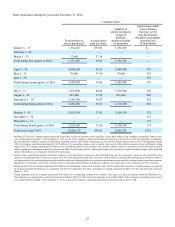

SunTrust 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

stock as part of a longer-term process to optimize the mix

between common and non-common Tier 1 capital.

Separately, our LCR at December 31, 2014 exceeds the

January 1, 2016, 90% requirement. The cumulative actions we

have taken to improve our risk and earnings profile, combined

with our strong capital and liquidity levels, should help us to

further increase capital returns to shareholders. See additional

discussion of our capital and liquidity position in the "Capital

Resources" and "Liquidity Risk Management" sections of this

MD&A.

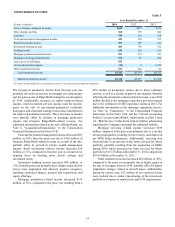

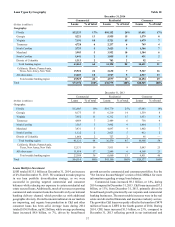

Business Segments Highlights

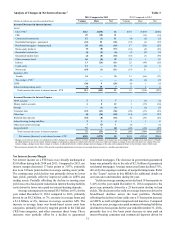

Consumer Banking and Private Wealth Management

Consumer Banking and Private Wealth Management net income

was up 7% compared to 2013, driven by higher revenue and a

lower provision for credit losses, partially offset by higher

expenses. Total revenue increased 2% compared to 2013, driven

primarily by growth in wealth management-related fees. This

reflects our increased investments in people, tools, and

technology to drive higher revenue growth across our affluent

and high net worth client segments. These investments were also

the primary drivers of the growth in expenses compared to 2013.

We believe our results in this business demonstrate good

execution of the core strategic initiatives we have outlined in the

past, which include improving wealth-management related

income, enhancing the growth and returns of our consumer

lending portfolio, and making critical investments in talent and

technology. For 2015, we are focused on continuing our core

revenue momentum; however, expense discipline will also

remain important, as we continue to balance cost reduction

opportunities with selective investments for growth.

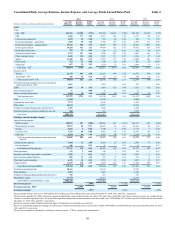

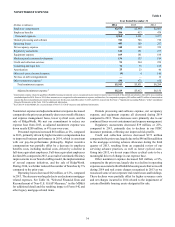

Wholesale Banking

Wholesale Banking remains a key growth engine for us, and we

gained momentum in that business in 2014. For the year, average

client deposits increased 10% and capital markets-related fees

were up 9%. Net income also increased compared to 2013, driven

by solid revenue growth and a lower provision for credit losses.

Fees were up modestly, as lower trading and leasing income,

combined with the exit of a legacy affordable housing

partnership, were more than offset by double-digit growth in

investment banking income. Our investment banking

performance in 2014 reflects broad-based growth, with record

or near-record results across debt and equity capital markets, as

well as in mergers and acquisitions advisory services. The

success of our platform reflects our continued investment in

talent to expand and diversify our capabilities. We are confident

that Wholesale Banking is poised for further growth in 2015.

Mortgage Banking

Over the past year, our core Mortgage business demonstrated

steady improvement. This progress was driven by our efforts to

normalize our cost base and improve our risk profile. Through

these efforts, we are now able to more firmly focus on the core

strategies in place to meet more client needs, drive higher

revenue, and deliver incremental efficiency improvement.

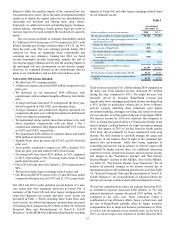

Mortgage Banking's core profitability for full year 2014 was

driven primarily by a 30% reduction in noninterest expense

compared to the prior year. Our 2014 efficiency ratio improved

significantly from 2013 to 102%, and excluding the $324 million

of Form 8-K and other legacy mortgage-related items presented

in Table 1 and Table 34, the efficiency ratio declined to below

75% for 2014. Revenue declined modestly, as growth in net

interest income was more than offset by a decline in fee income.

Core mortgage production income declined approximately 50%

compared to the prior year; however, mortgage servicing income

more than doubled, driven mainly by lower prepayments in the

servicing portfolio and increased service fees resulting from

servicing portfolio acquisitions in 2014.

Additional information related to our segments can be found in

Note 20, "Business Segment Reporting," to the Consolidated

Financial Statements in this Form 10-K, and further discussion

of segment results for 2014 and 2013 can be found in the

"Business Segment Results" section of this MD&A.