SunTrust 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

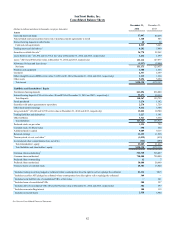

72

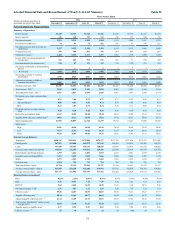

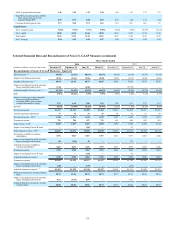

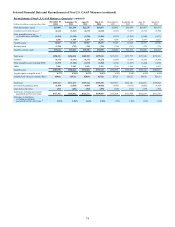

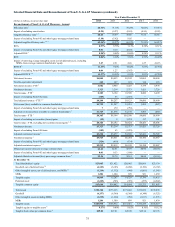

Selected Financial Data and Reconcilement of Non-U.S. GAAP Measures Table 34

Three Months Ended

(Dollars in millions and shares in

thousands, except per share data)

2014 2013

December 31 September 30 June 30 March 31 December 31 September 30 June 30 March 31

Selected Quarterly Financial Data

Summary of Operations:

Interest income $1,349 $1,353 $1,346 $1,336 $1,343 $1,339 $1,347 $1,359

Interest expense 138 138 137 132 130 131 136 138

Net interest income 1,211 1,215 1,209 1,204 1,213 1,208 1,211 1,221

Provision for credit losses 74 93 73 102 101 95 146 212

Net interest income after provision for

credit losses 1,137 1,122 1,136 1,102 1,112 1,113 1,065 1,009

Noninterest income 795 780 957 791 814 680 858 863

Noninterest expense 11,410 1,259 1,517 1,357 1,361 1,730 1,388 1,352

Income before provision/(benefit) for

income taxes 522 643 576 536 565 63 535 520

Provision/(benefit) for income taxes 1128 67 173 125 138 (133) 155 162

Net income attributable to noncontrolling

interest — — 4 6 1 7 3 6

Net income $394 $576 $399 $405 $426 $189 $377 $352

Net income available to common

shareholders $378 $563 $387 $393 $413 $179 $365 $340

Adjusted net income available to

common shareholders 2 $466 $433 $436 $393 $413 $358 $365 $340

Net interest income - FTE 3$1,248 $1,251 $1,244 $1,239 $1,247 $1,240 $1,242 $1,251

Total revenue - FTE 32,043 2,031 2,201 2,030 2,061 1,920 2,100 2,114

Total adjusted revenue - FTE 2, 3 2,043 2,031 2,096 2,030 2,061 1,983 2,100 2,114

Net income per average common share:

Diluted 0.72 1.06 0.72 0.73 0.77 0.33 0.68 0.63

Adjusted diluted 20.88 0.81 0.81 0.73 0.77 0.66 0.68 0.63

Basic 0.72 1.07 0.73 0.74 0.78 0.33 0.68 0.64

Dividends paid per average common

share 0.20 0.20 0.20 0.10 0.10 0.10 0.10 0.05

Book value per common share 41.52 40.85 40.18 39.44 38.61 37.85 37.65 37.89

Tangible book value per common share 429.82 29.21 28.64 27.82 27.01 26.27 26.08 26.33

Market capitalization 21,978 20,055 21,344 21,279 19,734 17,427 17,005 15,563

Market price:

High 43.06 40.86 40.84 41.26 36.99 36.29 32.84 29.98

Low 33.97 36.42 36.82 36.23 31.97 31.59 26.97 26.93

Close 41.90 38.03 40.06 39.79 36.81 32.42 31.57 28.81

Selected Average Balances:

Total assets $188,341 $183,433 $179,820 $176,971 $173,791 $171,838 $172,537 $171,808

Earning assets 167,227 163,688 160,373 157,343 154,567 154,235 153,495 152,471

Loans 133,438 130,747 130,734 128,525 125,649 122,672 121,372 120,882

Consumer and commercial deposits 136,892 132,195 130,472 128,396 127,460 126,618 126,579 127,655

Brokered time and foreign deposits 1,399 1,624 1,893 2,013 2,010 2,007 2,075 2,170

Intangible assets including MSRs 7,623 7,615 7,614 7,666 7,658 7,643 7,455 7,379

MSRs 1,272 1,262 1,220 1,265 1,253 1,232 1,039 957

Preferred stock 1,024 725 725 725 725 725 725 725

Total shareholders’ equity 22,754 22,191 21,994 21,727 21,251 21,027 21,272 21,117

Average common shares - diluted 527,959 533,230 535,486 536,992 537,921 538,850 539,763 539,862

Average common shares - basic 521,775 527,402 529,764 531,162 532,492 533,829 535,172 535,680

Financial Ratios (Annualized):

ROA 0.83% 1.25% 0.89% 0.93% 0.97% 0.44% 0.88% 0.83%

ROE 6.91 10.41 7.29 7.59 7.99 3.49 7.12 6.77

ROTCE 5 9.62 14.59 10.29 10.78 11.61 5.10 10.35 9.88

Net interest margin - FTE 32.96 3.03 3.11 3.19 3.20 3.19 3.25 3.33

Efficiency ratio 1, 669.00 62.03 68.93 66.83 66.05 90.13 66.07 63.97

Tangible efficiency ratio 1, 768.44 61.69 68.77 66.65 65.84 89.82 65.78 63.68

Adjusted tangible efficiency ratio 1, 2, 7 61.34 61.69 63.69 66.65 65.84 65.84 65.78 63.68

Total average shareholders’ equity to total

average assets 12.08 12.10 12.23 12.28 12.23 12.24 12.33 12.29

Tangible equity to tangible assets 89.17 8.94 9.07 9.01 9.00 8.98 8.95 9.00

Effective tax rate 1, 9 25 10 30 23 24 NM 29 31