SunTrust 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

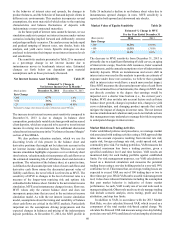

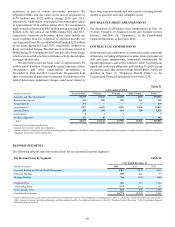

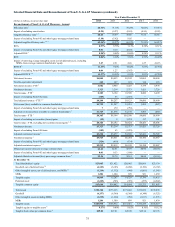

The following table presents average loans and average deposits for our reportable business segments during the years ended

December 31:

Average Loans and Deposits by Segment Table 33

Average Loans Average Consumer

and Commercial Deposits

(Dollars in millions) 2014 2013 2012 2014 2013 2012

Consumer Banking and Private Wealth Management $41,694 $40,511 $41,822 $86,249 $84,359 $83,903

Wholesale Banking 62,643 54,141 50,742 43,502 39,577 38,712

Mortgage Banking 26,494 27,974 30,288 2,333 3,206 3,638

Corporate Other 43 31 41 (72) (66) (4)

See Note 20, “Business Segment Reporting,” to the Consolidated

Financial Statements in this Form 10-K for a discussion of our

segment structure, basis of presentation, and internal

management reporting methodologies, including the

reclassification of RidgeWorth results from the Wholesale

Banking segment to Corporate Other during 2014.

BUSINESS SEGMENT RESULTS

Year Ended December 31, 2014 vs. 2013

Consumer Banking and Private Wealth Management

Consumer Banking and Private Wealth Management reported

net income of $687 million during the year ended December 31,

2014, an increase of $45 million, or 7%, compared to 2013. The

increase in net income was primarily driven by continued

improvement in credit quality resulting in lower credit losses and

an increase in noninterest income, which in aggregate more than

offset a 3% increase in expenses.

Net interest income was $2.6 billion, an increase of $37

million compared to 2013, driven by increased average asset and

deposit balances, partially offset by lower rate spreads. Net

interest income related to loans increased $3 million, driven by

a $1.2 billion increase in average loan balances, partially offset

by a six basis point decrease in loan spreads. The increase in

average loans was driven by growth in consumer loans, which

more than offset home equity line paydowns and a decline in

nonaccrual loans. Net interest income related to deposits

increased $16 million, or 1%, driven by $1.9 billion, or 2%,

increase in average deposit balances, partially offset by a three

basis point decrease in deposit spreads. However, favorable

deposit mix trends continued as average deposit balances

increased in all lower cost account categories, offsetting a $2.0

billion, or 15%, decline in average time deposits. Other funding

costs related to other assets improved by $19 million, driven

primarily by a decline in funding rates.

Provision for credit losses was $191 million, a decrease of

$70 million, or 27%, compared to 2013. The decrease was

primarily driven by declines in home equity line and commercial

loan net charge-offs, partially offset by an increase in

nonguaranteed student loan net charge-offs.

Total noninterest income was $1.5 billion, an increase of

$50 million, or 3%, compared to 2013, driven by an increase in

retail investment income, trust and investment management, and

card fees income, partially offset by a decrease in service charges

on deposits.

Total noninterest expense was $2.9 billion, an increase of

$86 million, or 3%, compared to 2013. The increase was driven

by higher staff expenses related to investment in revenue

generating positions, primarily in wealth management-related

businesses to help fulfill more of our clients’ wealth and

investment management needs. Additionally, higher operating

losses and allocated corporate overhead costs were partially

offset by a decrease in other operating expenses.

Wholesale Banking

Wholesale Banking reported net income of $900 million for the

year ended December 31, 2014, an increase of $78 million, or

9%, compared to 2013. The increase in net income was

attributable to an increase in net interest income and a decrease

in provision for credit losses, partially offset by an increase in

noninterest expense.

Net interest income was $1.8 billion, a $131 million, or 8%,

increase compared to 2013, driven by increases in average loan

and deposit balances, partially offset by lower rate spreads. Net

interest income related to loans increased, as average loan

balances grew $8.5 billion, or 16%, led by C&I, CRE, and tax-

exempt loans. Net interest income related to client deposits

increased as average deposit balances grew $3.9 billion, or 10%,

compared to the same period in 2013. Lower cost demand

deposits increased $1.8 billion, or 9%, and average combined

interest-bearing transaction accounts and money market

accounts increased $2.3 billion, or 12%, while average CD

balances declined approximately $147 million.

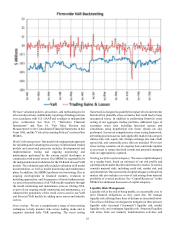

Provision for credit losses was $71 million, a decrease of

$53 million, or 43%, from the same period in 2013. The decline

reflects the continued improvement in overall Wholesale

Banking credit quality and a $56 million decline in net charge-

offs, partially offset by an increase in the provision for credit

losses recorded in the fourth quarter of 2014 related to the recent

decline in oil prices.

Total noninterest income was $1.1 billion and virtually

unchanged compared to 2013. A $49 million, or 14%, increase

in investment banking income along with higher structured real

estate gains, card fees, and non margin loan fees was largely

offset by declines in affordable housing partnership revenue and

related gains driven by the sale of certain affordable housing

properties. Additionally, trading revenue and service charges on

treasury related services declined, and impairment charges

related to aircraft leases increased during 2014.

Total noninterest expense was $1.5 billion, an increase of

$86 million or 6%, compared to 2013. The increase was primarily

due to an increase in employee compensation as we continue to