SunTrust 2014 Annual Report Download - page 113

Download and view the complete annual report

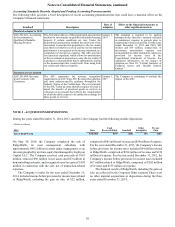

Please find page 113 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

90

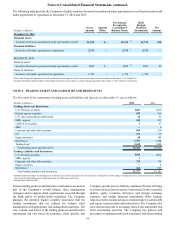

shareholders by the weighted average number of common shares

outstanding during each period, plus common share equivalents

calculated for stock options, warrants, and restricted stock

outstanding using the treasury stock method.

The Company has issued certain restricted stock awards,

which are unvested share-based payment awards that contain

nonforfeitable rights to dividends or dividend equivalents. These

restricted shares are considered participating securities.

Accordingly, the Company calculated net income available to

common shareholders pursuant to the two-class method,

whereby net income is allocated between common shareholders

and participating securities.

Net income available to common shareholders represents

net income after preferred stock dividends, gains or losses from

any repurchases of preferred stock, and dividends and allocation

of undistributed earnings to the participating securities. For

additional information on the Company’s EPS, see Note 12, “Net

Income Per Common Share.”

Securities Sold Under Agreements to Repurchase and

Securities Borrowed or Purchased Under Agreements to Resell

Securities sold under agreements to repurchase and securities

borrowed or purchased under agreements to resell are accounted

for as collateralized financing transactions and are recorded at

the amounts at which the securities were sold or acquired, plus

accrued interest. The fair value of collateral pledged or received

is continually monitored and additional collateral is obtained or

requested to be returned to the Company as deemed appropriate.

For additional information on the collateral pledged to secure

repurchase agreements, see Note 3, "Federal Funds Sold and

Securities Financing Activities," Note 4, "Trading Assets and

Liabilities and Derivatives," and Note 5, "Securities Available

for Sale."

Guarantees

The Company recognizes a liability at the inception of a

guarantee at an amount equal to the estimated fair value of the

obligation. A guarantee is defined as a contract that contingently

requires a company to make payment to a guaranteed party based

upon changes in an underlying asset, liability, or equity security

of the guaranteed party, or upon failure of a third party to perform

under a specified agreement. The Company considers the

following arrangements to be guarantees: certain asset purchase/

sale agreements, standby letters of credit and financial

guarantees, certain indemnification agreements included within

third party contractual arrangements, and certain derivative

contracts. For additional information on the Company’s

guarantor obligations, see Note 16, “Guarantees.”

Derivative Financial Instruments and Hedging Activities

The Company records all contracts that satisfy the definition of

a derivative at fair value in the Consolidated Balance Sheets.

Accounting for changes in the fair value of a derivative is

dependent upon whether or not it has been designated in a formal,

qualifying hedging relationship. The Company offsets all

outstanding derivative transactions with a single counterparty as

well as any cash collateral paid to and received from that

counterparty for derivative contracts that are subject to ISDA or

other legally enforceable netting arrangements and meet

accounting guidance for offsetting treatment.

Changes in the fair value of derivatives not designated in a

hedging relationship are recorded in noninterest income. This

includes derivatives that the Company enters into in a dealer

capacity to facilitate client transactions and as a risk management

tool to economically hedge certain identified market risks, along

with certain IRLCs on residential mortgage loans that are a

normal part of the Company’s operations. The Company also

evaluates contracts, such as brokered deposits and short-term

debt, to determine whether any embedded derivatives are

required to be bifurcated and separately accounted for as

freestanding derivatives.

Certain derivatives used as risk management tools are also

designated as accounting hedges of the Company’s exposure to

changes in interest rates or other identified market risks. The

Company prepares written hedge documentation for all

derivatives which are designated as hedges of (1) changes in the

fair value of a recognized asset or liability (fair value hedge)

attributable to a specified risk or (2) a forecasted transaction,

such as the variability of cash flows to be received or paid related

to a recognized asset or liability (cash flow hedge). The written

hedge documentation includes identification of, among other

items, the risk management objective, hedging instrument,

hedged item and methodologies for assessing and measuring

hedge effectiveness and ineffectiveness, along with support for

management’s assertion that the hedge will be highly effective.

Methodologies related to hedge effectiveness and

ineffectiveness are consistent between similar types of hedge

transactions and include (i) statistical regression analysis of

changes in the cash flows of the actual derivative and a perfectly

effective hypothetical derivative, and (ii) statistical regression

analysis of changes in the fair values of the actual derivative and

the hedged item.

For designated hedging relationships, the Company

performs retrospective and prospective effectiveness testing

using quantitative methods and does not assume perfect

effectiveness through the matching of critical terms.

Assessments of hedge effectiveness and measurements of hedge

ineffectiveness are performed at least quarterly. Changes in the

fair value of a derivative that is highly effective and that has been

designated and qualifies as a fair value hedge are recorded in

current period earnings, along with the changes in the fair value

of the hedged item that are attributable to the hedged risk. The

effective portion of the changes in the fair value of a derivative

that is highly effective and that has been designated and qualifies

as a cash flow hedge are initially recorded in AOCI and

reclassified to earnings in the same period that the hedged item

impacts earnings; any ineffective portion is recorded in current

period earnings.

Hedge accounting ceases on transactions that are no longer

deemed effective, or for which the derivative has been terminated

or de-designated. For discontinued fair value hedges where the

hedged item remains outstanding, the hedged item would cease

to be remeasured at fair value attributable to changes in the

hedged risk and any existing basis adjustment would be

recognized as an adjustment to earnings over the remaining life

of the hedged item. For discontinued cash flow hedges, the

unrealized gains and losses recorded in AOCI would be

reclassified to earnings in the period when the previously

designated hedged cash flows occur unless it was determined

that transaction was probable to not occur, whereby any