SunTrust 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

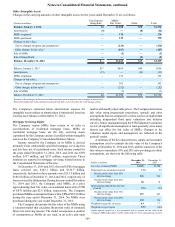

Notes to Consolidated Financial Statements, continued

107

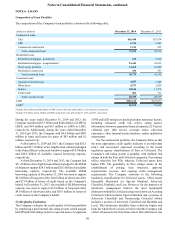

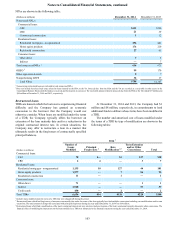

As discussed in Note 1, “Significant Accounting Policies,” the

ALLL is composed of both specific allowances for certain

nonaccrual loans and TDRs and general allowances grouped into

loan pools based on similar characteristics. No allowance is

required for loans carried at fair value. Additionally, the

Company records an immaterial allowance for loan products that

are guaranteed by government agencies, as there is nominal risk

of principal loss. The Company’s LHFI portfolio and related

ALLL is shown in the tables below:

December 31, 2014

Commercial Residential Consumer Total

(Dollars in millions) Carrying

Value Associated

ALLL Carrying

Value Associated

ALLL Carrying

Value Associated

ALLL Carrying

Value Associated

ALLL

Individually evaluated $92 $11 $2,563 $300 $126 $8 $2,781 $319

Collectively evaluated 73,300 975 35,940 477 20,819 166 130,059 1,618

Total evaluated 73,392 986 38,503 777 20,945 174 132,840 1,937

LHFI at fair value — — 272 — — — 272 —

Total LHFI $73,392 $986 $38,775 $777 $20,945 $174 $133,112 $1,937

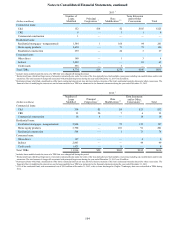

December 31, 2013

Commercial Residential Consumer Total

(Dollars in millions) Carrying

Value Associated

ALLL Carrying

Value Associated

ALLL Carrying

Value Associated

ALLL Carrying

Value Associated

ALLL

Individually evaluated $171 $10 $2,878 $345 $110 $8 $3,159 $363

Collectively evaluated 64,139 936 40,010 585 20,267 160 124,416 1,681

Total evaluated 64,310 946 42,888 930 20,377 168 127,575 2,044

LHFI at fair value — — 302 — — — 302 —

Total LHFI $64,310 $946 $43,190 $930 $20,377 $168 $127,877 $2,044

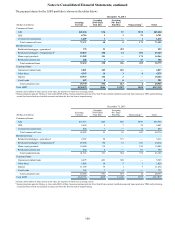

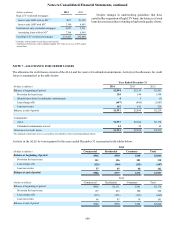

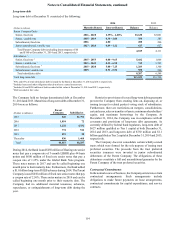

NOTE 8 - PREMISES AND EQUIPMENT

Premises and equipment at December 31 consisted of the

following:

(Dollars in millions) Useful Life

(in years) 2014 2013

Land Indefinite $334 $345

Buildings and improvements 2 - 40 1,051 1,045

Leasehold improvements 1 - 30 628 609

Furniture and equipment 1 - 20 1,426 1,399

Construction in progress 201 206

Total premises and equipment 3,640 3,604

Less: Accumulated depreciation and amortization 2,132 2,039

Premises and equipment, net $1,508 $1,565

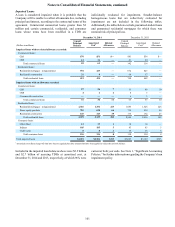

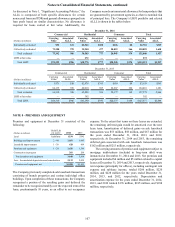

The Company previously completed sale leaseback transactions

consisting of branch properties and various individual office

buildings. Upon completion of these transactions, the Company

recognized a portion of the resulting gains and deferred the

remainder to be recognized ratably over the expected term of the

lease, predominantly 10 years, as an offset to net occupancy

expense. To the extent that terms on these leases are extended,

the remaining deferred gain would be amortized over the new

lease term. Amortization of deferred gains on sale leaseback

transactions was $53 million, $58 million, and $67 million for

the years ended December 31, 2014, 2013, and 2012,

respectively. At December 31, 2014 and 2013, the remaining

deferred gain associated with sale leaseback transactions was

$162 million and $215 million, respectively.

The carrying amounts of premises and equipment subject to

mortgage indebtedness (included in long-term debt) were

immaterial at December 31, 2014 and 2013. Net premises and

equipment included $4 million and $5 million related to capital

leases at December 31, 2014 and 2013, respectively. Aggregate

rent expense (principally for offices), including contingent rent

expense and sublease income, totaled $206 million, $220

million, and $228 million for the years ended December 31,

2014, 2013, and 2012, respectively. Depreciation and

amortization expense for the years ended December 31, 2014,

2013, and 2012 totaled $176 million, $185 million, and $188

million, respectively.