SunTrust 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

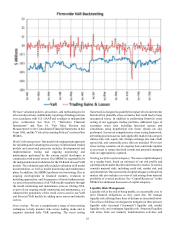

monitored as part of various governance processes. We

originated MSRs with fair values at the time of origination of

$178 million and $352 million during 2014 and 2013,

respectively. Additionally, we purchased servicing rights valued

at approximately $130 million during 2014. We recognized a

mark-to-market decrease of $401 million and an increase of $50

million in the fair value of our MSRs during 2014 and 2013,

respectively. Increases or decreases in fair value include the

decay resulting from the realization of expected monthly net

servicing cash flows. We recorded $134 million and $233 million

of net losses during 2014 and 2013, respectively, inclusive of

decay and related hedges. The decrease in net losses related to

MSRs during 2014 compared to 2013 was driven by lower decay,

which was a result of a decline in refinance activity due to higher

mortgage interest rates.

We also held a total net book value of approximately $9

million and $14 million of non-public equity exposures (direct

investments) and other equity-related investments at

December 31, 2014 and 2013, respectively. We generally hold

these investments as long-term investments. If conditions in the

market deteriorate, impairment charges could occur related to

these long-term investments and other assets, including but not

limited to goodwill and other intangible assets.

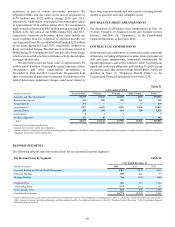

OFF-BALANCE SHEET ARRANGEMENTS

See discussion of off-balance sheet arrangements in Note 10,

“Certain Transfers of Financial Assets and Variable Interest

Entities,” and Note 16, “Guarantees,” to the Consolidated

Financial Statements in this Form 10-K.

CONTRACTUAL COMMITMENTS

In the normal course of business, we enter into certain contractual

obligations, including obligations to make future payments on

debt and lease arrangements, contractual commitments for

capital expenditures, and service contracts. Table 31 presents our

significant contractual obligations at December 31, 2014, except

for pension and other postretirement benefit plans, which are

included in Note 15, "Employee Benefit Plans," to the

Consolidated Financial Statements in this Form 10-K.

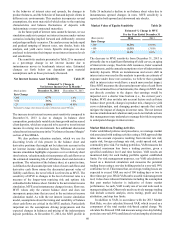

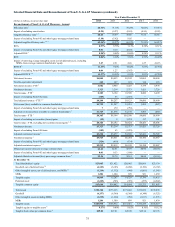

Table 31

At December 31, 2014

(Dollars in millions) 1 year or less 1-3 years 3-5 years After 5 years Total

Consumer and other time deposits 1$5,295 $3,843 $1,278 $458 $10,874

Brokered time deposits 1162 289 296 211 958

Foreign deposits 375 — — — 375

Long-term debt 1, 2 1,817 6,687 2,205 2,304 13,013

Operating leases 205 384 194 328 1,111

Capital leases 12 3 4 — 9

Purchase obligations 3421 38 3 — 462

Total $8,277 $11,244 $3,980 $3,301 $26,802

1 Amounts do not include accrued interest.

2 Amounts do not include capital lease obligations.

3 Amounts represent termination fees for legally binding purchase obligations of $5 million or more. Payments made towards the purchase of goods or services under these purchase

obligations totaled $223 million during 2014.

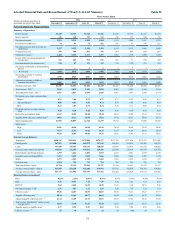

BUSINESS SEGMENTS

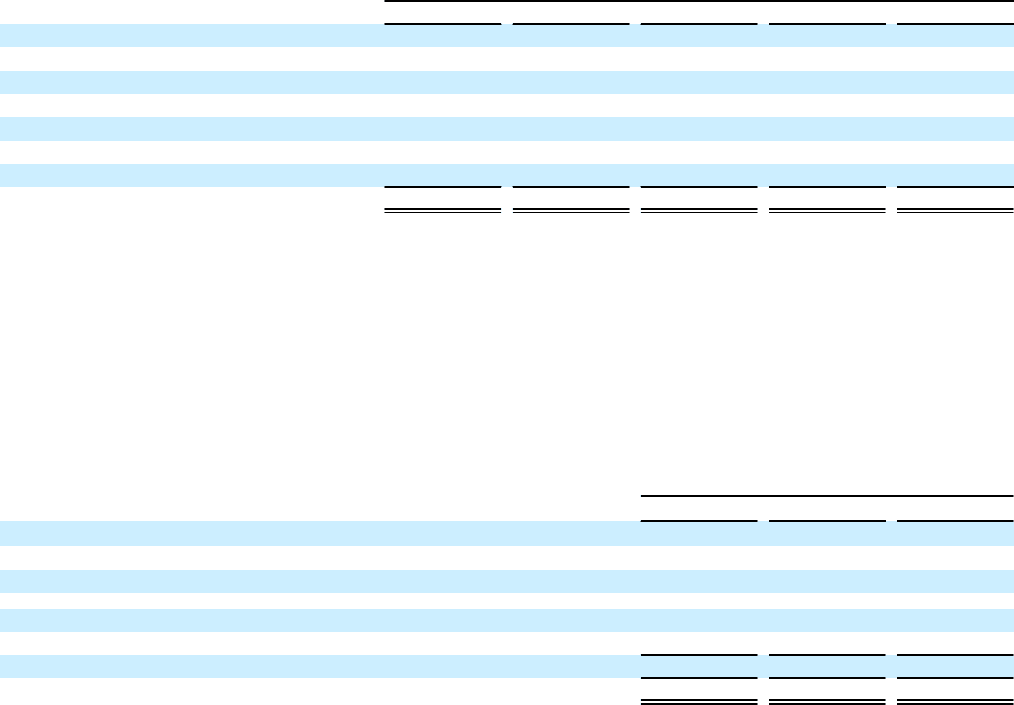

The following table presents net income/(loss) for our reportable business segments:

Net Income/(Loss) by Segment Table 32

Year Ended December 31

(Dollars in millions) 2014 2013 2012

Consumer Banking and Private Wealth Management $687 $642 $349

Wholesale Banking 900 822 719

Mortgage Banking (56) (527) (605)

Corporate Other 436 519 1,542

Reconciling Items 1(193) (112) (47)

Total Corporate Other 243 407 1,495

Consolidated net income $1,774 $1,344 1,958

1 Includes differences between net income/(loss) reported for each business segment using management accounting practices and U.S. GAAP. Prior period information has been restated to

reflect changes in internal reporting methodology and inter-segment transfers. See additional information in Note 20, "Business Segment Reporting," to the Consolidated Financial

Statements in this Form 10-K.