SunTrust 2014 Annual Report Download - page 51

Download and view the complete annual report

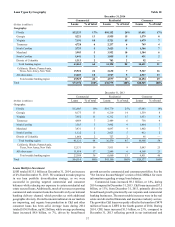

Please find page 51 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

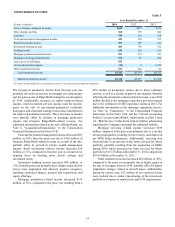

level; however, we will have to maintain strong expense

discipline in what will continue to be a challenging revenue

environment. See additional discussion related to noninterest

expense in the "Noninterest Expense" section of this MD&A.

Also see Table 34, "Selected Financial Data and Reconcilement

of Non-U.S. GAAP Measures," in this MD&A for a

reconciliation of adjusted noninterest expense.

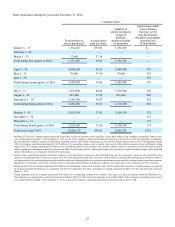

During 2014, our efficiency ratio improved to 66.7% from

71.2% in 2013. Our tangible efficiency and adjusted tangible

efficiency ratios also improved during 2014 to 66.4% and 63.3%,

compared to 70.9% and 65.3% in the prior year, respectively,

despite the significant headwinds from lower mortgage volumes

and declining net interest margin. We achieved our adjusted

tangible efficiency ratio target of less than 64% for 2014, and

for 2015, our goal is for our tangible efficiency ratio to be slightly

below 63%. Further progress in 2015 will be much more

challenging than 2014 for the following reasons: (1) we are

expecting commercial loan swap income to decline by $185

million, which represents an approximate 150-basis-point

headwind to our efficiency ratio; (2) our core expenses have

declined significantly over the past few years and we do not

anticipate further declines; and (3) having achieved a better than

projected result in 2014, we are starting from a lower base.

Irrespective of the short-term trajectory, we remain firmly

committed to delivering further efficiency improvement in 2015,

even if modest, to stay on track to achieve our primary long-term

target of below 60%. See Table 34, "Selected Financial Data and

Reconcilement of Non-U.S. GAAP Measures," in this MD&A

for additional information regarding, and reconciliations of, our

tangible and adjusted tangible efficiency ratios.

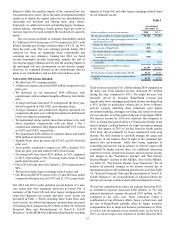

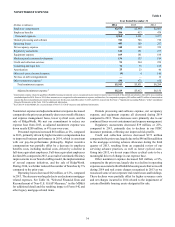

Our asset quality exhibited meaningful improvement during

2014. Total NPLs declined 35% compared to December 31,

2013, primarily reflecting reductions in our residential loan

portfolio. This significant reduction in the NPL portfolio was

achieved in conjunction with the net charge-off ratio declining

21 basis points to 0.34% during 2014, with both measures

reaching new multi-year lows. Over the near term, we expect

further, though moderating, declines in NPLs, primarily in the

residential portfolio. Reductions in OREO also continued,

declining 42% from 2013 to $99 million, the lowest level since

2006. Early stage delinquencies, a leading indicator of asset

quality, particularly for consumer loans, improved during the

year, both in total and when excluding government-guaranteed

loan delinquencies. While improving economic conditions have

played a role in our strong asset quality performance, it is also

the result of significant actions we have taken over the past

several years to de-risk our balance sheet and improve the quality

of our production.

At December 31, 2014, the ALLL balance equaled 1.46%

of total loans, a decline of 14 basis points compared to

December 31, 2013. The provision for loan losses decreased

$210 million, or 38%, compared to 2013. The decline in the

provision for loan losses was largely attributable to

improvements in credit quality trends, particularly in our

residential and CRE portfolios, and lower net charge-offs during

the year. Assuming that the loan loss provision remains relatively

stable to down slightly and loan growth continues, we expect the

ALLL to period-end loans ratio to gradually trend down. See

additional discussion of credit and asset quality in the “Loans,”

“Allowance for Credit Losses,” and “Nonperforming Assets,”

sections of this MD&A.

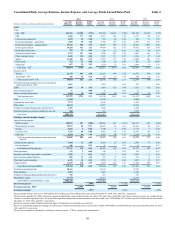

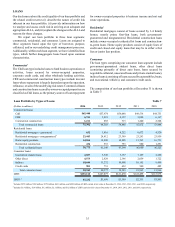

During 2014, our average loans increased $8.2 billion, or

7%, compared to the prior year, driven by our C&I, CRE, and

consumer portfolios, partially offset by strategic declines in our

government-guaranteed residential mortgage portfolio. Period-

end loans increased at a lower rate of 4%, or $5.2 billion,

compared to the prior year, as we completed approximately $4

billion of loan sales in 2014. Our solid loan production

performance reflects our execution of certain growth initiatives

along with generally improving economic conditions in our

markets. We have built positive and broad-based momentum

across our lending platforms and are focused on ensuring our

deposit growth is supportive of our lending initiatives. See

additional loan discussion in the “Loans,” “Nonperforming

Assets,” and "Net Interest Income/Margin" sections of this

MD&A.

Average consumer and commercial deposits increased 4%

during 2014, driven by improved and broad-based growth in

lower cost deposits across all of our business segments, partially

offset by declines in time deposits due to maturities. Additionally,

rates paid on these deposits declined five basis points compared

to the prior year. See additional discussion on our deposits in the

"Net Interest Income/Margin" and "Deposits" sections of this

MD&A.

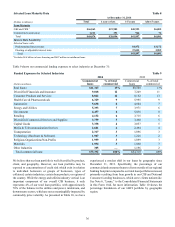

Capital and Liquidity

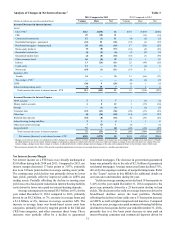

During 2014, we repurchased approximately $458 million of our

outstanding common stock, which included $328 million under

our 2013 and 2014 capital plans, as well as $130 million after

recognition of a tax benefit related to the completion of a tax

authority examination. Additionally, thus far during the first

quarter of 2015, we repurchased $50 million of our outstanding

common stock at market value and we expect to repurchase

between $60 million and $70 million of additional outstanding

common stock through the end of the first quarter of 2015, which

would complete our share repurchases under our 2014 capital

plan. We have submitted our 2015 capital plan in conjunction

with the 2015 CCAR cycle.

Our book value and tangible book value per share increased

8% and 10%, respectively, compared to the prior year due

primarily to growth in retained earnings. Additionally, we

increased our quarterly common stock dividend by $0.10 per

common share effective in the second quarter of 2014, which

resulted in dividends for 2014 of $0.70 per common share, an

increase from $0.35 per common share in 2013. See additional

details related to our capital actions in the “Capital Resources”

section of this MD&A.

The Federal Reserve's final rules related to capital adequacy

requirements to implement the BCBS's Basel III framework for

financial institutions in the U.S. became effective for us on

January 1, 2015. Based on our analysis of the requirements, we

estimate our Basel III CET 1 ratio at December 31, 2014, on a

fully phased-in basis, to be approximately 9.69%, which is well

above the regulatory requirement prescribed by the final rules.

See Table 34, "Selected Financial Data and Reconcilement of

Non-U.S. GAAP Measures" in this MD&A for a reconciliation

of the current Basel I ratio to the estimated Basel III ratio. In

November 2014, we issued $500 million of perpetual preferred