SunTrust 2014 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

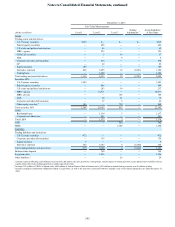

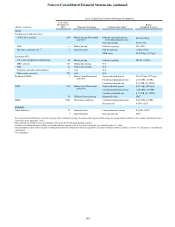

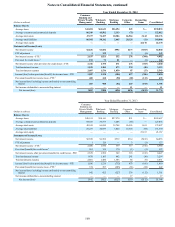

Notes to Consolidated Financial Statements, continued

151

Fair Value Measurements

Using Significant Unobservable Inputs

(Dollars in millions)

Beginning

balance

January 1,

2013

Included

in

earnings OCI Purchases Sales Settlements

Transfers to/

from other

balance sheet

line items

Transfers

into

Level 3

Transfers

out of

Level 3

Fair value

December

31, 2013

Included in

earnings (held

at December

31, 2013) 1

Assets

Trading assets and

derivatives:

CDO/CLO securities $52 $23 3$— $— ($20) ($1) $— $— $— $54 $15 3

ABS 5 1 3— — — — — — — 6 1 3

Derivative contracts, net 132 93 2— — — 2 (222) — — 5 7(5)2

Corporate and other debt

securities 1 — — — — (1) — — — — —

Total trading assets and

derivatives 190 117 — — (20) — (222) — — 65 11

Securities AFS:

U.S. states and political

subdivisions 46 — 2 — (6) (8) — — — 34 —

MBS - private 209 — (5) — — (50) — — — 154 —

ABS 21 (1) 4 — — (3) — — — 21 (1)

Corporate and other debt

securities 5 — — 4 — (4) — — — 5 —

Other equity securities 633 — — 200 — (94) — — — 739 —

Total securities AFS 914 (1) 415204 (6) (159) — — — 953 (1)4

Residential LHFS 8 1 6— — (25) (1)(8) 32 (4) 3 —

LHFI 379 (5) 6— — — (55)(17) — — 302 (11)6

Liabilities

Other liabilities 31 (1) 7— — — (4) — — — 26 (1)7

1 Change in unrealized gains/(losses) included in earnings for the period related to financial assets still held at December 31, 2013.

2 Amounts included in earnings are net of issuances, fair value changes, and expirations and are recognized in mortgage production related income.

3 Amounts included in earnings are recognized in trading income.

4 Amounts included in earnings are recognized in net securities (losses)/gains.

5 Amounts recognized in OCI are recognized in change in unrealized gains/(losses) on AFS securities.

6 Amounts are generally included in mortgage production related income; however, the mark on certain fair value loans is included in trading income.

7 Amounts included in earnings are recognized in other interest expense.

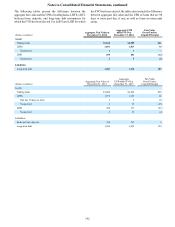

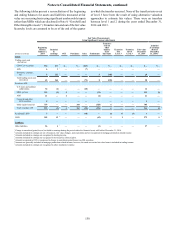

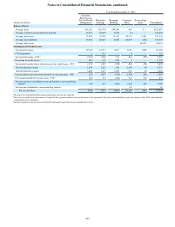

Non-recurring Fair Value Measurements

The following tables present those assets measured at fair value

on a non-recurring basis at December 31, 2014 and 2013 as well

as corresponding losses recognized during the years ended

December 31, 2014 and 2013. When comparing balances at

December 31, 2014 to those at December 31, 2013, the changes

in fair value generally result from the application of LOCOM

or through write-downs of individual assets. The tables do not

reflect changes in fair value attributable to economic hedges the

Company may have used to mitigate interest rate risk associated

with LHFS and MSRs.

(Dollars in millions) December 31, 2014 Level 1 Level 2 Level 3

Losses for the

Year Ended

December 31,

2014

LHFS $1,108 $121 $45 $942 ($6)

LHFI 24 — — 24 —

OREO 29 — 1 28 (6)

Affordable housing 77 — — 77 (21)

Other assets 225 — 216 9 (64)

(Dollars in millions) December 31, 2013 Level 1 Level 2 Level 3

Losses for the

Year Ended

December 31,

2013

LHFS $278 $— $278 $— ($3)

LHFI 75 — — 75 —

OREO 49 — 1 48 (10)

Affordable housing 7 — — 7 (3)

Other assets 171 — 158 13 (61)