SunTrust 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

92

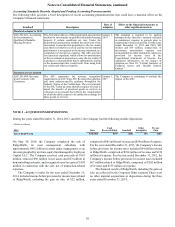

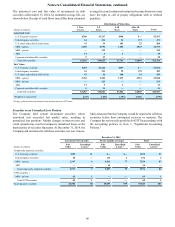

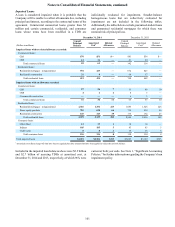

Accounting Standards Recently Adopted and Pending Accounting Pronouncements

The following table provides a brief description of recent accounting pronouncements that could have a material effect on the

Company's financial statements:

Standard Description Date of

adoption Effect on the financial statements or

other significant matters

Standards adopted in 2014

ASU 2014-01, Accounting

for Investments in

Qualified Affordable

Housing Projects

The ASU allows the use of the proportional amortization

method for investments in qualified affordable housing

projects if certain conditions are met. Under the

proportional amortization method, the initial cost of the

investment is amortized in proportion to the tax credits

and other tax benefits received and the net investment

performance is recognized in the income statement as a

component of income tax expense. The ASU provides

for a practical expedient, which allows for amortization

of the investment in proportion to only the tax credits if

it produces a measurement that is substantially similar

to the measurement that would result from using both

tax credits and other tax benefits.

January 1,

2014 The standard is required to be applied

retrospectively; therefore amounts included

in noninterest expense in periods prior to

adoption have been reclassified. For the years

ended December 31, 2013 and 2012, $49

million and $39 million, respectively, of

investment amortization expense was

reclassified from other noninterest expense to

provision for income taxes in the

Consolidated Statements of Income. For

additional information on the impact of

adoption see Note 10, "Certain Transfers of

Financial Assets and Variable Interest

Entities."

Standards not yet adopted

ASU 2014-09, Revenue

from Contracts with

Customers

The ASU supersedes the revenue recognition

requirements in ASC Topic 605, Revenue Recognition,

and most industry-specific guidance throughout the

Industry Topics of the Codification. The core principle

of the ASU is that an entity should recognize revenue to

depict the transfer of promised goods or services to

customers in an amount that reflects the consideration

to which the entity expects to be entitled in exchange for

those goods or services.

January 1,

2017 The Company is continuing to evaluate the

impact of the ASU.

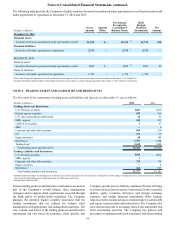

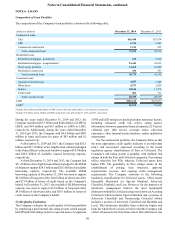

NOTE 2 - ACQUISITIONS/DISPOSITIONS

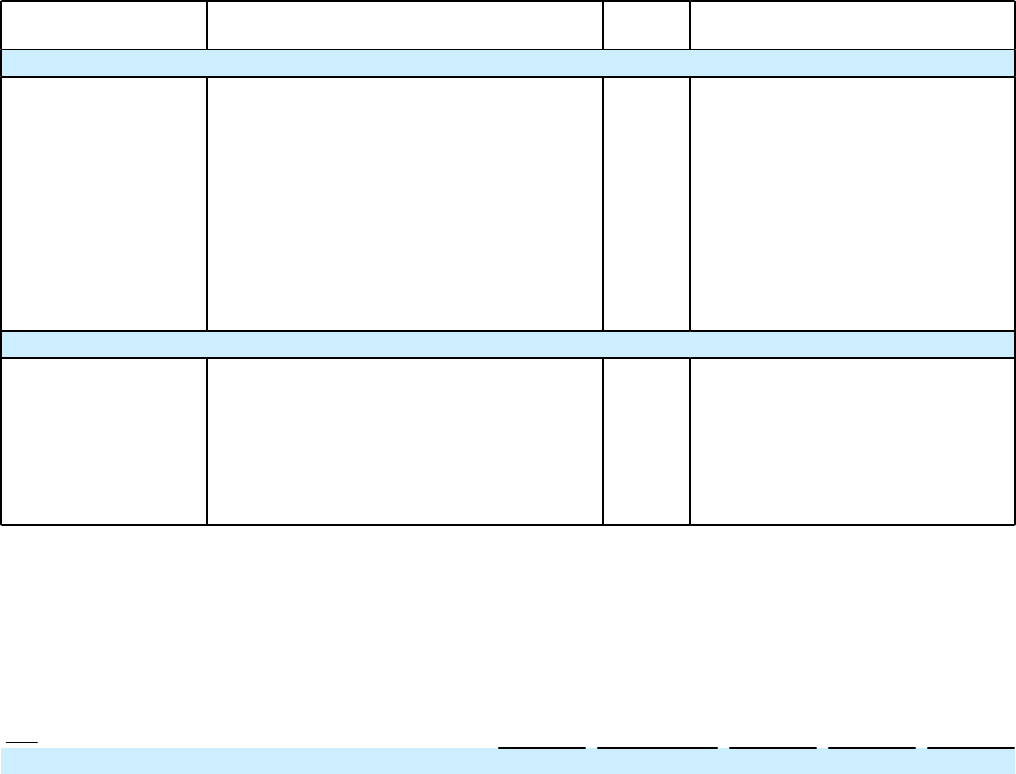

During the years ended December 31, 2014, 2013, and 2012, the Company had the following notable disposition:

(Dollars in millions)

2014 Date Cash

Received/(Paid) Goodwill Other

Intangibles Pre-tax

Gain

Sale of RidgeWorth 5/30/2014 $193 ($40) ($9) $105

On May 30, 2014, the Company completed the sale of

RidgeWorth, its asset management subsidiary with

approximately $49.1 billion in assets under management, to an

investor group led by a private equity fund managed by Lightyear

Capital LLC. The Company received cash proceeds of $193

million, removed $96 million in net assets and $23 million in

noncontrolling interests, and recognized a pre-tax gain of $105

million in connection with the sale, net of transaction-related

expenses.

The Company’s results for the year ended December 31,

2014, included income before provision for income taxes related

to RidgeWorth, excluding the gain on sale, of $22 million,

comprised of $81 million of revenue and $59 million of expense.

For the year ended December 31, 2013, the Company’s income

before provision for income taxes included $64 million related

to RidgeWorth, comprised of $194 million of revenue and $130

million of expense. For the year ended December 31, 2012, the

Company’s income before provision for income taxes included

$67 million related to RidgeWorth, comprised of $202 million

of revenue and $135 million of expense.

The financial results of RidgeWorth, including the gain on

sale, are reflected in the Corporate Other segment. There were

no other material acquisitions or dispositions during the three

years ended December 31, 2014.