SunTrust 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

112

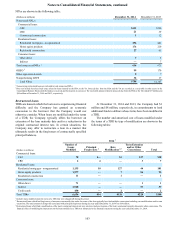

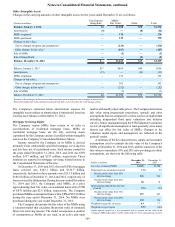

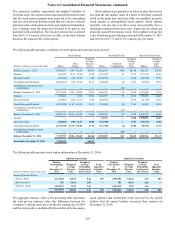

In relation to the Commercial, Residential and Consumer

financial assets discussed above, the following table presents

portfolio and delinquency balances for accruing loans 90 days

or more past due and all nonaccrual loans at December 31, 2014

and 2013, as well as net charge-offs for the years ended December

31, 2014 and 2013:

Portfolio Balance 1Past Due and Nonaccrual 2Net Charge-offs

December 31,

2014 December 31,

2013 December 31,

2014 December 31,

2013

Year Ended December 31

(Dollars in millions) 2014 2013

Type of loan:

Commercial $73,392 $64,310 $181 $272 $71 $153

Residential 38,775 43,190 891 1,296 279 444

Consumer 20,945 20,377 619 631 95 81

Total loan portfolio 133,112 127,877 1,691 2,199 445 678

Managed securitized loans:

Commercial —1,617 —29 ——

Residential 110,591 100,695 183 3493 316 23

Total managed loans $243,703 $230,189 $1,874 $2,721 $461 $701

1 Excludes $3.2 billion and $1.7 billion of LHFS at December 31, 2014 and 2013, respectively.

2 Excludes $39 million and $17 million of past due LHFS at December 31, 2014 and 2013, respectively.

3 Excludes loans that have completed the foreclosure or short sale process (i.e. involuntary prepayments).

Other Variable Interest Entities

In addition to the Company’s involvement with certain VIEs

related to transfers of financial assets, the Company also has

involvement with VIEs from other business activities.

Total Return Swaps

The Company has involvement with various VIEs related to its

TRS business. Under the matched book TRS business model,

the VIEs purchase assets (typically commercial leveraged loans)

from the market, which are identified by third party clients, that

serve as the underlying reference assets for a TRS between the

VIE and the Company and a mirror-image TRS between the

Company and its third party clients. The TRS contracts between

the VIEs and the Company hedge the Company’s exposure to

the TRS contracts with its third party clients. These third parties

are not related parties to the Company, nor are they and the

Company de facto agents of each other. In order for the VIEs to

purchase the reference assets, the Company provides senior

financing, in the form of demand notes, to these VIEs. The TRS

contracts pass through interest and other cash flows on the assets

owned by the VIEs to the third parties, along with exposing the

third parties to decreases in value on the assets and providing

them with the rights to appreciation on the assets. The terms of

the TRS contracts require the third parties to post initial

collateral, in addition to ongoing margin as the fair values of the

underlying assets change.

The Company evaluated the VIEs for consolidation, noting

that the Company and its third party clients are the VI holders.

As such, the Company evaluated the nature of all VIs and other

interests and involvement with the VIEs, in addition to the

purpose and design of the VIEs, relative to the risks they were

designed to create. The purpose and design of a VIE are key

components of a consolidation analysis. The VIEs were designed

for the benefit of the third parties and would not exist if the

Company did not enter into the TRS contracts with the third

parties. The activities of the VIEs are restricted to buying and

selling reference assets with respect to the TRS contracts entered

into between the Company and its third party clients and the

risks/benefits of any such assets owned by the VIEs are passed

to the third party clients via the TRS contracts. The TRS contracts

between the Company and its third party clients have a

substantive effect on the design of the overall transaction and the

VIEs. Based on its evaluation, the Company has determined that

it is not the primary beneficiary of the VIEs, as the design of the

TRS business results in the Company having no substantive

power to direct the significant activities of the VIEs.

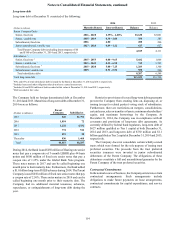

At December 31, 2014 and 2013, the Company had $2.3

billion and $1.5 billion, respectively, in senior financing

outstanding to VIEs, which was classified within trading assets

and derivatives on the Consolidated Balance Sheets and carried

at fair value. These VIEs had entered into TRS contracts with

the Company with outstanding notional amounts of $2.3 billion

and $1.5 billion at December 31, 2014 and 2013, respectively,

and the Company had entered into mirror-image TRS contracts

with third parties with the same outstanding notional amounts.

At December 31, 2014, the fair values of these TRS assets and

liabilities were $19 million and $14 million, respectively, and at

December 31, 2013, the fair values of these TRS assets and

liabilities were $35 million and $31 million, respectively,

reflecting the pass-through nature of these structures. The

notional amounts of the TRS contracts with the VIEs represent

the Company’s maximum exposure to loss, although such

exposure to loss has been mitigated via the TRS contracts with

third parties. For additional information on the Company’s TRS

with these VIEs, see Note 17, “Derivative Financial

Instruments.”

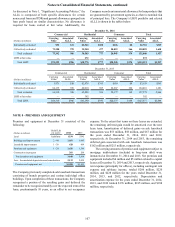

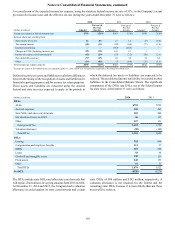

Community Development Investments

As part of its community reinvestment initiatives, the Company

invests primarily within its footprint in multi-family affordable

housing developments and other community development

entities as a limited and/or general partner and/or a debt

provider. The Company receives tax credits for its limited partner

investments. The Company has determined that the vast majority

of the related partnerships in which the investments are held are