SunTrust 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

122

and the life insurance plans are noncontributory. Certain retiree

health benefits are funded in a Retiree Health Trust. Additionally,

certain retiree life insurance benefits are funded in a VEBA. The

Company reserves the right to amend or terminate any of the

benefits at any time. Effective April 1, 2014, the Company

amended the plan which now requires retirees age 65 and older

to enroll in individual Medicare supplemental plans. In addition,

the Company will fund a tax-advantaged HRA to assist some

retirees with medical expenses. The plan amendment was

measured as of December 31, 2013 and resulted in a decrease of

$76 million in the liability and AOCI for the postretirement

benefits plan. The Company contributed less than $1 million to

the Postretirement Welfare Plan during the year ended December

31, 2014. The expected pre-tax long-term rate of return on plan

assets for the Postretirement Welfare Plan is 5.00% for 2015.

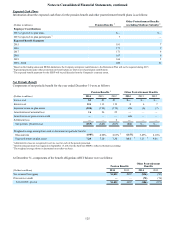

Assumptions

Each year, the SBFC, which includes several members of senior

management, reviews and approves the assumptions used in the

year-end measurement calculations for each plan. The discount

rate for each plan, used to determine the present value of future

benefit obligations, is determined by matching the expected cash

flows of each plan to a yield curve based on long-term, high

quality fixed income debt instruments available as of the

measurement date. A series of benefit payments projected to be

paid by the plan is developed based on the most recent census

data, plan provisions, and assumptions. The benefit payments at

each future maturity date are discounted by the year-appropriate

spot interest rates. The model then solves for the discount rate

that produces the same present value of the projected benefit

payments as generated by discounting each year’s payments by

the spot interest rate.

Actuarial gains and losses are created when actual

experience deviates from assumptions. The actuarial losses on

obligations generated within the pension plans during 2014

resulted primarily from lower interest rates. The actuarial gains

during 2013 resulted primarily from higher interest rates and

better than expected asset returns.

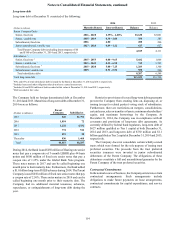

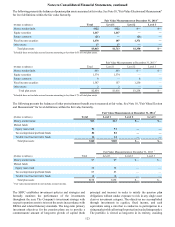

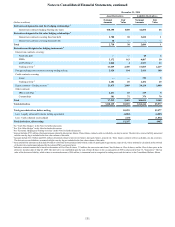

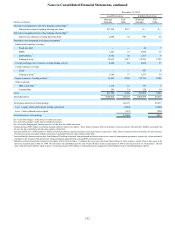

The following table presents the change in benefit

obligations, change in fair value of plan assets, funded status,

and accumulated benefit obligation for the years ended

December 31.

Pension Benefits 1Other Postretirement Benefits 2

(Dollars in millions) 2014 2013 2014 2013

Benefit obligation, beginning of year $2,575 $2,838 $81 $167

Service cost 55——

Interest cost 124 113 36

Plan participants’ contributions ——11 21

Actuarial loss/(gain) 401 (195) (10) 1

Benefits paid (165) (181) (16) (38)

Administrative expenses paid from pension trust (5) (5) ——

Plan amendments ———(76)

Benefit obligation, end of year 3$2,935 $2,575 $69 $81

Change in plan assets:

Fair value of plan assets, beginning of year $2,873 $2,742 $158 $164

Actual return on plan assets 371 309 814

Employer contributions 68——

Plan participants’ contributions ——11 21

Benefits paid (165) (181) (17) (41)

Administrative expenses paid from pension trust (5) (5) ——

Fair value of plan assets, end of year 4$3,080 $2,873 $160 $158

Funded status at end of year $145 $298 $91 $77

Funded status at end of year (%) 105% 112%

Accumulated benefit obligation $2,935 $2,575

1 Employer contributions represent the benefits that were paid to nonqualified plan participants. SERPs are not funded through plan assets.

2 Plan remeasured at December 31, 2013 due to plan amendment.

3 Includes $85 million and $80 million of benefit obligations for the unfunded nonqualified supplemental pension plans at December 31, 2014 and 2013, respectively.

4 Includes $1 million and $0, of the Company's common stock acquired by the asset manager and held as part of the equity portfolio for pension benefits at December

31, 2014 and 2013, respectively.

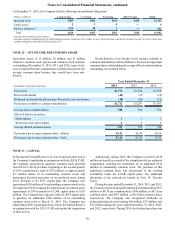

Pension Benefits Other Postretirement

Benefits

(Weighted average assumptions used to determine benefit obligations, end of year) 2014 2013 2014 2013

Discount rate 4.09% 4.98% 3.60% 4.15%