SunTrust 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

Total noninterest income was $402 million during 2013, a

decrease of $100 million, or 20%, compared to 2012. The

decrease was predominantly driven by a decline in mortgage

production related income and lower mortgage servicing

income, partially offset by a decline in the mortgage repurchase

provision. Mortgage production related income decreased $27

million due to lower gain on sale margins and lower loan

production, largely offset by an approximate $600 million

decline in mortgage repurchase provision. Loan originations

were $29.9 billion for the year ended December 31, 2013,

compared to $32.1 billion during 2012, a decrease of $2.2 billion,

or 7%. Mortgage servicing income was $87 million, a decrease

of $173 million, or 67%, driven by less favorable net MSR hedge

performance, higher decay, and lower servicing fees due to a

decline in the servicing portfolio. Total loans serviced were

$136.7 billion at December 31, 2013 compared with $144.9

billion at December 31, 2012, down 6%.

Total noninterest expense was $1.5 billion during 2013, an

increase of $134 million, or 10%, compared to 2012. Operating

losses and collection services increased $234 million due to $291

million in charges to settle certain mortgage-related legal matters

and a $96 million charge related to the increase in our allowance

for servicing advances recorded during the third quarter of 2013,

compared to lower legal and servicing related losses recognized

during 2012. These expenses were partially offset by declines in

consulting expense of $84 million, predominantly due to lower

costs associated with the Federal Reserve Consent Order, staff

expense of $33 million, credit services expense of $15 million,

and other real estate expense of $14 million. Additionally, total

allocated support costs increased $51 million.

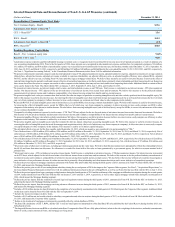

Corporate Other

Corporate Other net income during the year ended December 31,

2013 was $519 million, a decrease of $1.0 billion, or 66%,

compared to 2012. The decrease was primarily due to the

securities gains as a result of the sale of our investment in The

Coca-Cola Company stock during 2012 and lower net interest

income as a result of maturing commercial loan related-swap

income, partially offset by lower provision for income taxes.

Net interest income was $317 million during 2013, a

decrease of $84 million, or 21%, compared to 2012. The decrease

was driven by lower income from interest rate swaps and a $31

million decrease in foregone dividend income resulting from the

sale of The Coca-Cola Company stock in 2012. These declines

were partially offset by a decrease in funding costs. Total average

assets decreased $1.8 billion, or 6%, primarily driven by a

reduction in the securities AFS portfolio due to the

aforementioned sale of The Coca-Cola Company stock. Average

long-term debt decreased $1.9 billion, or 17%, and average short-

term borrowings decreased $1.5 billion, or 27%, compared to

2012. The decline in average long-term debt was primarily due

to the repayment of senior and subordinated debt, while the

decline in average short-term debt was the result of the repayment

of FHLB borrowings.

Total noninterest income was $241 million during 2013, a

decrease of $1.9 billion, or 89%, compared to 2012,

predominantly due to a $1.9 billion net gain on sale of our

investment in The Coca-Cola Company stock in 2012. This

decrease was partially offset by a $63 million decline in mark-

to-market valuation losses on our public debt and index-linked

CDs carried at fair value.

Total noninterest expense was $86 million during 2013, a

decrease of $125 million, or 59% compared to 2012. The

decrease in expense was mainly due to a higher recovery of

internal cost allocations and declines in severance costs,

incentive compensation and employee benefits related to

business performance, and operating losses compared to 2012.

Additionally, 2012 expenses also included a $38 million

charitable contribution of The Coca-Cola Company stock to the

SunTrust Foundation and debt extinguishment charges related

to the redemption of higher cost trust preferred securities.

The benefit for income taxes was $63 million during 2013

compared to a provision for income taxes of $781 million during

2012. The provision for income taxes for the year 2012 included

the income tax impact of the gains on the sale of The Coca-Cola

Company stock, while 2013 included the impact of certain audit

settlements, statute expirations, tax planning strategies, and

changes in tax rates.

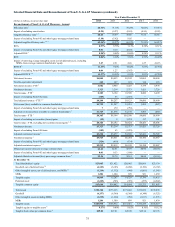

FOURTH QUARTER 2014 RESULTS

Quarter Ended December 31, 2014 vs. Quarter Ended

December 31, 2013

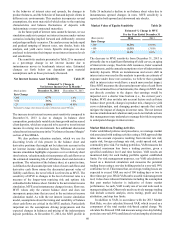

We reported net income available to common shareholders of

$378 million during the fourth quarter of 2014, a decrease of $35

million, or 8%, compared with the same period of the prior year.

Earnings per average common diluted share were $0.72 for the

fourth quarter of 2014. The fourth quarter of 2014 results include

a $145 million legal provision, or $0.17 per share, related to

legacy mortgage matters, to increase legal reserves and complete

the resolution of a specific matter. Excluding the impact of this

expense, adjusted earnings per average common diluted share

were $0.88, compared to $0.77 in the fourth quarter of 2013.

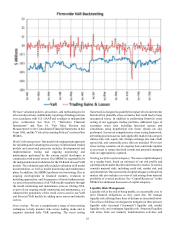

During the fourth quarter of 2014, net interest income on a

FTE basis was $1.2 billion which was consistent with the fourth

quarter of 2013. Net interest margin decreased 24 basis points

to 2.96% during the fourth quarter of 2014, compared to the same

period in 2013, largely due to a 23 and 26 basis point reduction

in loan and investment securities yields, respectively.

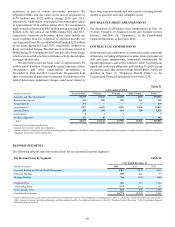

The provision for credit losses was $74 million during the

fourth quarter of 2014, a decrease of $27 million, or 27%,

compared to the fourth quarter of 2013, as asset quality continued

to improve due to targeted reductions of NPLs, primarily within

the residential and CRE categories, as well as a decline in net

charge-offs.

Total noninterest income was $795 million for the fourth

quarter of 2014, a decrease of $19 million, or 2%, compared to

the fourth quarter of 2013, largely driven by foregone

RidgeWorth revenue and lower trading income, partially offset

by higher mortgage-related and investment banking income.

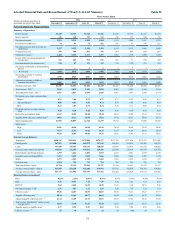

Trust and investment management income decreased $47

million during the fourth quarter of 2014 compared to the fourth

quarter of 2013, entirely due to foregone revenue resulting from

the sale of RidgeWorth. Investment banking income increased

$13 million during the fourth quarter of 2014 compared to the

fourth quarter of 2013, primarily driven by higher syndicated

finance and M&A advisory revenues, partially offset by a decline

in equity and fixed income origination fees. Trading income