SunTrust 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

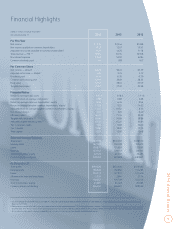

Financial Highlights

(Dollars in millions, except per share data)

Year ended December 31 2014 2013 2012

For The Year

Net income $1,774 $1,344 $1,958

Net income available to common shareholders 1,722 1,297 1,931

Adjusted net income available to common shareholders1 1,729 1,476 1,178

Total revenue — FTE 1, 2 8,305 8,194 10,598

Noninterest expense 5,543 5,831 6,284

Common dividends paid 371 188 107

Per Common Share

Net income — diluted $3.23 $2.41 $3.59

Adjusted net income — diluted 1 3.24 2.74 2.19

Dividends paid 0.70 0.35 0.20

Common stock closing price 41.90 36.81 28.35

Book value 41.52 38.61 37.59

Tangible book value 1 29.82 27.01 25.98

Financial Ratios

Return on average total assets 0.97% 0.78 % 1.1 1 %

Adjusted return on average total assets 1 0.98 0.88 0.68

Return on average common shareholders’ equity 8.06 6.34 9.56

Return on average tangible common shareholders’ equity 1 11.33 9.25 14.02

Adjusted return on average tangible common shareholders’ equity 1 11.37 10.52 8.55

Net interest margin 2 3.07 3.24 3.40

Efficiency ratio 2 66.74 71.16 59.29

Tangible efficiency ratio 1,2 66.44 70.89 58.86

Adjusted tangible efficiency ratio 1,2 63.34 65.27 66.91

Tier 1 common equity 9.60 9.82 10.04

Tier 1 capital 10.80 10.81 11.13

Total capital 12.51 12.81 13.48

Selected Average Balances

Total assets $182,176 $172 , 4 9 7 $176,1 34

Earning assets 162,189 153,728 153,479

Loans 130,874 122,657 122,893

Deposits 133,742 129,141 128,504

Total shareholders’ equity 22,170 21,167 20,495

Common shares — diluted 533,391 539,093 538,061

At December 31

Total assets $190,328 $175,335 $173,442

Earning assets 168,678 156,856 151,223

Loans 133,112 127,877 121,470

Allowance for loan and lease losses 1,937 2,044 2,174

Deposits 140,567 129,759 132,316

Total shareholders’ equity 23,005 21,422 20,985

Common shares outstanding 524,540 536,097 538,959

1 See reconciliation of non-GAAP measures in Table 34, “Selected Financial Data and Reconcilement of Non-U.S. GAAP Measures,” in the MD&A section of the Company’s 2014 Annual

Report on Form 10-K.

2 Total revenue is comprised of net interest income presented on a fully taxable-equivalent (FTE) basis and noninterest income. The net interest margin and efficiency ratios are presented

on a FTE basis. The FTE basis adjusts for the tax-favored status of income from certain loans and investments. The Company believes this measure to be the preferred industry measurement

of net interest income and it enhances comparability of net interest income arising from taxable and tax-exempt sources.

2014 Annual Report

5