SunTrust 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

103

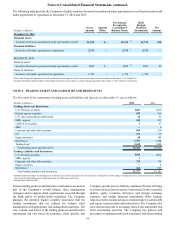

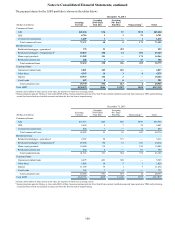

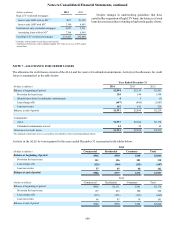

NPAs are shown in the following table:

(Dollars in millions) December 31, 2014 December 31, 2013

Nonaccrual/NPLs:

Commercial loans:

C&I $151 $196

CRE 21 39

Commercial construction 112

Residential loans:

Residential mortgages - nonguaranteed 254 441

Home equity products 174 210

Residential construction 27 61

Consumer loans:

Other direct 65

Indirect —7

Total nonaccrual/NPLs 1634 971

OREO 299 170

Other repossessed assets 97

Nonperforming LHFS 38 17

Total NPAs $780 $1,165

1 Nonaccruing restructured loans are included in total nonaccrual/NPLs.

2 Does not include foreclosed real estate related to loans insured by the FHA or the VA. Proceeds due from the FHA and the VA are recorded as a receivable in other assets in the

Consolidated Balance Sheets until the funds are received and the property is conveyed. The receivable amount related to proceeds due from the FHA or the VA totaled $57 million and

$88 million at December 31, 2014 and 2013, respectively.

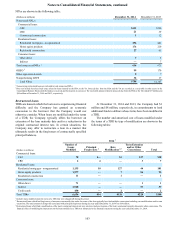

Restructured Loans

TDRs are loans in which the borrower is experiencing financial

difficulty and the Company has granted an economic

concession to the borrower that the Company would not

otherwise consider. When loans are modified under the terms

of a TDR, the Company typically offers the borrower an

extension of the loan maturity date and/or a reduction in the

original contractual interest rate. In certain situations, the

Company may offer to restructure a loan in a manner that

ultimately results in the forgiveness of contractually specified

principal balances.

At December 31, 2014 and 2013, the Company had $1

million and $8 million, respectively, in commitments to lend

additional funds to debtors whose terms have been modified in

a TDR.

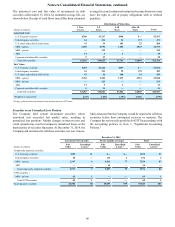

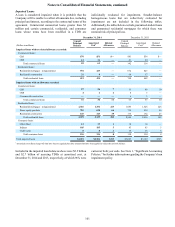

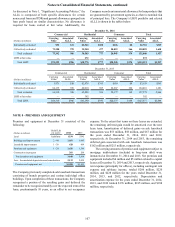

The number and amortized cost of loans modified under

the terms of a TDR by type of modification are shown in the

following tables:

2014 1

(Dollars in millions)

Number of

Loans

Modified Principal

Forgiveness 2Rate

Modification 2,3

Term Extension

and/or Other

Concessions Total

Commercial loans:

C&I 78 $— $1 $37 $38

CRE 6 4 — 3 7

Residential loans:

Residential mortgages - nonguaranteed 1,135 10 127 44 181

Home equity products 1,977 — 7 86 93

Residential construction 11 — 1 — 1

Consumer loans:

Other direct 71 — — 1 1

Indirect 2,928 — — 57 57

Credit cards 450 — 2 — 2

Total TDRs 6,656 $14 $138 $228 $380

1 Includes loans modified under the terms of a TDR that were charged-off during the period.

2 Restructured loans which had forgiveness of amounts contractually due under the terms of the loan typically have had multiple concessions including rate modifications and/or term

extensions. The total amount of charge-offs associated with principal forgiveness during the year ended December 31, 2014 was $14 million.

3 Restructured loans which had a modification of the loan's contractual interest rate may also have had an extension of the loan's contractual maturity date and/or other concessions. The

financial effect of modifying the interest rate on the loans modified as a TDR was immaterial to the financial statements during the year ended December 31, 2014.