SunTrust 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

Parent Company Liquidity. Our primary measure of Parent

Company liquidity is the length of time the Parent Company can

meet its existing and certain forecasted obligations using its cash

resources. We measure and manage this metric, "Months to

Required Funding," using forecasts of both normal and adverse

conditions. Under adverse conditions, we measure how long the

Parent Company can meet its capital and debt service obligations

after experiencing material attrition of short-term, unsecured

funding and without the support of dividends from the Bank or

access to the capital markets. At December 31, 2014, the Parent's

Months to Required Funding remained well in excess of current

ALCO and Board limits. The BRC regularly reviews this and

other liquidity risk metrics. In accordance with these risk limits

established by ALCO and the Board, we manage the Parent

Company’s liquidity by structuring its net maturity schedule to

minimize the amount of debt maturing within a short period of

time. No Parent Company debt matured during 2014 and no

material Parent Company debt is scheduled to mature in 2015.

A majority of the Parent Company’s liabilities are long-term in

nature, coming from the proceeds of issuances of our capital

securities and long-term senior and subordinated notes.

We manage the Parent Company to maintain most of its

liquid assets in cash and securities that it could quickly convert

to cash. Unlike the Bank, it is not typical for the Parent Company

to maintain a material investment portfolio of publicly traded

securities. We manage the Parent Company cash balance to

provide sufficient liquidity to fund all forecasted obligations

(primarily debt and capital service) for an extended period of

months in accordance with our risk limits.

The primary uses of Parent Company liquidity include debt

service, dividends on capital instruments, the periodic purchase

of investment securities, loans to our subsidiaries, and common

share repurchases. See further details of the authorized common

share repurchases in the "Capital Resources" section of this

MD&A and in Item 5, "Market for Registrant's Common Equity,

Related Stockholder Matters, and Issuer Purchases of Equity

Securities" in this Form 10-K. We fund corporate dividends with

Parent Company cash, the primary sources of which are

dividends from our banking subsidiary and proceeds from the

issuance of debt and capital securities. We are subject to both

state and federal banking regulations that limit our ability to pay

common stock dividends in certain circumstances.

Other Liquidity Considerations. At December 31, 2014, our

liability for UTBs was $210 million and the liability for interest

related to these UTBs was $20 million. The UTBs represent the

difference between tax positions taken or expected to be taken

in our tax returns and the benefits recognized and measured in

accordance with the relevant accounting guidance for income

taxes. The UTBs are based on various tax positions in several

jurisdictions, and if taxes related to these positions are ultimately

paid, the payments would be made from our normal operating

cash flows, likely over multiple years. See additional discussion

in Note 14, "Income Taxes," to the Consolidated Financial

Statements in this Form 10-K.

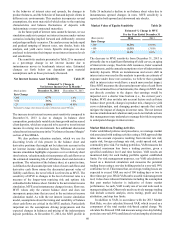

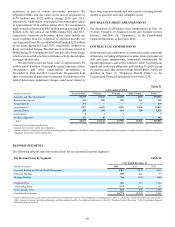

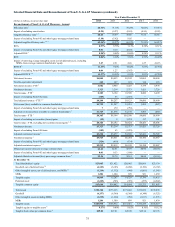

As presented in Table 30, we had an aggregate potential

obligation of $74.2 billion to our clients in unused lines of credit

at December 31, 2014. Commitments to extend credit are

arrangements to lend to clients who have complied with

predetermined contractual obligations. We also had $3.1 billion

in letters of credit at December 31, 2014, most of which are

standby letters of credit, which require that we provide funding

if certain future events occur. Approximately $1.1 billion of these

letters supported variable rate demand obligations at

December 31, 2014. Unused commercial lines of credit have

increased since December 31, 2013, as we continued to provide

credit availability to our clients.

Unfunded Lending Commitments Table 30

(Dollars in millions) December 31,

2014 December 31,

2013

Unused lines of credit:

Commercial $50,122 $43,444

Mortgage commitments 13,259 2,722

Home equity lines 10,858 11,157

CRE 3,302 2,078

Credit card 6,675 4,708

Total unused lines of credit $74,216 $64,109

Letters of credit:

Financial standby $2,917 $3,256

Performance standby 121 57

Commercial 32 28

Total letters of credit $3,070 $3,341

1 Includes IRLC contracts with notional balances of $2.3 billion and $1.8 billion at December

31, 2014 and 2013, respectively.

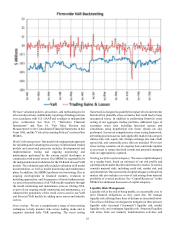

Other Market Risk

Other sources of market risk include the risk associated with

holding residential and commercial mortgage loans, and other

loans designated for sale, prior to selling them into the secondary

market, commitments to clients to make mortgage loans that will

be sold to the secondary market, and our investment in MSRs.

We manage the risks associated with the residential mortgage

LHFS (i.e., the warehouse) and our IRLCs on residential loans

intended for sale. The warehouses and IRLCs consist primarily

of fixed and adjustable rate single family residential loans. The

risk associated with the warehouses and IRLCs is the potential

change in interest rates between the time the customer locks the

rate on the anticipated loan and the time the loan is sold on the

secondary market, which is typically 60-150 days.

We manage interest rate risk predominantly with interest

rate swaps, futures, and forward sale agreements, where the

changes in value of the instruments substantially offset the

changes in value of the warehouse and the IRLCs. The IRLCs

on residential mortgage loans intended for sale are classified as

derivative financial instruments and are not designated as hedge

accounting relationships.

MSRs are the present value of future net cash flows that are

expected to be received from the mortgage servicing portfolio.

The value of MSRs is highly dependent upon the assumed

prepayment speed of the mortgage servicing portfolio, which is

driven by the level of certain key interest rates, primarily the 30-

year current coupon par mortgage rate. Future expected net cash

flows from servicing a loan in the mortgage servicing portfolio

would not be realized if the loan pays off earlier than anticipated.

MSRs are carried at fair value, with a balance of $1.2 billion

and $1.3 billion at December 31, 2014 and 2013, respectively.

They are managed within established risk limits and are