SunTrust 2014 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

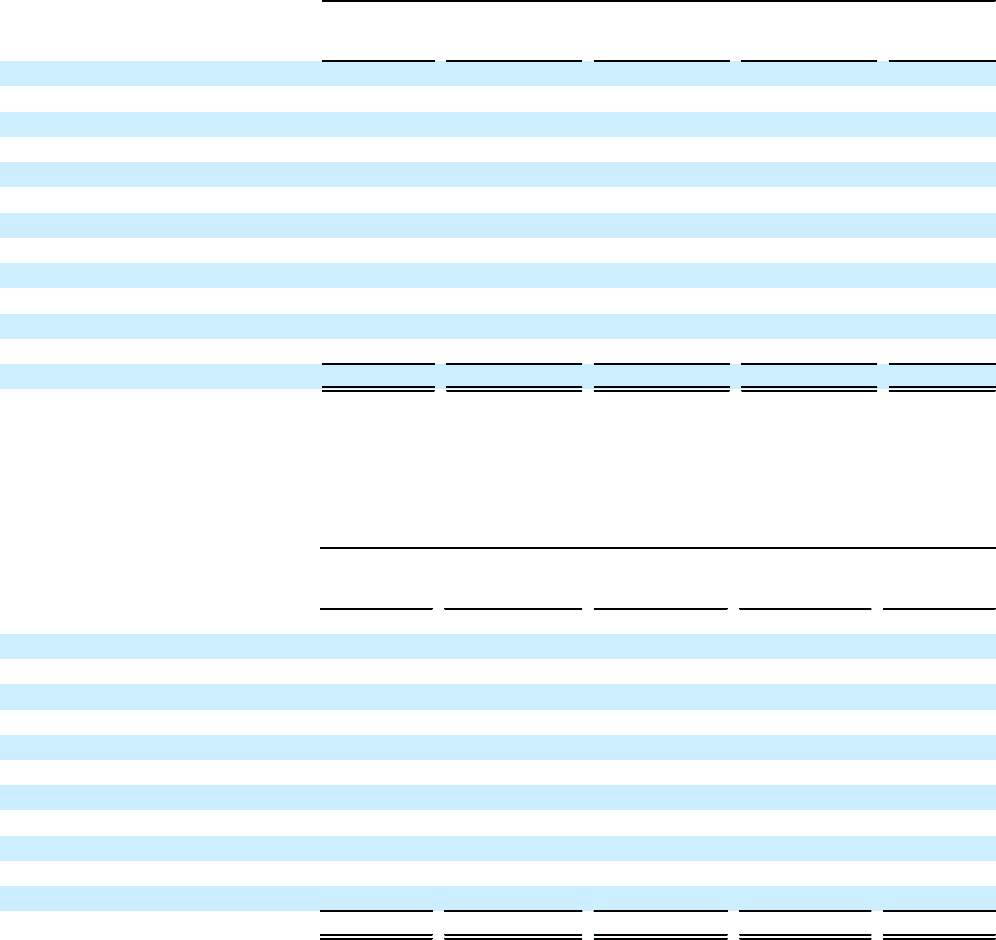

Notes to Consolidated Financial Statements, continued

104

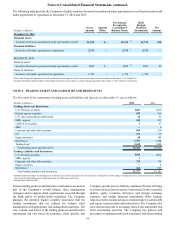

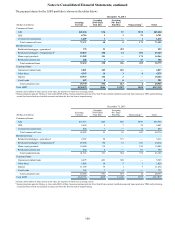

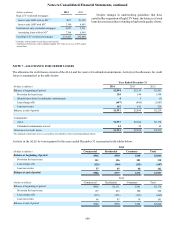

2013 1

(Dollars in millions)

Number of

Loans

Modified Principal

Forgiveness 2Rate

Modification 2,3

Term Extension

and/or Other

Concessions Total

Commercial loans:

C&I 152 $18 $2 $105 $125

CRE 6 — 3 1 4

Commercial construction 1 — — — —

Residential loans:

Residential mortgages - nonguaranteed 1,584 1 166 94 261

Home equity products 2,630 — 71 75 146

Residential construction 259 — 24 3 27

Consumer loans:

Other direct 140 — 1 3 4

Indirect 3,409 — — 65 65

Credit cards 593 — 3 — 3

Total TDRs 8,774 $19 $270 $346 $635

1 Includes loans modified under the terms of a TDR that were charged-off during the period.

2 Restructured loans which had forgiveness of amounts contractually due under the terms of the loan typically have had multiple concessions including rate modifications and/or term

extensions. The total amount of charge-offs associated with principal forgiveness during the year ended December 31, 2013 was $2 million.

3 Restructured loans which had a modification of the loan's contractual interest rate may also have had an extension of the loan's contractual maturity date and/or other concessions. The

financial effect of modifying the interest rate on the loans modified as a TDR was immaterial to the financial statements during the year ended December 31, 2013.

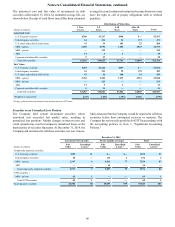

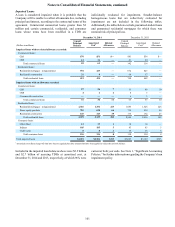

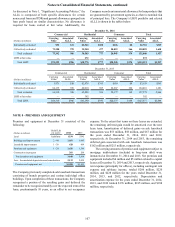

2012 1

(Dollars in millions)

Number of

Loans

Modified Principal

Forgiveness 2Rate

Modification 2,3

Term Extension

and/or Other

Concessions 4Total

Commercial loans:

C&I 358 $5 $4 $23 $32

CRE 33 20 7 6 33

Commercial construction 16 4 — 14 18

Residential loans:

Residential mortgages - nonguaranteed 2,804 — 72 125 197

Home equity products 3,790 — 110 91 201

Residential construction 564 — 1 73 74

Consumer loans:

Other direct 127 — — 4 4

Indirect 2,803 — — 49 49

Credit cards 1,421 — 8 — 8

Total TDRs 11,916 $29 $202 $385 $616

1 Includes loans modified under the terms of a TDR that were charged-off during the period.

2 Restructured loans which had forgiveness of amounts contractually due under the terms of the loan typically have had multiple concessions including rate modifications and/or term

extensions. The total amount of charge-offs associated with principal forgiveness during the year ended December 31, 2013 was $9 million.

3 Restructured loans which had a modification of the loan's contractual interest rate may also have had an extension of the loan's contractual maturity date and/or other concessions. The

financial effect of modifying the interest rate on the loans modified as a TDR was immaterial to the financial statements during the year ended December 31, 2013.

4 4,231 of the residential loans, with an amortized cost of $201 million at December 31, 2012, relate to loans discharged in Chapter 7 bankruptcy that were reclassified as TDRs during

2012.