SunTrust 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

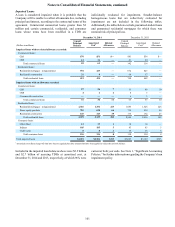

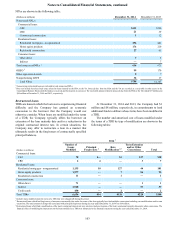

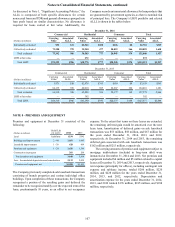

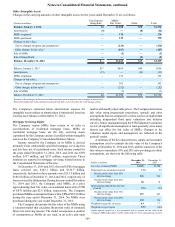

Notes to Consolidated Financial Statements, continued

99

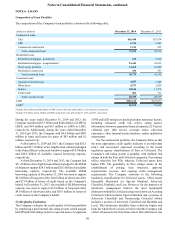

certain. Commercial risk ratings are refreshed at least

annually, or more frequently as appropriate, based upon

considerations such as market conditions, borrower

characteristics, and portfolio trends. Additionally, management

routinely reviews portfolio risk ratings, trends, and

concentrations to support risk identification and mitigation

activities.

For consumer and residential loans, the Company monitors

credit risk based on indicators such as delinquencies and FICO

scores. The Company believes that consumer credit risk, as

assessed by the industry-wide FICO scoring method, is a

relevant credit quality indicator. Borrower-specific FICO

scores are obtained at origination as part of the Company’s

formal underwriting process, and refreshed FICO scores are

obtained by the Company at least quarterly.

For government-guaranteed loans, the Company monitors

the credit quality based primarily on delinquency status, as it

is a more relevant indicator of credit quality due to the

government guarantee. At December 31, 2014 and 2013, 28%

and 82%, respectively, of the guaranteed residential loan

portfolio was current with respect to payments. The decline in

the percentage of current loans in LHFI is solely due to the sale

of approximately $2.0 billion in accruing current guaranteed

residential loans in the third quarter of 2014. At December 31,

2014 and 2013, 79% and 81%, respectively, of the guaranteed

student loan portfolio was current with respect to payments.

Loss exposure to the Company on these loans is mitigated by

the government guarantee.

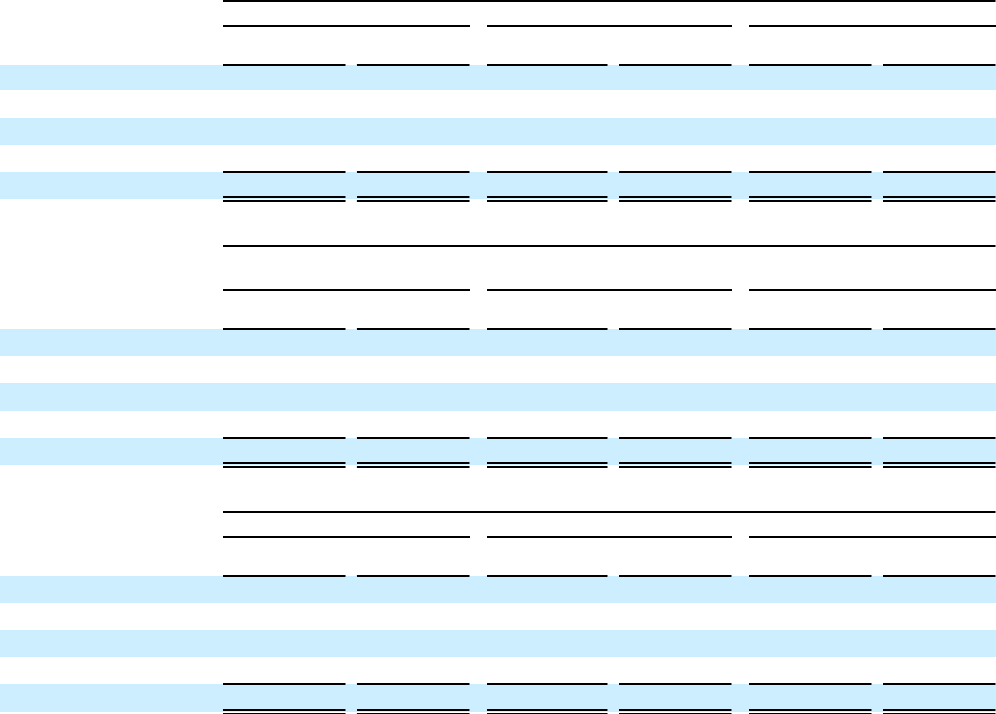

LHFI by credit quality indicator are shown in the tables

below:

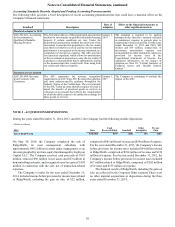

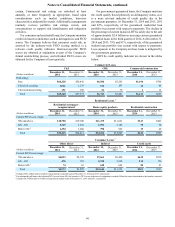

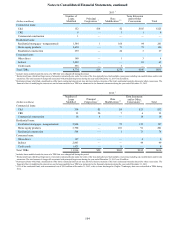

Commercial Loans

C&I CRE Commercial construction

(Dollars in millions) December 31,

2014 December 31,

2013 December 31,

2014 December 31,

2013 December 31,

2014 December 31,

2013

Risk rating:

Pass $64,228 $56,443 $6,586 $5,245 $1,196 $798

Criticized accruing 1,061 1,335 134 197 14 45

Criticized nonaccruing 151 196 21 39 112

Total $65,440 $57,974 $6,741 $5,481 $1,211 $855

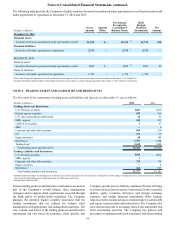

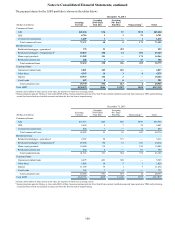

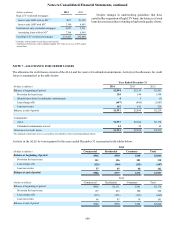

Residential Loans 1

Residential mortgages -

nonguaranteed Home equity products Residential construction

(Dollars in millions) December 31,

2014 December 31,

2013 December 31,

2014 December 31,

2013 December 31,

2014 December 31,

2013

Current FICO score range:

700 and above $18,780 $19,100 $11,475 $11,661 $347 $423

620 - 699 3,369 3,652 1,991 2,186 70 90

Below 620 21,294 1,660 798 962 19 40

Total $23,443 $24,412 $14,264 $14,809 $436 $553

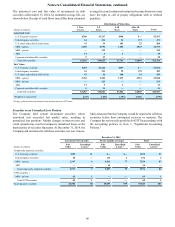

Consumer Loans 3

Other direct Indirect Credit cards

(Dollars in millions) December 31,

2014 December 31,

2013 December 31,

2014 December 31,

2013 December 31,

2014 December 31,

2013

Current FICO score range:

700 and above $4,023 $2,370 $7,661 $8,420 $639 $512

620 - 699 476 397 2,335 2,228 212 176

Below 620 274 62 648 624 50 43

Total $4,573 $2,829 $10,644 $11,272 $901 $731

1 Excludes $632 million and $3.4 billion of guaranteed residential loans at December 31, 2014 and 2013, respectively.

2 For substantially all loans with refreshed FICO scores below 620, the borrower’s FICO score at the time of origination exceeded 620 but has since deteriorated as the loan has seasoned.

3 Excludes $4.8 billion and $5.5 billion of guaranteed student loans at December 31, 2014 and 2013, respectively.