SunTrust 2014 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

115

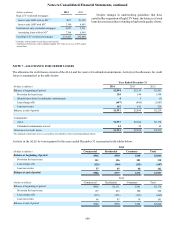

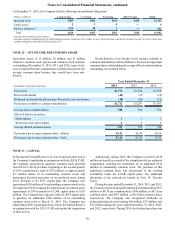

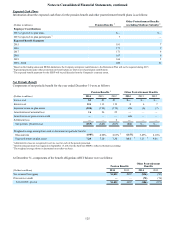

At December 31, 2014, the Company had the following unconditional obligations:

(Dollars in millions) 1 year or less 1-3 years 3-5 years After 5 years Total

Operating leases $205 $384 $194 $328 $1,111

Capital leases 12 3 4 — 9

Purchase obligations 2421 38 3 — 462

Total $628 $425 $201 $328 $1,582

1 Amounts do not include accrued interest.

2 Amounts represent termination fees for legally binding purchase obligations of $5 million or more. Payments made towards the purchase of goods or services under these

purchase obligations totaled $223 million during 2014.

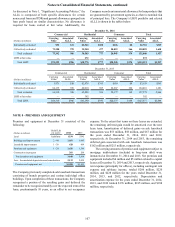

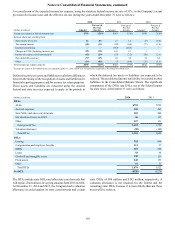

NOTE 12 – NET INCOME PER COMMON SHARE

Equivalent shares of 15 million, 18 million, and 23 million

related to common stock options and common stock warrants

outstanding at December 31, 2014, 2013, and 2012, respectively,

were excluded from the computations of diluted net income per

average common share because they would have been anti-

dilutive.

Reconciliations of net income to net income available to

common shareholders and the difference between average basic

common shares outstanding and average diluted common shares

outstanding are included below.

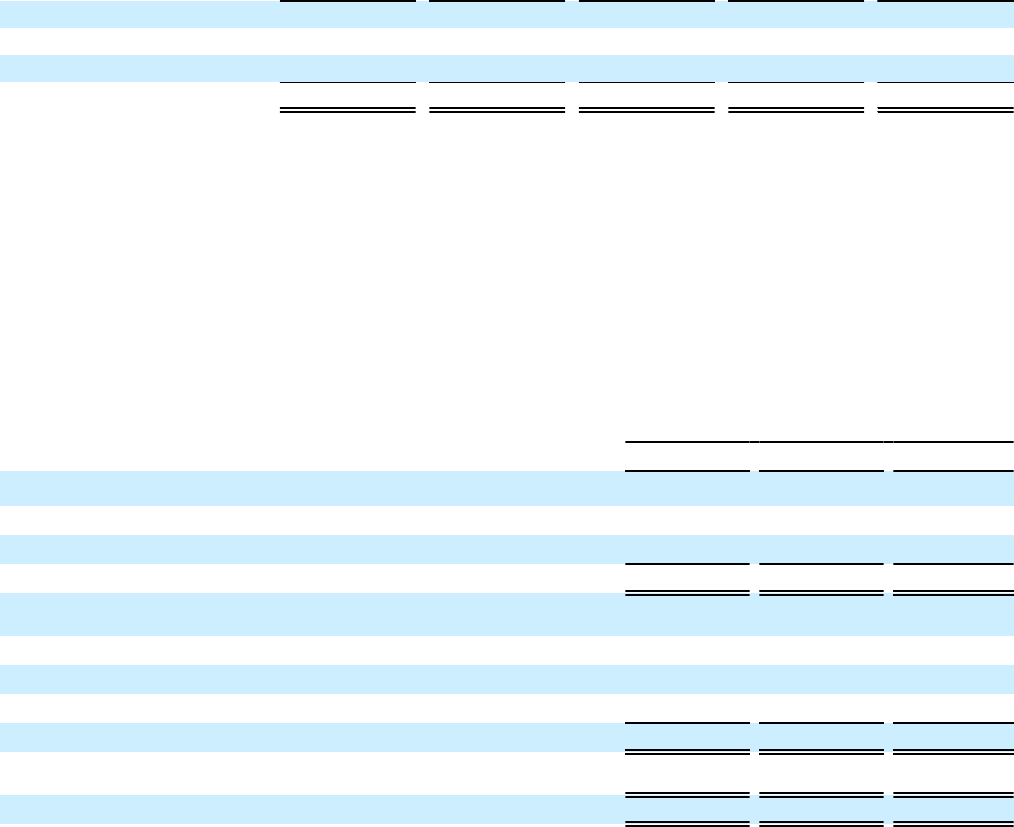

Year Ended December 31

(In millions, except per share data) 2014 2013 2012

Net income $1,774 $1,344 $1,958

Preferred dividends (42)(37) (12)

Dividends and undistributed earnings allocated to unvested shares (10)(10) (15)

Net income available to common shareholders $1,722 $1,297 $1,931

Average basic common shares 528 534 534

Effect of dilutive securities:

Stock options 11 1

Restricted stock and warrants 44 3

Average diluted common shares 533 539 538

Net income per average common share - diluted $3.23 $2.41 $3.59

Net income per average common share - basic $3.26 $2.43 $3.62

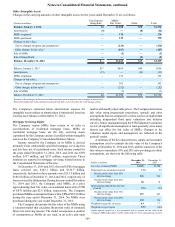

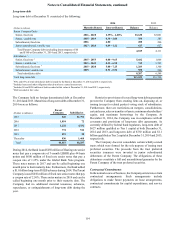

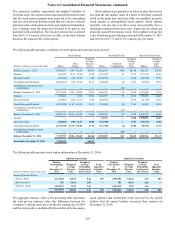

NOTE 13 – CAPITAL

Following the Federal Reserve's review of and non-objection to

the Company's capital plan in conjunction with the 2014 CCAR,

the Company increased its quarterly common stock dividend

from $0.10 to $0.20 per share beginning in the second quarter

of 2014, repurchased a total of $278 million, or approximately

8.5 million shares of its outstanding common stock, and

maintained dividend payments on its preferred stock during

2014. Pursuant to its 2013 capital plan, the Company also

repurchased $50 million of its outstanding common stock in the

first quarter of 2014, bringing the total amount of common stock

repurchased in 2014 pursuant to CCAR capital plans to $328

million. The Company has capacity under its 2014 capital plan

to purchase an additional $120 million of its outstanding

common stock prior to March 31, 2015. The Company has

submitted its 2015 capital plan for review by the Federal Reserve

in conjunction with the 2015 CCAR and awaits the completion

of their review.

Additionally, during 2014, the Company recorded a $130

million tax benefit as a result of the completion of a tax authority

examination, enabling the repurchase of an additional $130

million of outstanding common stock. The purchase of this

additional common stock was incremental to the existing

availability under the CCAR capital plans. See additional

discussion of the realized tax benefit in Note 14, "Income

Taxes."

During the years ended December 31, 2014, 2013, and 2012,

the Company declared and paid common dividends totaling $371

million, or $0.70 per common share, $188 million, or $0.35 per

common share, and $107 million, or $0.20 per common share,

respectively. The Company also recognized dividends on

perpetual preferred stock totaling $42 million, $37 million, and

$12 million during the years ended December 31, 2014, 2013,

and 2012, respectively. During 2014, the dividend per share was