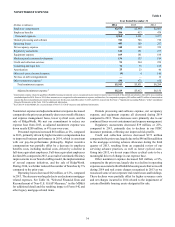

SunTrust 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

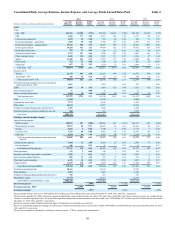

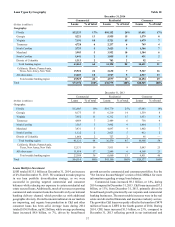

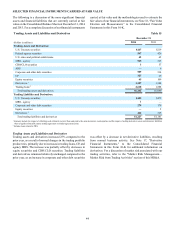

Loan Types by Geography Table 10

December 31, 2014

Commercial Residential Consumer

(Dollars in millions) Loans % of total Loans % of total Loans % of total

Geography:

Florida $12,333 17% $10,152 26% $3,651 17%

Georgia 9,221 13 5,955 15 1,579 8

Virginia 7,191 10 5,721 15 1,479 7

Tennessee 4,728 6 2,237 6 749 4

North Carolina 3,733 5 3,623 9 1,366 7

Maryland 3,903 5 3,952 10 1,304 6

South Carolina 1,441 2 1,855 5 431 2

District of Columbia 1,313 2 703 2 92 —

Total banking region 43,863 60 34,198 88 10,651 51

California, Illinois, Pennsylvania,

Texas, New Jersey, New York 15,926 22 2,630 7 5,367 26

All other states 13,603 18 1,947 5 4,927 23

Total outside banking region 29,529 40 4,577 12 10,294 49

Total $73,392 100% $38,775 100% $20,945 100%

December 31, 2013

Commercial Residential Consumer

(Dollars in millions) Loans % of total Loans % of total Loans % of total

Geography:

Florida $12,003 19% $10,770 25% $3,683 18%

Georgia 8,175 13 6,210 14 1,539 8

Virginia 7,052 11 6,312 15 1,633 8

Tennessee 4,689 7 2,489 6 738 4

North Carolina 3,583 5 3,902 9 1,464 7

Maryland 3,431 5 4,097 9 1,402 7

South Carolina 1,122 2 2,023 5 412 2

District of Columbia 1,066 2 727 2 95 —

Total banking region 41,121 64 36,530 85 10,966 54

California, Illinois, Pennsylvania,

Texas, New Jersey, New York 12,131 19 3,811 9 5,043 25

All other states 11,058 17 2,849 6 4,368 21

Total outside banking region 23,189 36 6,660 15 9,411 46

Total $64,310 100% $43,190 100% $20,377 100%

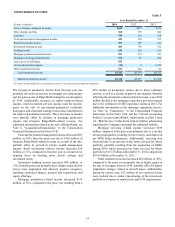

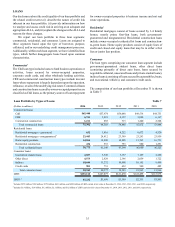

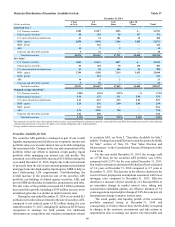

Loans Held for Investment

LHFI totaled $133.1 billion at December 31, 2014, an increase

of 4% from December 31, 2013. We continued to make progress

in our loan portfolio diversification strategy, as we were

successful in growing targeted commercial and consumer

balances while reducing our exposure to certain residential real

estate secured loans. Additionally, much of our success growing

commercial and consumer loans has been driven by our national

banking delivery channel, which provides us with additional

geographic diversity. Overall economic indicators in our markets

are improving, and organic loan production in C&I and other

consumer loans has been solid. Average loans during 2014

totaled $130.9 billion, up $8.2 billion, while average performing

loans increased $8.6 billion, or 7%, driven by broad-based

growth across the commercial and consumer portfolios. See the

"Net Interest Income/Margin" section of this MD&A for more

information regarding average loan balances.

Commercial loans increased $9.1 billion, or 14%, during

2014 compared to December 31, 2013. C&I loans increased $7.5

billion, or 13%, from December 31, 2013, primarily driven by

broad-based growth generated by our corporate and commercial

banking businesses. The most notable increases were in the real

estate and diversified financials and insurance industry sectors.

The growth in C&I loans was partly offset by the transfer of $470

million of loans to LHFS in the fourth quarter of 2014. During

2014, CRE loans increased $1.3 billion, or 23%, compared to

December 31, 2013 reflecting growth in our institutional and