SunTrust 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

other negative consequences from regulatory violations,

possibly even inadvertent or unintentional violations; we depend

on the expertise of key personnel. If these individuals leave or

change their roles without effective replacements, operations

may suffer; we may not be able to hire or retain additional

qualified personnel and recruiting and compensation costs may

increase as a result of turnover, both of which may increase costs

and reduce profitability and may adversely impact our ability to

implement our business strategies; our accounting policies and

processes are critical to how we report our financial condition

and results of operations. They require management to make

estimates about matters that are uncertain; changes in our

accounting policies or in accounting standards could materially

affect how we report our financial results and condition; our stock

price can be volatile; our disclosure controls and procedures may

not prevent or detect all errors or acts of fraud; our financial

instruments carried at fair value expose us to certain market risks;

our revenues derived from our investment securities may be

volatile and subject to a variety of risks; and we may enter into

transactions with off-balance sheet affiliates or our subsidiaries.

INTRODUCTION

We are a leading provider of financial services, particularly in

the Southeastern and Mid-Atlantic U.S., and our headquarters is

located in Atlanta, Georgia. Our principal banking subsidiary,

SunTrust Bank, offers a full line of financial services for

consumers, businesses, corporations, and institutions, both

through its branches (located primarily in Florida, Georgia,

Maryland, North Carolina, South Carolina, Tennessee, Virginia,

and the District of Columbia) and through other national delivery

channels. We operate three business segments: Consumer

Banking and Private Wealth Management, Wholesale Banking,

and Mortgage Banking, with the remainder in Corporate Other.

Within each of our businesses, we have growth strategies both

within our Southeastern and Mid-Atlantic footprint and targeted

national markets. See Note 20, "Business Segment Reporting,"

to the Consolidated Financial Statements in this Form 10-K for

a description of our business segments. In addition to deposit,

credit, mortgage banking, and trust and investment services

offered by the Bank, our other subsidiaries provide asset and

wealth management, securities brokerage, and capital markets

services.

This MD&A is intended to assist readers in their analysis of

the accompanying Consolidated Financial Statements and

supplemental financial information. It should be read in

conjunction with the Consolidated Financial Statements and

Notes to the Consolidated Financial Statements in Item 8 of this

Form 10-K. When we refer to “SunTrust,” “the Company,” “we,”

“our,” and “us” in this narrative, we mean SunTrust Banks, Inc.

and subsidiaries (consolidated). In the MD&A, net interest

income, net interest margin, total revenue, and efficiency ratios

are presented on an FTE basis. The FTE basis adjusts for the tax-

favored status of net interest income from certain loans and

investments. We believe this measure to be the preferred industry

measurement of net interest income and it enhances

comparability of net interest income arising from taxable and

tax-exempt sources. Additionally, we present other non-U.S.

GAAP metrics to assist investors in understanding

management’s view of particular financial measures, as well as

to align presentation of these financial measures with peers in

the industry who may also provide a similar presentation.

Reconcilements for all non-U.S. GAAP measures are provided

in Table 34.

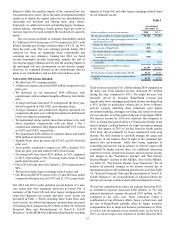

EXECUTIVE OVERVIEW

Economic

The economy grew modestly in 2014, with gains in consumer

spending, business investment, and employment. The

unemployment rate finished the year at 5.6%. Fixed income and

equity markets fluctuated significantly in the fourth quarter, with

the S&P 500 volatility index peaking at levels not seen since

2012. Current economic conditions are likely to keep financial

market volatility at elevated levels.

Corporate profits grew modestly in 2014, aided by a slight

increase in revenue and a continuation of operational rightsizing.

The real national Gross Domestic Product grew at a rate of 2.4%

during 2014, compared to 2.2% during 2013. Consumer

confidence increased during the year, propelled by a more

favorable assessment of current economic and labor market

conditions. The concern regarding the persistently low rate of

inflation in the U.S. increased when U.S. crude oil and natural

gas supplies flooded global markets, while weakening Asian and

European economies dampened demand. Overall, the U.S.

macroeconomic environment outlook suggests continued steady

growth in 2015 as a more neutral fiscal policy stance and low

energy prices boost consumer spending, in spite of wage

stagnation.

The Federal Reserve continued to maintain a highly

accommodative monetary policy and indicated that this policy

would remain in effect for a considerable time after the

completion of its asset purchase program. In this regard, the

Federal Reserve concluded its asset purchase program in October

2014. The further reduction of its asset purchases was in response

to improving labor market and other economic indicators. The

Federal Reserve noted that its sizable holdings of longer-term

government securities should maintain downward pressure on

longer-term interest rates, thereby supporting housing markets

and fostering accommodative financial conditions. During 2014,

the yield curve flattened considerably as expectations for future

inflation and global expansion moderated. The Federal Reserve

continues to forecast economic growth strengthening from

current levels with appropriate policy accommodation, a gradual

decline in unemployment, and the expectation of gradually

increasing inflation over the longer-term. The market

expectation is for the Federal Reserve to begin tightening its

monetary policy at a measured pace during the second half of

2015 and for the yield curve to remain flat as future inflation

expectation is contained by low commodity prices and global

economic weakness. The precise timing of the Federal Reserve

beginning to tighten its monetary policy remains uncertain.

Financial Performance

We demonstrated improved financial performance in 2014 by

generating solid earnings growth, growing loans and deposits,

and maintaining expense discipline. We also experienced a

significant improvement in asset quality during the year, which