SunTrust 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

111

receipt of benefits would generally manifest itself through the

retention of senior or subordinated interests in the securitization.

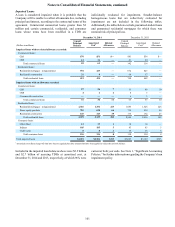

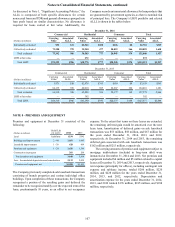

Total assets at December 31, 2014 and 2013, of the

unconsolidated trusts in which the Company has a VI were $288

million and $350 million, respectively.

The Company’s maximum exposure to loss related to the

unconsolidated VIEs in which it holds a VI is comprised of the

loss of value of any interests it retains, which are immaterial, and

any repurchase obligations it incurs as a result of a breach of

representations and warranties, discussed further in Note 16,

“Guarantees.”

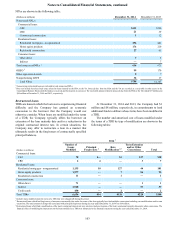

Commercial and Corporate Loans

The Company has involvement with CLO entities that own

commercial leveraged loans and bonds, certain of which were

transferred by the Company to the entities. The Company

currently holds certain securities issued by these entities and

previously acted as collateral manager for the CLOs; however,

upon the sale of RidgeWorth in May 2014, the Company is no

longer the collateral manager. The Company previously

determined that it was the primary beneficiary of, and thus, had

consolidated one of these CLOs as it had both the power to direct

the activities that most significantly impacted the entity’s

economic performance and the obligation to absorb losses and

the right to receive benefits from the entity that could potentially

be significant to the CLO. The Company's involvement with this

CLO includes ownership in one of the senior interests in the CLO

and certain preference shares. Since the Company is no longer

the collateral manager for the CLO, the Company no longer

possesses the power to direct the activities that most significantly

impact the economic performance of the VIE; therefore, the

Company is no longer the primary beneficiary of this CLO and

in connection with the sale of RidgeWorth, the CLO was

deconsolidated. At December 31, 2013, the Company’s

Consolidated Balance Sheets reflected $261 million of loans held

by the CLO and $256 million of debt issued by the CLO.

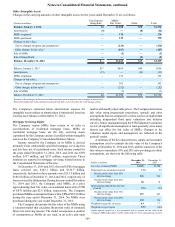

At December 31, 2014, all CLOs that the Company has

involvement with are considered to be VIEs and are

unconsolidated. The Company has determined that it is not the

primary beneficiary of these entities as it does not possess the

power to direct the activities that most significantly impact the

economic performance of the VIEs. The Company's preference

share exposure was valued at $3 million at both December 31,

2014 and 2013. The Company's senior interest exposure was

valued at $18 million and $26 million at December 31, 2014 and

2013, respectively. At December 31, 2014 and 2013,

unconsolidated VIEs that the Company had involvement with

had $704 million and $1.6 billion of estimated assets,

respectively, and $654 million and $1.6 billion of estimated

liabilities, respectively.

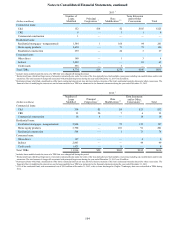

Student Loans

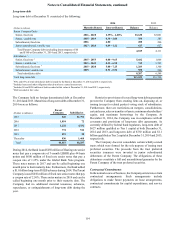

During 2006, the Company completed a securitization of

government-guaranteed student loans through a transfer of loans

to a SPE, which previously qualified as a QSPE, and retained

the related residual interest in the SPE. The Company concluded

that this securitization of government-guaranteed student loans

should be consolidated. At December 31, 2014 and 2013, the

Company’s Consolidated Balance Sheets reflected $306 million

and $344 million, respectively, of assets held by the Student Loan

entity and $302 million and $341 million, respectively, of debt

issued by the Student Loan entity.

Payments from the assets in the SPE must first be used to

settle the obligations of the SPE, with any remaining payments

remitted to the Company as the owner of the residual interest.

To the extent that losses are incurred on the SPE’s assets, the SPE

has recourse to the federal government as the guarantor, up to a

maximum guarantee of 97%. Losses in excess of the government

guarantee reduce the amount of available cash payable to the

Company as the owner of the residual interest. To the extent that

losses result from a breach of the master servicer’s servicing

responsibilities, the SPE has recourse to the Company; the

Company may be required to repurchase the defaulting loan(s)

from the SPE at par value. If the breach was caused by the

subservicer, the Company has recourse to seek reimbursement

from the subservicer up to the guaranteed amount. The

Company’s maximum exposure to loss related to the SPE is

represented by the potential losses resulting from a breach of

servicing responsibilities. To date, all loss claims filed with the

guarantor that have been denied due to servicing errors have

either been or are in the process of being cured or reimbursement

has been provided to the Company by the subservicer.

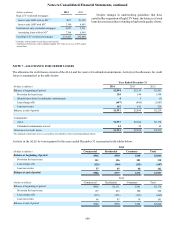

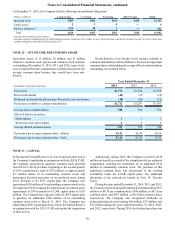

CDO Securities

The Company has transferred bank trust preferred securities to

securitization entities, which have been determined to be VIEs.

The Company concluded that it was not the primary beneficiary

of any of these VIEs as the Company lacked the power to direct

the significant activities of the entities. During the first quarter

of 2014, the Company sold all of its remaining exposures to these

VIEs.