SunTrust 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

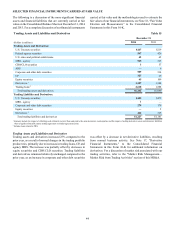

Maturity of Consumer Time and Other Time Deposits in Amounts of $100,000 or More Table 19

At December 31, 2014

(Dollars in millions) Consumer

Time Brokered

Time Foreign

Time Total

Months to Maturity:

3 or less $952 $103 $375 $1,430

Over 3 through 6 560 44 — 604

Over 6 through 12 610 16 — 626

Over 12 1,871 795 — 2,666

Total $3,993 $958 $375 $5,326

BORROWINGS

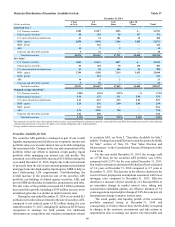

Short-Term Borrowings Table 20

December 31, 2014 Year Ended December 31, 2014

Balance Rate

Daily Average Maximum

Outstanding at

any Month-End

(Dollars in millions) Balance Rate

Funds purchased 1$1,276 0.06% $931 0.09% $1,375

Securities sold under agreements to repurchase 12,276 0.22 2,202 0.14 2,323

Other short-term borrowings 5,634 0.21 6,135 0.23 7,283

Total $9,186 $9,268

December 31, 2013 Year Ended December 31, 2013

Balance Rate

Daily Average Maximum

Outstanding at

any Month-End

(Dollars in millions) Balance Rate

Funds purchased 1$1,192 0.07% $639 0.10% $1,192

Securities sold under agreements to repurchase 11,759 0.10 1,857 0.14 1,911

Other short-term borrowings 5,788 0.22 4,953 0.26 5,868

Total $8,739 $7,449

December 31, 2012 Year Ended December 31, 2012

Balance Rate

Daily Average Maximum

Outstanding at

any Month-End

(Dollars in millions) Balance Rate

Funds purchased 1$617 0.09% $798 0.11% $925

Securities sold under agreements to repurchase 11,574 0.18 1,602 0.18 1,781

Other short-term borrowings 3,303 0.31 6,952 0.27 10,697

Total $5,494 $9,352

1 Funds purchased and securities sold under agreements to repurchase mature overnight or at a fixed maturity generally not exceeding three months. Rates on overnight funds reflect current

market rates. Rates on fixed maturity borrowings are set at the time of the borrowings.

Our total period-end short-term borrowings at December 31,

2014 increased $447 million, or 5%, from December 31, 2013,

primarily due to a $517 million increase in securities sold under

agreements to repurchase, partially offset by a decrease in other

short-term borrowings of $154 million. The decrease in other

short-term borrowings was primarily due to a $274 million

decline in master notes, offset by an increase of $122 million in

dealer collateral held.

For the year ended December 31, 2014, our total daily

average short-term borrowings increased $1.8 billion, or 24%,

compared to the year ended December 31, 2013. The increase

was largely driven by increases in other short-term borrowings

of $1.2 billion, largely due to a $1.0 billion increase in FHLB

advances, and securities sold under agreements to repurchase of

$345 million due to ordinary balance sheet management

practices. For the year ended December 31, 2014, our maximum

outstanding balance at any month-end for other short-term

borrowings was higher than our period-end balance primarily

due to maturities of FHLB advances toward the end of the year.