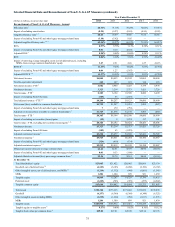

SunTrust 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

invest in talent to better meet our clients’ needs and augment our

capabilities, along with a reduction to incentive compensation

accruals in the first quarter of 2013. Other expenses increased

due to our strategic decision to sell certain legacy investments

in affordable housing partnerships in the first quarter of 2014

that resulted in a net $21 million impairment charge during 2014.

These increases in expense were partially offset by a decrease

in operating losses driven by a $32 million settlement of legal

matters during the third quarter of 2013 and lower affordable

housing partnership expense.

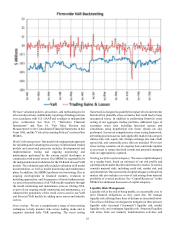

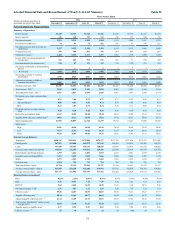

Mortgage Banking

Mortgage Banking reported a net loss of $56 million for the year

ended December 31, 2014, compared to a net loss of $527 million

for 2013. During 2014, results included $324 million of pre-tax

charges as described in the Form 8-K and other legacy mortgage-

related items. Net income as adjusted for those charges would

have been $147 million for the year ended December 31, 2014.

See Table 34, "Selected Financial Data and Reconcilement of

Non-U.S. GAAP Measures," and the "Executive Overview" in

this MD&A where Form 8-K and other legacy mortgage-related

items are described.

Net interest income was $552 million, an increase of $13

million, or 2%, predominantly due to higher net interest income

on loans, partially offset by a decline net interest income on

LHFS and deposits. Net interest income on loans increased $37

million mainly due to an increase in loan spreads. This increase

was partially offset by a $10 million decline in interest income

on LHFS due to a $0.7 billion, or 29%, decrease in average

balances which was driven by lower production volume during

2014, partially negated by higher spreads. Additionally, a $14

million decline in income on average deposits was driven by a

$0.9 billion, or 27%, decline in average total deposit balances,

partially offset by higher spreads.

Provision for credit losses was $81 million, a decrease of

$89 million, or 52%, compared to 2013. The improvement was

largely attributable to improved credit quality.

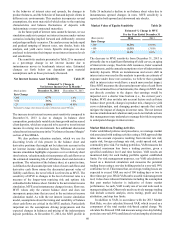

Total noninterest income was $473 million, an increase of

$71 million, or 18%, compared to 2013. The increase was

predominantly driven by higher mortgage servicing and other

income, partially offset by lower mortgage production income.

Mortgage servicing income of $196 million increased $109

million, driven by lower decay, higher servicing fees and

improved net MSR hedge performance. Loans serviced for

others were $115.5 billion at December 31, 2014 compared with

$106.8 billion at December 31, 2013, up 8%. The increase was

largely attributable to the purchase of MSRs during 2014.

Mortgage loan production income decreased $113 million due

to a decline in production volume driven by lower refinance

volume, as well as gain on sale margins, partially offset by a

$102 million decline in the mortgage repurchase provision. The

mortgage repurchase provision in the third quarter of 2013

included $63 million related to the settlement of certain

repurchase claims with the GSEs. Loan origination volume was

$16.4 billion for the year ended December 31, 2014, compared

to $29.9 billion for 2013, a decrease of $13.5 billion, or 45%.

Other income increased $75 million, predominantly driven by

gains on the sale of $2.0 billion of government-guaranteed

mortgages that were transferred to LHFS during the second

quarter of 2014 and subsequently sold during the third quarter

of 2014, as well as gains on government-guaranteed loans that

were sold in the second quarter of 2014.

Total noninterest expense was $1.1 billion, a decline of $453

million, or 30%, compared to the same period in 2013. Operating

losses and collection services decreased $200 million due to a

$291 million charge to settle specific mortgage-related legal

matters and a $96 million charge related to the increase in our

allowance for servicing advances, both recognized in the third

quarter of 2013, in addition to a decline in other operating losses.

These specific 2013 charges were offset by $324 million of

expenses for mortgage-related legal matters in 2014;

specifically, HAMP-related charges net of the impact of the

progression of other legal-related matters during 2014 and a $145

million legal provision. Total staff expense declined $120 million

driven by lower staffing levels reflecting the decline in loan

production volumes and ongoing efforts to improve productivity.

In addition, lower mortgage production volumes resulted in

declines in outside processing cost of $33 million and credit

services of $22 million. Additionally, total allocated expense

decreased $47 million during 2014.

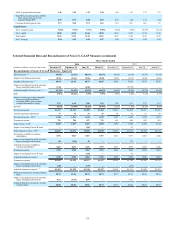

Corporate Other

Corporate Other net income during the year ended December 31,

2014 was $436 million, a decrease of $83 million, or 16%,

compared to 2013. The decrease in income was primarily due to

a decline in net interest income and a reduction in the amount of

tax benefits resulting from the recognition of discrete items

during 2013.

Net interest income during 2014 was $276 million, a

decrease of $41 million, or 13%, compared to 2013. The decrease

was primarily due to a $31 million decline in commercial loan

related swap income and $7 million foregone RidgeWorth net

interest income. Average long-term debt increased by $2.4

billion, or 27%, and average short-term borrowings increased by

$1.7 billion, or 45%, compared to 2013, driven by balance sheet

management activities.

Total noninterest income was $238 million, a decrease of

$3 million, or 1%, compared to 2013. The decrease was primarily

due to foregone RidgeWorth trust and investment management

income and a $17 million increase in losses on the sale of AFS

securities driven by a repositioning of the AFS portfolio during

2014. These declines were substantially offset by a $105 million

gain on sale of RidgeWorth during the second quarter of 2014.

Total noninterest expense was $87 million, an increase of

$1 million, or 1%, compared to 2013. The increase was mainly

due to higher severance cost and incentive compensation related

to business performance, higher debt issuance costs, and the

lower recovery of allocated internal costs. Additionally,

operating losses increased due to the reversal of a loss accrual

during 2013. These increases were offset by a reduction in

expenses due to sale of RidgeWorth.

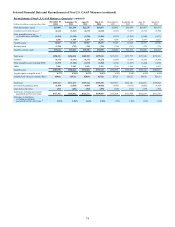

Years Ended December 31, 2013 vs. 2012

Consumer Banking and Private Wealth Management

Consumer Banking and Private Wealth Management reported

net income of $642 million during the year ended December 31,

2013, an increase of $293 million, or 84%, compared to 2012.

The increase in net income was driven by continued

improvement in credit quality resulting in a lower provision for