SunTrust 2014 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

162

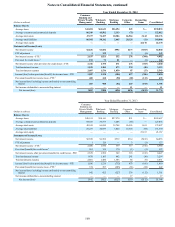

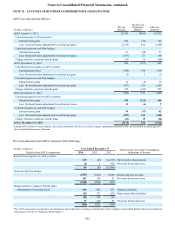

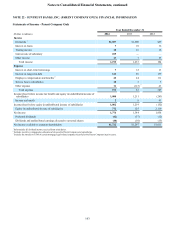

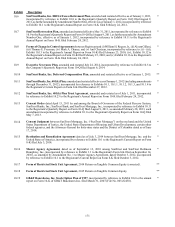

NOTE 21 - ACCUMULATED OTHER COMPREHENSIVE (LOSS)/INCOME

AOCI was calculated as follows:

(Dollars in millions) Pre-tax

Amount

Income Tax

(Expense)/

Benefit After-tax

Amount

AOCI, January 1, 2012 $2,744 ($995) $1,749

Unrealized gains on AFS securities:

Unrealized net gains 198 (72) 126

Less: Reclassification adjustment for realized net gains 1(2,279) 810 (1,469)

Unrealized gains on cash flow hedges:

Unrealized net gains 81 (28) 53

Less: Reclassification adjustment for realized net gains (143) 53 (90)

Change related to employee benefit plans (95) 35 (60)

AOCI, December 31, 2012 506 (197) 309

Unrealized (losses)/gains on AFS securities:

Unrealized net losses (944) 348 (596)

Less: Reclassification adjustment for realized net gains (2) 1 (1)

Unrealized gains on cash flow hedges:

Unrealized net gains 16 (6) 10

Less: Reclassification adjustment for realized net gains (417) 154 (263)

Change related to employee benefit plans 399 (147) 252

AOCI, December 31, 2013 (442) 153 (289)

Unrealized gains/(losses) on AFS securities:

Unrealized net gains 578 (212) 366

Less: Reclassification adjustment for realized net losses 15 (6) 9

Unrealized gains on cash flow hedges:

Unrealized net gains 99 (37) 62

Less: Reclassification adjustment for realized net gains (387) 143 (244)

Change related to employee benefit plans (41) 15 (26)

AOCI, December 31, 2014 ($178) $56 ($122)

1 Excludes $305 million of losses related to derivatives associated with The Coca-Cola Company Agreements termination that was recorded in securities gains on

the Consolidated Statements of Income.

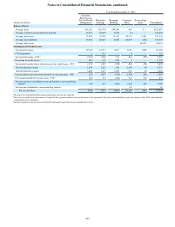

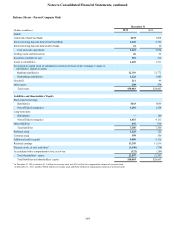

The reclassification from AOCI consisted of the following:

(Dollars in millions) Year Ended December 31 Affected line item in the Consolidated

Statements of Income

Details about AOCI components 2014 2013 2012

Realized losses/(gains) on AFS securities:

$15 ($2) ($2,279) Net securities (losses)/gains

(6) 1 810 Provision for income taxes

$9 ($1) ($1,469)

Gains on cash flow hedges:

($387) ($417) ($143) Interest and fees on loans

143 154 53 Provision for income taxes

($244) ($263) ($90)

Change related to employee benefit plans:

Amortization of actuarial losses $10 $26 $27 Employee benefits

(51) 373 (122) Other assets/other liabilities 1

(41) 399 (95)

15 (147) 35 Provision for income taxes

($26) $252 ($60)

1 This AOCI component is recognized as an adjustment to the funded status of employee benefit plans in the Company's Consolidated Balance Sheets. (For additional

information, see Note 15, "Employee Benefit Plans.")