SunTrust 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

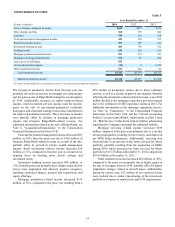

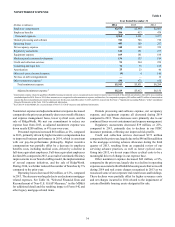

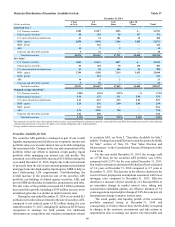

ALLOWANCE FOR CREDIT LOSSES

The allowance for credit losses consists of the ALLL and the

reserve for unfunded commitments. A rollforward of our

allowance for credit losses and summarized credit loss

experience is shown in Table 11. See Note 1, "Significant

Accounting Policies," and Note 7, "Allowance for Credit

Losses," to the Consolidated Financial Statements in this Form

10-K, as well as the "Allowance for Credit Losses" section within

"Critical Accounting Policies" in this MD&A for further

information regarding our ALLL accounting policy,

determination, and allocation.

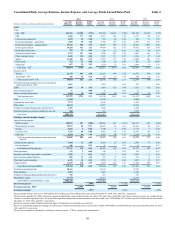

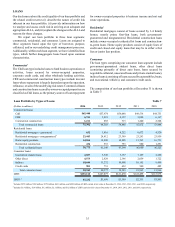

Summary of Credit Losses Experience Table 11

Year Ended December 31

(Dollars in millions) 2014 2013 2012 2011 2010

Allowance for Credit Losses

Balance - beginning of period $2,094 $2,219 $2,505 $3,032 $3,235

Allowance recorded upon VIE consolidation —— — — 1

Provision/(benefit) for unfunded commitments 45 (3) (10) (57)

Provision for loan losses:

Commercial loans 111 197 241 324 938

Residential loans 126 243 1,062 1,113 1,622

Consumer loans 101 108 95 86 148

Total provision for loan losses 338 548 1,398 1,523 2,708

Charge-offs:

Commercial loans (128) (219) (457) (803) (1,087)

Residential loans (344) (531) (1,316) (1,275) (1,736)

Consumer loans (135) (119) (134) (163) (195)

Total charge-offs (607) (869) (1,907) (2,241) (3,018)

Recoveries:

Commercial loans 57 66 154 140 99

Residential loans 65 87 31 18 20

Consumer loans 40 38 41 43 44

Total recoveries 162 191 226 201 163

Net charge-offs (445) (678) (1,681) (2,040) (2,855)

Balance - end of period $1,991 $2,094 $2,219 $2,505 $3,032

Components:

ALLL $1,937 $2,044 $2,174 $2,457 $2,974

Unfunded commitments reserve 154 50 45 48 58

Allowance for credit losses $1,991 $2,094 $2,219 $2,505 $3,032

Average loans $130,874 $122,657 $122,893 $116,308 $113,925

Period-end loans outstanding 133,112 127,877 121,470 122,495 115,975

Ratios:

ALLL to period-end loans 2,3 1.46% 1.60% 1.80% 2.01% 2.58%

ALLL to NPLs 4307 212 142 85 73

ALLL to net charge-offs 4.35x 3.01x 1.29x 1.20x 1.04x

Net charge-offs to average loans 0.34% 0.55% 1.37% 1.75% 2.51%

1 The unfunded commitments reserve is recorded in other liabilities in the Consolidated Balance Sheets.

2 $272 million, $302 million, $379 million, $433 million, and $492 million of LHFI carried at fair value at December 31, 2014, 2013, 2012, 2011, and 2010, respectively, were excluded

from period-end loans in the calculation, as no allowance is recorded for loans held at fair value. We believe that this presentation more appropriately reflects the relationship between the

ALLL and loans that attract an allowance.

3 Excluding government-guaranteed loans of $5.5 billion, $9.0 billion, $9.6 billion, $13.9 billion, and $8.8 billion at December 31, 2014, 2013, 2012, 2011, and 2010, respectively, from

period-end loans in the calculation results in ratios of 1.52%, 1.72%, 1.95%, 2.27%, and $2.79%, respectively.

4 $3 million, $7 million, $19 million, $25 million, and $28 million of NPLs carried at fair value at December 31, 2014, 2013, 2012, 2011, and 2010, respectively, were excluded from NPLs

in the calculation.

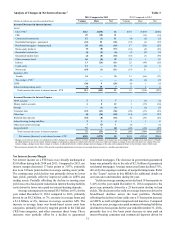

Provision for Credit Losses

The total provision for credit losses includes the provision for

loan losses and the provision for unfunded commitments. The

provision for loan losses is the result of a detailed analysis

performed to estimate an appropriate and adequate ALLL.

During 2014, the provision for loan losses decreased $210

million, or 38%, compared to 2013. The decline in the provision

for loan losses was largely attributable to improvements in credit

quality trends, particularly in our residential and CRE portfolios,

and lower net charge-offs during 2014 compared to 2013. The

decrease was partially offset by the effects of loan growth in the

commercial and consumer loan portfolios and an adjustment

made in the fourth quarter of 2014 to account for the recent

decline in oil prices.

We expect our provision for loan losses in 2015 to be

relatively stable to down slightly from 2014, as continued

improvement in asset quality may be partially offset by loan