SunTrust 2014 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199

|

|

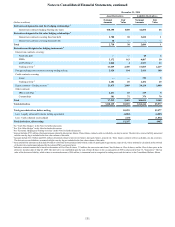

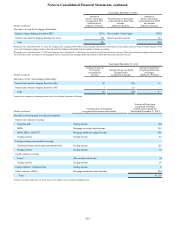

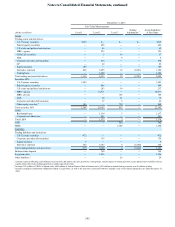

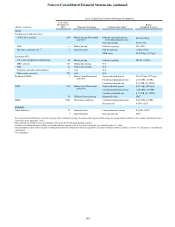

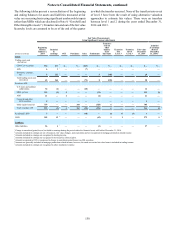

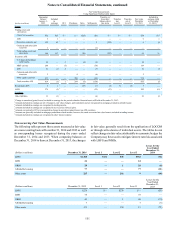

Notes to Consolidated Financial Statements, continued

141

December 31, 2013

Fair Value Measurements

(Dollars in millions) Level 1 Level 2 Level 3 Netting

Adjustments 1Assets/Liabilities

at Fair Value

Assets

Trading assets and derivatives:

U.S. Treasury securities $219 $— $— $— $219

Federal agency securities — 426 — — 426

U.S. states and political subdivisions — 65 — — 65

MBS - agency — 323 — — 323

CDO/CLO securities — 3 54 — 57

ABS — — 6 — 6

Corporate and other debt securities — 534 — — 534

CP — 29 — — 29

Equity securities 109 — — — 109

Derivative contracts 828 5,285 12 (4,741) 1,384

Trading loans — 1,888 — — 1,888

Total trading assets and derivatives 1,156 8,553 72 (4,741) 5,040

Securities AFS:

U.S. Treasury securities 1,293 — — — 1,293

Federal agency securities — 984 — — 984

U.S. states and political subdivisions — 203 34 — 237

MBS - agency — 18,911 — — 18,911

MBS - private — — 154 — 154

ABS — 58 21 — 79

Corporate and other debt securities — 37 5 — 42

Other equity securities 2103 — 739 — 842

Total securities AFS 1,396 20,193 953 — 22,542

LHFS:

Residential loans — 1,114 3 — 1,117

Corporate and other loans — 261 — — 261

Total LHFS — 1,375 3 — 1,378

LHFI — — 302 — 302

MSRs — — 1,300 — 1,300

Liabilities

Trading liabilities and derivatives:

U.S. Treasury securities 472 — — — 472

Corporate and other debt securities — 179 — — 179

Equity securities 5 — — — 5

Derivative contracts 502 5,167 4 (5,148) 525

Total trading liabilities and derivatives 979 5,346 4 (5,148) 1,181

Brokered time deposits — 764 — — 764

Long-term debt — 1,556 — — 1,556

Other liabilities 3— — 29 — 29

1 Amounts represent offsetting cash collateral received from, and paid to, the same derivative counterparties, and the impact of netting derivative assets and derivative liabilities when a

legally enforceable master netting agreement or similar agreement exists.

2 Includes $336 million of FHLB of Atlanta stock, $402 million of Federal Reserve Bank of Atlanta stock, $103 million in mutual fund investments, and $1 million of other.

3 Includes contingent consideration obligations related to acquisitions, as well as the derivative associated with the Company's sale of Visa shares during the year ended December 31,

2009.