SunTrust 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

96

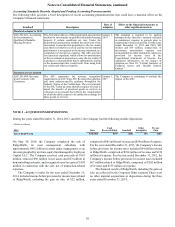

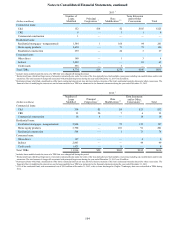

The amortized cost and fair value of investments in debt

securities at December 31, 2014, by estimated average life, are

shown below. Receipt of cash flows may differ from estimated

average lives and contractual maturities because borrowers may

have the right to call or prepay obligations with or without

penalties.

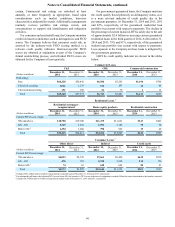

Distribution of Maturities

(Dollars in millions) 1 Year

or Less 1-5

Years 5-10

Years After 10

Years Total

Amortized Cost:

U.S. Treasury securities $200 $1,217 $496 $— $1,913

Federal agency securities 64 234 36 137 471

U.S. states and political subdivisions 43 34 101 22 200

MBS - agency 2,550 8,992 7,106 3,925 22,573

MBS - private — 122 — — 122

ABS 14 3 2 — 19

Corporate and other debt securities 5 33 — — 38

Total debt securities $2,876 $10,635 $7,741 $4,084 $25,336

Fair Value:

U.S. Treasury securities $203 $1,221 $497 $— $1,921

Federal agency securities 64 244 38 138 484

U.S. states and political subdivisions 43 36 106 24 209

MBS - agency 2,704 9,202 7,219 3,923 23,048

MBS - private — 123 — — 123

ABS 14 5 2 — 21

Corporate and other debt securities 5 36 — — 41

Total debt securities $3,033 $10,867 $7,862 $4,085 $25,847

Weighted average yield 12.34% 2.40% 2.78% 2.90% 2.59%

1Average yields are based on amortized cost and presented on a FTE basis.

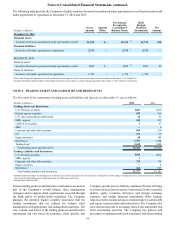

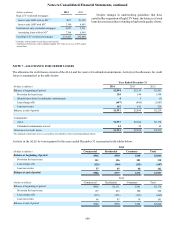

Securities in an Unrealized Loss Position

The Company held certain investment securities where

amortized cost exceeded fair market value, resulting in

unrealized loss positions. Market changes in interest rates and

credit spreads may result in temporary unrealized losses as the

market price of securities fluctuates. At December 31, 2014, the

Company did not intend to sell these securities nor was it more-

likely-than-not that the Company would be required to sell these

securities before their anticipated recovery or maturity. The

Company has reviewed its portfolio for OTTI in accordance with

the accounting policies in Note 1, "Significant Accounting

Policies."

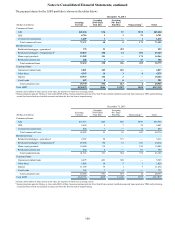

December 31, 2014

Less than twelve months Twelve months or longer Total

(Dollars in millions) Fair

Value Unrealized

Losses 2Fair

Value Unrealized

Losses 2Fair

Value Unrealized

Losses 2

Temporarily impaired securities:

U.S. Treasury securities $150 $1 $— $— $150 $1

Federal agency securities 20 — 132 2 152 2

MBS - agency 2,347 6 4,911 77 7,258 83

ABS — — 14 — 14 —

Total temporarily impaired securities 2,517 7 5,057 79 7,574 86

OTTI securities 1:

MBS - private 69 1 — — 69 1

Total OTTI securities 69 1 — — 69 1

Total impaired securities $2,586 $8 $5,057 $79 $7,643 $87