SunTrust 2014 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

120

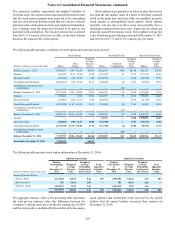

The expected volatility represented the implied volatility of

SunTrust stock. The expected term represented the period of time

that the stock options granted were expected to be outstanding

and was derived from historical data that was used to evaluate

patterns such as stock option exercise and employee termination.

The Company used the projected dividend to be paid as the

dividend yield assumption. The risk-free interest rate is derived

from the U.S. Treasury yield curve in effect at the time of grant

based on the expected life of the option.

Stock options were granted at an exercise price that was no

less than the fair market value of a share of SunTrust common

stock on the grant date and were either tax-qualified incentive

stock options or non-qualified stock options. Stock options

typically vest pro-rata over three years and generally have a

maximum contractual life of ten years. Upon exercise, shares are

generally issued from treasury stock. The weighted average fair

value of options granted during years ended December 31, 2013

and 2012 were $7.37 and $7.83, respectively, per share.

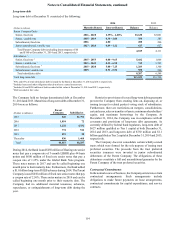

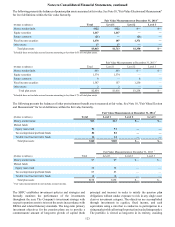

The following table presents a summary of stock option and restricted stock activity:

Stock Options Restricted Stock Restricted Stock Units

(Dollars in millions, except per share data) Shares Price

Range

Weighted

Average

Exercise

Price Shares Deferred

Compensation

Weighted

Average

Grant

Price Shares

Weighted

Average

Grant

Price

Balance, January 1, 2012 15,869,417 9.06 - 150.45 $48.53 4,622,167 $48 $21.46 405,475 $35.98

Granted 859,390 21.67 - 23.68 21.92 1,737,202 38 21.97 1,717,148 22.65

Exercised/vested (973,048) 9.06 - 22.69 9.90 (2,148,764) — 14.62 (109,149) 27.73

Cancelled/expired/forfeited (2,444,107) 9.06 - 85.06 45.73 (524,284) (8) 19.91 (82,828) 22.79

Amortization of restricted stock

compensation — — — — (30) — — —

Balance, December 31, 2012 13,311,652 9.06 - 150.45 50.15 3,686,321 48 25.56 1,930,646 25.16

Granted 552,998 27.41 27.41 1,314,277 39 29.58 593,093 24.65

Exercised/vested (712,981) 9.06 - 27.79 16.94 (821,636) — 25.95 (41,790) 28.73

Cancelled/expired/forfeited (2,222,298) 21.67 - 118.18 56.55 (195,424) (5) 27.41 14,229 20.54

Amortization of restricted stock

compensation — — — — (32) — — —

Balance, December 31, 2013 10,929,371 $9.06 - 150.45 49.86 3,983,538 50 27.04 2,496,178 26.69

Granted — — — 21,427 — 39.20 1,590,075 36.67

Exercised/vested (426,889) 9.06 - 32.27 20.86 (957,308) — 29.31 (338,196) 32.80

Cancelled/expired/forfeited (2,774,725) 23.70 - 149.81 71.10 (117,798) (2) 25.60 (58,793) 37.73

Amortization of restricted stock

compensation — — — — (27) — — —

Balance, December 31, 2014 7,727,757 $9.06 - 150.45 $43.84 2,929,859 $21 $26.45 3,689,264 $31.15

Exercisable, December 31, 2014 7,106,639 $45.47

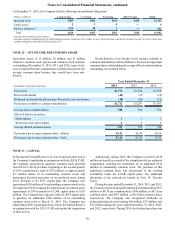

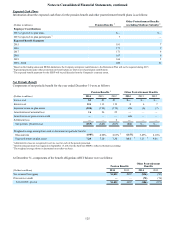

The following table presents stock option information at December 31, 2014:

Options Outstanding Options Exercisable

(Dollars in millions, except per share data)

Number

Outstanding

at

December 31,

2014

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (Years)

Total

Aggregate

Intrinsic

Value

Number

Exercisable

at

December 31,

2014

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (Years)

Total

Aggregate

Intrinsic

Value

Range of Exercise Prices:

$9.06 to 49.46 4,174,504 $19.63 5.18 $93 3,553,386 $18.66 4.73 $83

$49.47 to 64.57 781 56.34 2.84 — 781 56.34 2.84 —

$64.58 to 150.45 3,552,472 72.29 1.16 — 3,552,472 72.29 1.16 —

7,727,757 $43.84 3.33 $93 7,106,639 $45.47 2.95 $83

The aggregate intrinsic value in the preceding table represents

the total pre-tax intrinsic value (the difference between the

Company’s closing stock price on the last trading day of 2014

and the exercise price, multiplied by the number of in-the-money

stock options) that would have been received by the option

holders had all option holders exercised their options on

December 31, 2014.