SunTrust 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

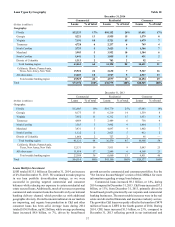

38

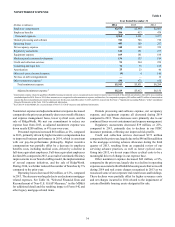

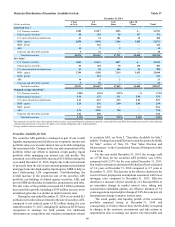

regional businesses, including the purchase of approximately

$735 million in loans from third parties during 2014.

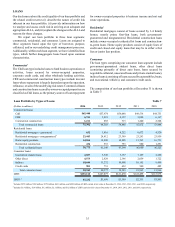

Residential loans decreased $4.4 billion, or 10%, during

2014 compared to December 31, 2013, primarily driven by a

$2.8 billion, or 81%, decrease in government-guaranteed

residential mortgages, a $969 million, or 4%, decrease in non-

guaranteed residential mortgages, and a $545 million, or 4%,

decrease in home equity products. The decrease in government-

guaranteed loans was primarily due to the sale of $2.3 billion in

government-guaranteed residential mortgages on a servicing

retained basis, resulting in $60 million of pre-tax gains during

2014. The decrease in nonguaranteed residential mortgages was

driven by payments and charge-offs, partly offset by new

originations, and the sale of $207 million of accruing TDRs and

NPLs to further enhance our asset quality position, resulting in

a $6 million gain, as well as the sale of $253 million of performing

nonguaranteed mortgages, resulting in an insignificant loss.

At December 31, 2014, 39% of our home equity products

were in a first lien position and 61% were in a junior lien position.

For home equity products in a junior lien position, we own or

service 29% of the loans that are senior to the home equity

product. Additionally, approximately 16% of the home equity

line portfolio is due to convert to amortizing term loans by the

end of 2015 and an additional 45% enter the conversion phase

over following three years. Based on historical trends, within 12

months of the end of their draw period, approximately 77% of

all accounts, and approximately 65% of accounts with a balance,

are closed or refinanced into an amortizing loan or a new line of

credit. We perform credit management activities to limit our loss

exposure on home equity accounts. These activities may result

in the suspension of available credit and curtailment of available

draws of most home equity junior lien accounts when the first

lien position is delinquent, including when the junior lien is still

current. We monitor the delinquency status of first mortgages

serviced by other parties. Additionally, we actively monitor

refreshed credit bureau scores of borrowers with junior liens, as

these scores are highly sensitive to first lien mortgage

delinquency. At December 31, 2014 and 2013, our home equity

junior lien loss severity was approximately 80% and 87%,

respectively. The average borrower FICO score related to loans

in our home equity portfolio was approximately 760 at both

December 31, 2014 and 2013, and the average outstanding loan

size was approximately $46,000 and $48,000 at December 31,

2014 and 2013, respectively.

Consumer loans increased $568 million, or 3%, during 2014

compared to December 31, 2013. The increase is attributable to

the $1.7 billion, or 62%, increase in other direct loans, which

was largely related to origination of high credit quality consumer

loans through our LightStream online lending business, as well

as other high credit quality home improvement loans. The

increase in consumer loans was partially offset by the $718

million, or 13%, decrease in government-guaranteed student

loans and the $628 million, or 6%, decrease in indirect loans

during 2014 compared to December 31, 2013. The decrease in

government-guaranteed student loans was due to paydowns and

the sale of $335 million of these loans during the fourth quarter

of 2014. Indirect loans decreased due to the sale of approximately

$475 million of indirect auto loans and the transfer of

approximately $600 million of indirect auto loans to LHFS in

the fourth quarter of 2014, partially offset by growth in our

portfolio. The net gain or loss on the sale and transfer of the

indirect auto and student loans was immaterial.

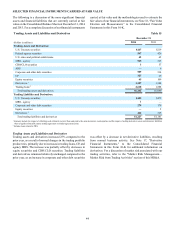

Collectively, these loan sale transactions during the year,

along with the loan transfers described below, were part of our

strategy to optimize our balance sheet and improve returns.

Going forward, we will continue to opportunistically evaluate

loan sales to further this strategy.

Loans Held for Sale

LHFS increased $1.5 billion, or 90%, from December 31, 2013

to December 31, 2014, primarily reflecting the approximately

$600 million of indirect auto loans and $470 million of C&I loans

transferred from LHFI to LHFS as part of our strategy to optimize

our balance sheet and improve returns. Also contributing to the

increase in LHFS was an increase in mortgage loan volume

towards the end of 2014 as the continued low interest rate

environment drove higher production.

Asset Quality

The asset quality condition of our loan portfolio continued to

trend favorably during 2014, driven by overall improvements in

the economy, improved residential housing markets, resolution

of existing NPAs, and lower levels of new NPLs. This was

primarily driven by positive trends in our residential portfolios

reflected in lower delinquencies, lower loss severities, and higher

prices upon disposition of foreclosed assets. The overall

improvement in asset quality is also the result of significant

actions we have taken over the past several years to de-risk and

diversify our balance sheet and improve the quality of new loan

production.

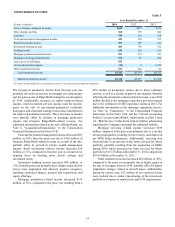

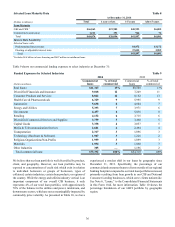

NPLs decreased $337 million, or 35%, compared to

December 31, 2013, largely driven by a reduction in residential

mortgage NPLs. At December 31, 2014, the percentage of NPLs

to total loans was 0.48%, down 28 basis points compared to

December 31, 2013. We expect further, though moderating,

declines in NPLs in the near term, primarily driven by

improvements in the residential mortgage portfolios.

Net charge-offs were $445 million during 2014, compared

to $678 million during 2013, a decrease of $233 million, or 34%,

largely driven by declines in the commercial and residential

categories, partially offset by a slight increase in indirect auto

loan charge-offs within the consumer category. During 2014, the

net charge-off ratio declined to 0.34%, compared to 0.55%

during 2013. It is unlikely that we will be able to sustain the level

of our current net charge-off ratio over the long-term, though we

are not expecting a significant increase in 2015 relative to 2014.

We expect net charge-offs in the residential portfolio to move

modestly lower in the near-term. We do not expect further

declines in commercial and consumer net charge-offs, which we

believe are at or below normal levels.

Total early stage delinquencies decreased 10 basis points

from December 31, 2013 to 0.64% of total loans at December 31,

2014. Early stage delinquencies, excluding government-

guaranteed loans, improved six basis points from December 31,

2013 to 0.30% of total loans at December 31, 2014. At

December 31, 2014, all loan classes, except residential

construction and consumer indirect, showed improvement in

early stage delinquencies compared to December 31, 2013.