SunTrust 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

phased-in basis, was 9.69%. This is in excess of the 4.5%

minimum for the CET 1 ratio plus the 2.5% fully phased-in

capital conservation buffer. See Table 34, "Selected Financial

Data and Reconcilement of Non-U.S. GAAP Measures" in this

MD&A for a reconciliation of the current Basel I ratio to the

estimated Basel III ratio.

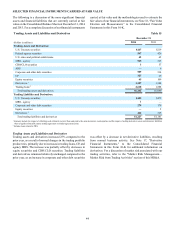

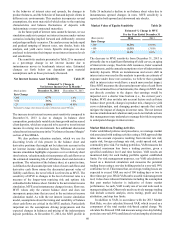

Regulatory Capital Ratios Table 22

December 31

(Dollars in millions) 2014 2013 2012

Tier 1 capital $17,554 $16,073 $14,975

Total capital 20,338 19,052 18,131

RWA 162,516 148,746 134,524

Average total assets for leverage

ratio 182,186 167,848 168,053

Tier 1 common equity:

Tier 1 capital $17,554 $16,073 $14,975

Less:

Qualifying trust preferred

securities 627 627 627

Preferred stock 1,225 725 725

Minority interest 108 119 114

Tier 1 common equity $15,594 $14,602 $13,509

Risk-based ratios:

Tier 1 common equity 19.60% 9.82% 10.04%

Tier 1 capital 10.80 10.81 11.13

Total capital 12.51 12.81 13.48

Tier 1 leverage ratio 9.64 9.58 8.91

Total shareholders’ equity to assets 12.09 12.22 12.10

1 At December 31, 2014, our Basel III CET 1 ratio as calculated under the final Basel III

capital rules was estimated to be 9.69%. See the "Selected Financial Data and

Reconcilement of Non-U.S. GAAP Measures" section in this MD&A for a reconciliation

of the current Basel I ratio to the estimated Basel III ratio.

At December 31, 2014, our capital ratios were well above

current regulatory requirements. Tier 1 capital ratios decreased

slightly during 2014 due to an increase in our RWA from

December 31, 2013, primarily the result of loan growth and an

increase in off-balance sheet lending commitments, partially

offset by an increase in retained earnings and the issuance of

preferred stock.

We declared and paid common dividends totaling $371

million, or $0.70 per common share during 2014, compared with

$188 million, or $0.35 per common share during 2013.

Additionally, we recognized dividends on our preferred stock of

$42 million and $37 million in 2014 and 2013, respectively.

Various regulations administered by federal and state bank

regulatory authorities restrict the Bank's ability to distribute its

retained earnings. At December 31, 2014 and 2013, the Bank's

capacity to pay cash dividends to the Parent Company under

these regulations totaled approximately $2.9 billion and $2.6

billion, respectively.

During the first quarter of 2014, we announced capital plans

in response to the Federal Reserve's review of and non-objection

to our capital plan in conjunction with the 2014 CCAR. Our

capital plan included the repurchase of common stock, an

increase in the common stock dividend, and maintaining the

current level of preferred stock dividends. To this end, the Board

approved the repurchase of up to $450 million of our outstanding

common stock between the second quarter of 2014 and the first

quarter of 2015, as well as an increase of the quarterly common

stock dividend to $0.20 per common share, which reflected an

increase from $0.10 per common share paid prior to the second

quarter.

During the second quarter, the Federal Reserve issued new

industry guidance that limits a BHC’s ability to make capital

distributions to the extent that its actual capital issuances,

including employee share-based compensation, are less than the

amount indicated in its submitted capital plan. Given this new

guidance and our revised forecast for employee-related share-

based compensation, our planned share repurchases through the

first quarter of 2015 will be approximately $50 million lower

than the $450 million maximum in our 2014 capital plan. The

drivers of the lower than planned capital issuance include

changes in employee option exercises relative to forecast and a

valuation adjustment to our noncontrolling interest in

RidgeWorth. The net share dilution impact from this change is

immaterial.

During the first quarter of 2014, we repurchased $50 million

of our outstanding common stock, which completed our

authorized share repurchases in conjunction with the 2013

capital plan. During the second, third and fourth quarters we

repurchased $278 million of our outstanding common stock in

conjunction with the 2014 capital plan. Additionally, thus far

during the first quarter of 2015, we repurchased $50 million of

our outstanding common stock at market value and we expect

to repurchase between $60 million and $70 million of additional

outstanding common stock through the end of the first quarter

of 2015, which would complete the repurchase of authorized

shares as approved by the Board in conjunction with the 2014

capital plan.

During the third quarter we recorded a $130 million tax

benefit as a result of the completion of a tax authority

examination. The Federal Reserve did not object to us utilizing

this gain to repurchase additional common stock and, as a result,

we repurchased an additional $130 million of our outstanding

common stock during that quarter. The purchase of this

additional common stock was incremental to the existing

availability previously noted under our 2014 capital plan. See

additional discussion of the realized tax benefit in Note 14,

"Income Taxes," to the Consolidated Financial Statements in this

Form 10-K.

In November 2014, we issued depositary shares

representing ownership interest in 5,000 shares of Perpetual

Preferred Stock, Series F, with no par value and $100,000

liquidation preference per share (the "Series F Preferred Stock").

As a result of this issuance, we received net proceeds of $496

million after the underwriting discount, but before expenses, and

used the net proceeds for general corporate purposes. The Series

F Preferred Stock has no stated maturity and will not be subject

to any sinking fund or other obligation of ours to redeem,

repurchase, or retire the shares. Dividends for the shares are

noncumulative and, if declared, will be payable semi-annually

beginning on June 15, 2015 through December 15, 2019 at a rate

per annum of 5.625%, and payable quarterly beginning on March

15, 2020 at a rate per annum equal to the three-month LIBOR

plus 3.86%. We will accrue for dividends on these shares on a

quarterly basis. By its terms, we may redeem the Series F

Preferred Stock on any dividend payment date occurring on or

after December 15, 2019 or at any time within 90 days following