SunTrust 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

the shift from time deposits to lower-cost deposit products, as

well as a reduction in rates paid on time deposits as maturing

CDs renew at lower rates.

We utilize interest rate swaps to manage interest rate risk.

These instruments are primarily pay variable-receive fixed

interest rate swaps that convert a portion of our commercial loan

portfolio from floating rates, based on LIBOR, to fixed rates. At

December 31, 2014, the outstanding notional balance of active

swaps that qualified as cash flow hedges on variable rate

commercial loans was $15.4 billion, compared to active swaps

of $17.3 billion at December 31, 2013.

In addition to the income recognized from active swaps, we

also continue to recognize interest income over the original

hedge period resulting from terminated or de-designated swaps

that were previously designated as cash flow hedges on variable

rate commercial loans. Interest income from our commercial

loan swaps decreased to $387 million during 2014, compared to

$417 million during 2013. The decline was primarily due to a

decline in income from the maturity of $4.2 billion of active

swaps during 2014 and $3.3 billion of previously terminated

swaps that reached their original maturity date during 2014. As

we manage our interest rate risk we may continue to purchase

additional and/or terminate existing interest rate swaps.

Remaining swaps on commercial loans have maturities

through 2019. The average maturity of our active swaps at

December 31, 2014 was 1.9 years. We will continue to carefully

manage the usage and sensitivity of our balance sheet in light of

the continued low interest rate environment, while also being

cognizant of controlling interest rate risk in advance of what we

expect will eventually be higher interest rates. See Table 25, "Net

Interest Income Asset Sensitivity," in this MD&A for an analysis

of potential changes in net interest income due to instantaneous

moves in benchmark interest rates.

The commercial loan swaps have a fixed rate of interest that

is received, while the rate paid is based on LIBOR. The weighted

average rate on the receive-fixed rate leg of the commercial loan

swap portfolio at December 31, 2014 is 1.36%. Estimated

income from these swaps is included in Table 4 and is based on

the assumption of unchanged LIBOR rates relative to

December 31, 2014, which may be different than our assumption

for future interest rates. Actual income from these swaps may

vary from estimates.

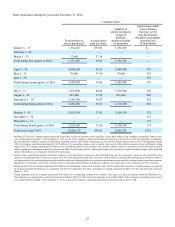

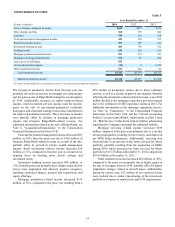

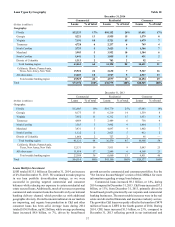

Table 4

Ending Notional

Balance of Swaps

(in billions)

Estimated Net Interest

Income Related to

Swaps (in millions) 1

First Quarter 2015 $14.0 $52

Second Quarter 2015 15.5 52

Third Quarter 2015 15.1 50

Fourth Quarter 2015 15.0 49

1 Includes estimated interest income related to active, terminated/de-designated, and

forward-starting swaps. See Note 17, "Derivative Financial Instruments," to the

Consolidated Financial Statements in this Form 10-K for additional swap information.

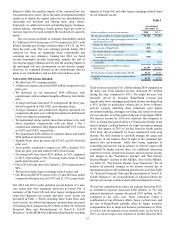

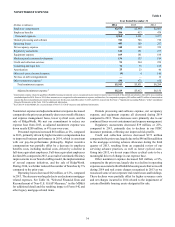

Compared to the year ended December 31, 2013, average

interest-bearing liabilities increased $7.2 billion, or 7%,

primarily due to increases in average lower-cost deposits,

average long-term debt, and average other short-term

borrowings for the year ended December 31, 2014. These

increases were partially offset by a decrease in average time

deposits. The increase in average long-term debt was primarily

attributable to an increase in senior unsecured debt issuances

given average loan growth exceeded average deposit growth in

2014. The $1.2 billion, or 24%, increase in average other short-

term borrowings was primarily due to increased FHLB

borrowings during the current year. See additional information

regarding other short-term borrowings and long-term debt in

Note 11, "Borrowings and Contractual Commitments," to the

Consolidated Financial Statements in this Form 10-K and the

"Borrowings" section in this MD&A.

The two basis point reduction in rates paid on average

interest-bearing liabilities at December 31, 2014 was primarily

due to a five basis point decline in rates paid on interest-bearing

consumer and commercial deposits, partially offset by a seven

basis point increase in rates paid on long-term debt primarily

attributable to the aforementioned issuances. The decline in the

average rate paid on interest-bearing deposits was a result of the

improved mix driven by the shift from time deposits to lower-

cost deposit products, as well as a reduction in rates paid on time

deposits as higher rate CDs matured.

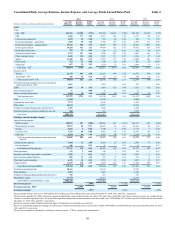

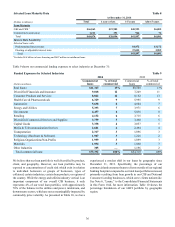

During 2014, net interest margin declined more than

anticipated at the beginning of the year, as Wholesale Banking

loan growth was stronger than expected, commercial loan yields

continued to decline, and the yield curve flattened. See Table 2,

"Consolidated Daily Average Balances, Income/Expense, and

Average Yields Earned/Rates Paid," in this MD&A for additional

details that impacted our net interest income/margin.

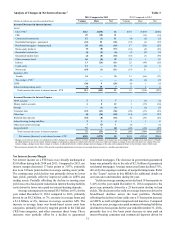

Looking forward, we expect net interest margin to decline

in the first quarter of 2015 by approximately seven to nine basis

points from the fourth quarter 2014 level, driven primarily by

lower commercial loan swap income. In addition, all things being

equal, we expect net interest income will decline from the fourth

quarter of 2014 to the first quarter of 2015 given lower

commercial loan swap income and two fewer days.

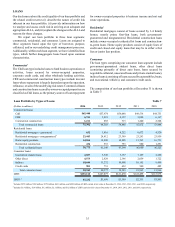

Foregone Interest

Foregone interest income from NPLs reduced the net interest

margin by two basis points during 2014, compared to a reduction

of three basis points during 2013, as average nonaccrual loans

decreased during the year ended December 31, 2014. See

additional discussion of our expectations of future credit quality

in the “Loans,” “Allowance for Credit Losses,” and

“Nonperforming Assets” sections of this MD&A. In addition,

Table 2 of this MD&A contains more detailed information

concerning average balances, yields earned, and rates paid.