SunTrust 2014 Annual Report Download - page 162

Download and view the complete annual report

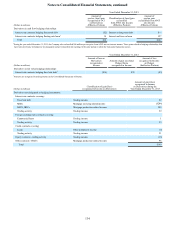

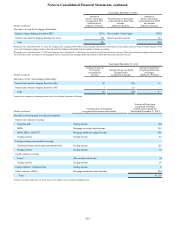

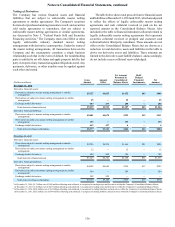

Please find page 162 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

139

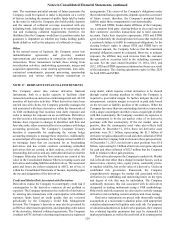

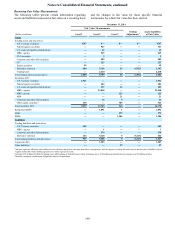

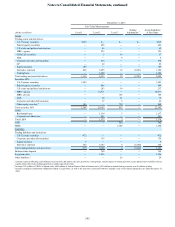

NOTE 18 - FAIR VALUE ELECTION AND MEASUREMENT

The Company measures certain assets and liabilities at fair value

and classifies them as level 1, 2, or 3 within the fair value

hierarchy, as shown below, on the basis of whether the

measurement employs observable or unobservable inputs.

Observable inputs reflect market data obtained from

independent sources, while unobservable inputs reflect the

Company’s own assumptions taking into account information

about market participant assumptions that is readily available.

• Level 1: Quoted prices for identical instruments in active

markets.

• Level 2: Quoted prices for similar instruments in active

markets; quoted prices for identical or similar instruments

in markets that are not active; and model-derived valuations

in which all significant inputs and significant value drivers

are observable in active markets.

• Level 3: Valuations derived from valuation techniques in

which one or more significant inputs or significant value

drivers are unobservable.

Fair value is defined as the price that would be received to

sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date. The

Company’s recurring fair value measurements are based on a

requirement to measure such assets and liabilities at fair value

or the Company’s election to measure certain financial assets

and liabilities at fair value. Assets and liabilities that are required

to be measured at fair value on a recurring basis include trading

securities, securities AFS, and derivative financial instruments.

Assets and liabilities that the Company has elected to measure

at fair value on a recurring basis include MSRs and certain

LHFS, LHFI, trading loans, brokered time deposits, and

issuances of fixed rate debt.

The Company elects to measure certain assets and liabilities

at fair value to more accurately align its financial performance

with the economic value of actively traded or hedged assets or

liabilities. The use of fair value also enables the Company to

mitigate non-economic earnings volatility caused from financial

assets and liabilities being carried at different bases of

accounting, as well as to more accurately portray the active and

dynamic management of the Company’s balance sheet.

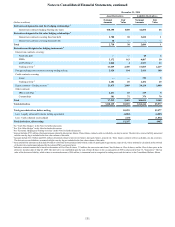

The Company uses various valuation techniques and

assumptions in estimating fair value. The assumptions used to

estimate the value of an instrument have varying degrees of

impact to the overall fair value of an asset or liability. This

process involves the gathering of multiple sources of

information, including broker quotes, values provided by

pricing services, trading activity in other identical or similar

securities, market indices, and pricing matrices. When

observable market prices for the asset or liability are not

available, the Company employs various modeling techniques,

such as discounted cash flow analyses to estimate fair value.

Models used to produce material financial reporting information

are validated prior to use, and following any material change in

methodology. Their performance is monitored quarterly, and

any material deterioration in model performance is addressed.

This review is performed by an internal group that reports to the

Corporate Risk Function.

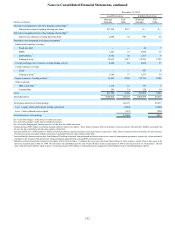

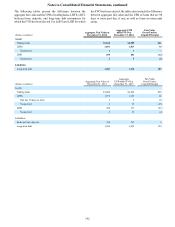

The Company has formal processes and controls in place

to support the appropriateness of its fair value estimates. For

fair values obtained from a third party or those that include

certain trader estimates of fair value, there is an independent

price validation function that provides oversight for these

estimates. For level 2 instruments and certain level 3

instruments, the validation generally involves evaluating

pricing received from two or more other third party pricing

sources that are widely used by market participants. The

Company evaluates this pricing information from both a

qualitative and quantitative perspective and determines whether

any pricing differences exceed acceptable thresholds. If these

thresholds are exceeded, then the Company assesses differences

in valuation approaches used, which may include contacting a

pricing service to gain further insight into the valuation of a

particular security or class of securities to resolve the pricing

variance, which could include an adjustment to the price used

for financial reporting purposes.

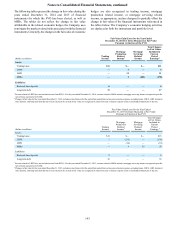

The Company classifies instruments within level 2 in the

fair value hierarchy when it determines that external pricing

sources estimated fair value using prices for similar instruments

trading in active markets. A wide range of quoted values from

pricing sources may imply a reduced level of market activity

and indicate that significant adjustments to price indications

have been made. In such cases, the Company evaluates whether

the asset or liability should be classified as level 3.

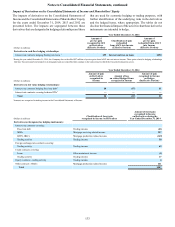

Determining whether to classify an instrument as level 3

involves judgment and is based on a variety of subjective factors

including whether a market is inactive. A market is considered

inactive if significant decreases in the volume and level of

activity for the asset or liability have been observed. In making

this determination the Company evaluates the number of recent

transactions in either the primary or secondary market, whether

price quotations are current, the nature of market participants,

the variability of price quotations, the breadth of bid/ask spreads,

declines in (or the absence of) new issuances, and the availability

of public information. When a market is determined to be

inactive, significant adjustments may be made to price

indications when estimating fair value. In making these

adjustments the Company seeks to employ assumptions a

market participant would use to value the asset or liability,

including consideration of illiquidity in the referenced market.