SunTrust 2014 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2014 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

140

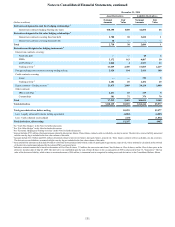

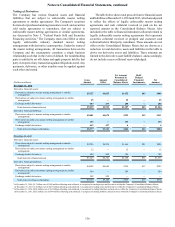

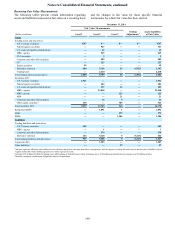

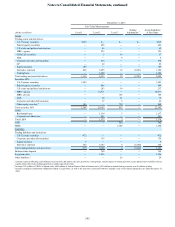

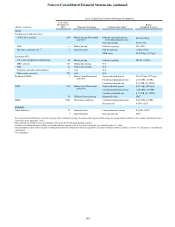

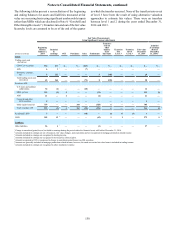

Recurring Fair Value Measurements

The following tables present certain information regarding

assets and liabilities measured at fair value on a recurring basis and the changes in fair value for those specific financial

instruments for which fair value has been elected.

December 31, 2014

Fair Value Measurements

(Dollars in millions) Level 1 Level 2 Level 3 Netting

Adjustments 1Assets/Liabilities

at Fair Value

Assets

Trading assets and derivatives:

U.S. Treasury securities $267 $— $— $— $267

Federal agency securities — 547 — — 547

U.S. states and political subdivisions — 42 — — 42

MBS - agency — 545 — — 545

CLO securities — 3 — — 3

Corporate and other debt securities — 509 — — 509

CP — 327 — — 327

Equity securities 45 — — — 45

Derivative contracts 688 5,126 25 (4,532) 1,307

Trading loans — 2,610 — — 2,610

Total trading assets and derivatives 1,000 9,709 25 (4,532) 6,202

Securities AFS:

U.S. Treasury securities 1,921 — — — 1,921

Federal agency securities — 484 — — 484

U.S. states and political subdivisions — 197 12 — 209

MBS - agency — 23,048 — — 23,048

MBS - private — — 123 — 123

ABS — — 21 — 21

Corporate and other debt securities — 36 5 — 41

Other equity securities 2138 — 785 — 923

Total securities AFS 2,059 23,765 946 — 26,770

Residential LHFS — 1,891 1 — 1,892

LHFI — — 272 — 272

MSRs — — 1,206 — 1,206

Liabilities

Trading liabilities and derivatives:

U.S. Treasury securities 485 — — — 485

MBS - agency — 1 — — 1

Corporate and other debt securities — 279 — — 279

Derivative contracts 444 5,128 5 (5,115) 462

Total trading liabilities and derivatives 929 5,408 5 (5,115) 1,227

Long-term debt — 1,283 — — 1,283

Other liabilities 3— — 27 — 27

1 Amounts represent offsetting cash collateral received from, and paid to, the same derivative counterparties, and the impact of netting derivative assets and derivative liabilities when a

legally enforceable master netting agreement or similar agreement exists.

2 Includes $376 million of FHLB of Atlanta stock, $402 million of Federal Reserve Bank of Atlanta stock, $138 million in mutual fund investments, and $7 million of other.

3 Includes contingent consideration obligations related to acquisitions.