents using a mix that is conducive to participation in a

rising market while allowing for protection in a declining market.

The portfolio is viewed as long-term in its entirety, avoiding